Calendar Year Q4 2022 is Indian Financial Year Q3 2022-23

In this Insight, ARC Advisory Group includes the most recent quarterly results for major Indian IT suppliers that publicly report their results.

We translated financials reported in Indian rupees to US dollars using an average exchange rate for the given reporting period. Owing to this translation, some companies may show negative growth.

Companies have substantially increased the hiring of fresh graduates to expand the talent pool of skilled employees, which should hopefully address the shortage of skilled workers and reduce the cost of delivery.

Financial results during calendar period from October 1 to December 31.

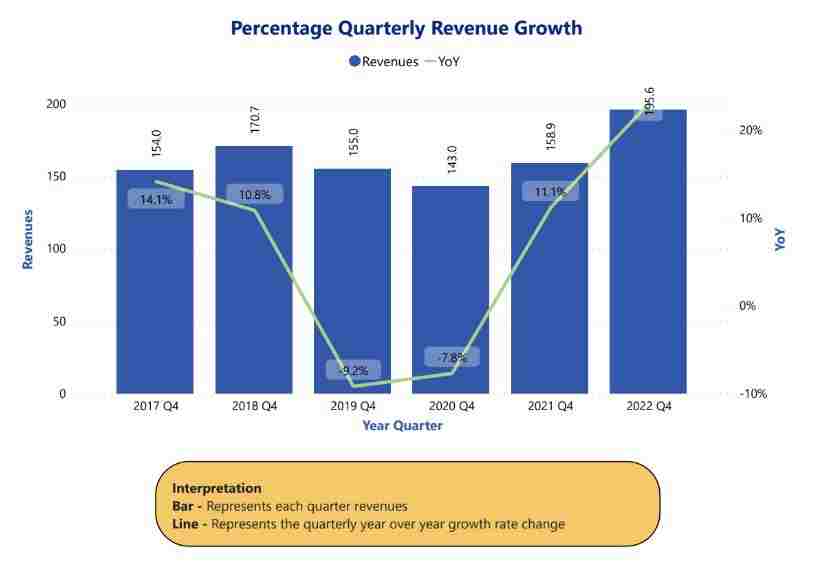

India’s information technology (IT) services industry continues its upward momentum as major of the IT services companies covered in the report exhibited above[1]average growth.

India’s top IT services companies reported their fiscal third-quarter earnings, posting strong growth in what is generally seen as a slow period of the year due to the holidays.

India’s biggest IT companies all had solid double-digit year-on-year revenue growth rates – a reflection of the massive surge in demand for IT and digital services across the world since the pandemic. All companies said their growth was broad based, with good growth across geographies and industry verticals.

We expect the companies that we covered to report steady sequential revenue growth on good demand, healthy deal wins, and active mergers and acquisition activities.

The demand environment is expected to be strong in addition to cloud services, there was also a strong demand around cybersecurity, consulting, and enterprise application services.

Indian IT companies are benefiting from clients by handling large projects, offer “full services” and track record of helping customers recast their operations to get big savings helps IT companies to win more deals.

The third quarter of the year 2022-23 reports that Infosys, Tata Consultancy Services (TCS), HCL, Wipro and Tech Mahindra maintained their annual revenue and margin guidance.

