To provide our Advisory Service clients with holistic coverage of the various industrial and automation markets we cover, ARC Advisory Group publishes indices on automation on a quarterly basis. This Special Report in PowerPoint format covers the performance of machinery and user CapEx markets. This concise report focuses more on the quantitative than the qualitative aspects of the markets.

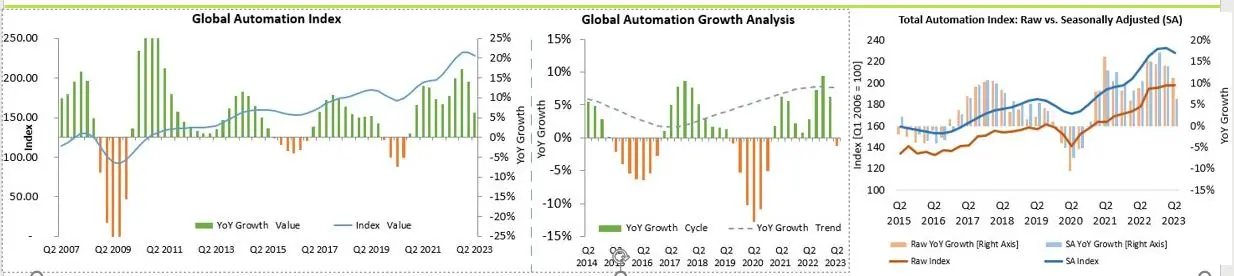

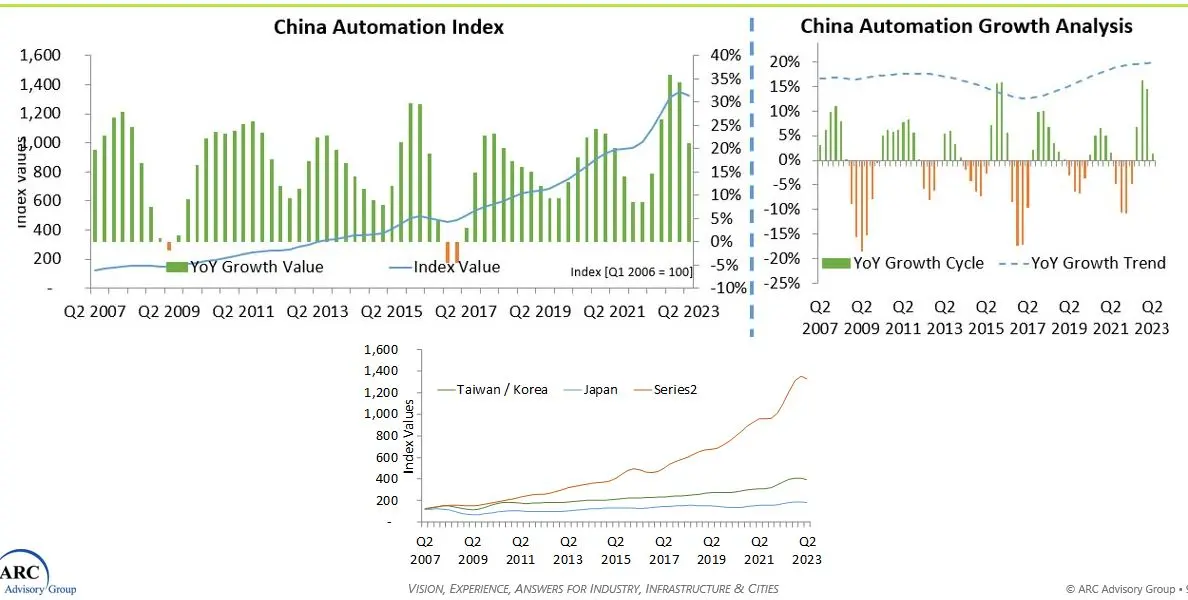

2022 was a great year for automation companies, but 2023 appears to offer slightly lower growth compared with 2022 as the YoY growth cycle shows a