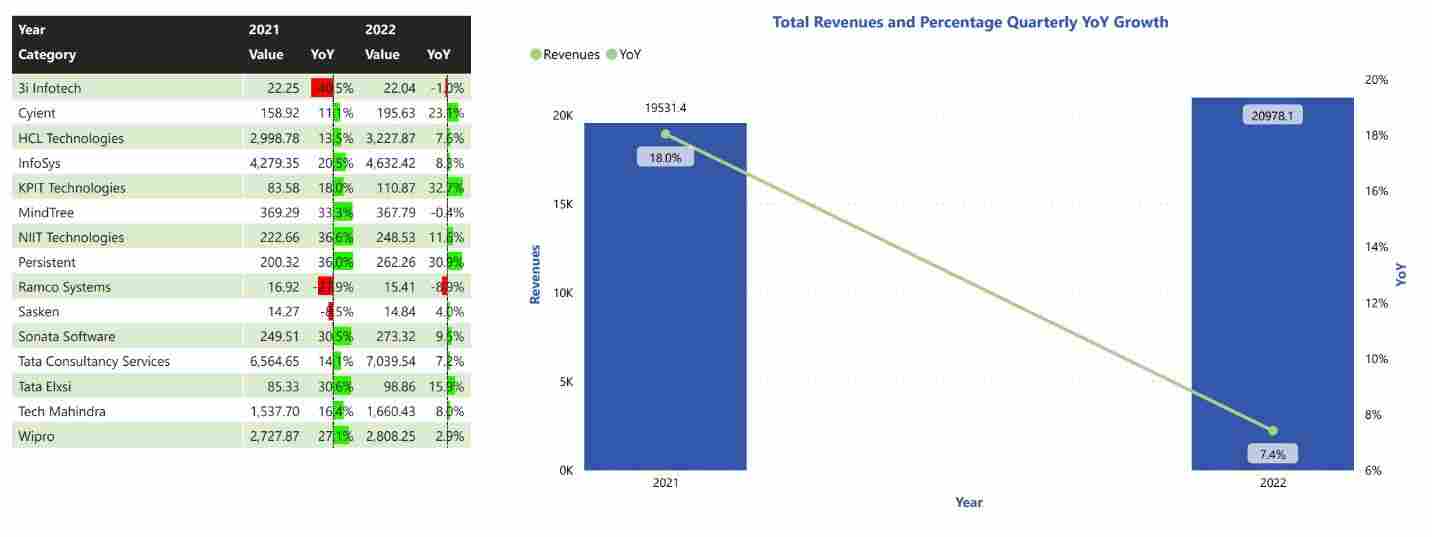

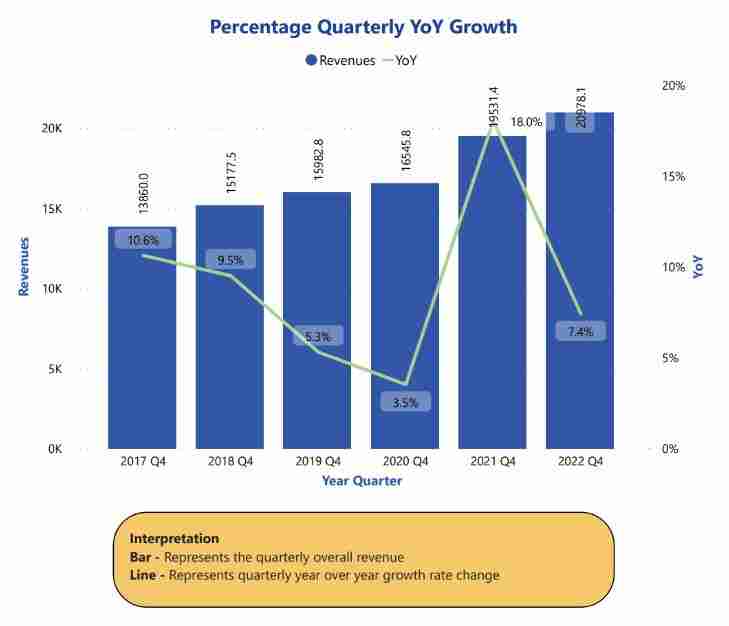

The IT services sector saw an upward momentum compared to the last year. Indian IT & Services industry recorded combined quarterly revenue of $20 billion and recorded 7 percent year-over-year (YoY) growth as compared to last year.

While strong demand from customers was reflected in the December quarter’s revenue growth, India’s top IT companies are also expecting a slowdown and delays in spending decisions ahead.

Staff churn, an important metric in the services business, continued to reduce during the quarter. While attrition has come down, the top IT companies are also being circumspect on hiring because of a combination of strong hiring in the prior quarters and the anticipated slowdown ahead.

We expect Indian IT services firms to surprise positively with a relatively resilient demand environment and continued revenue market share gains.

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us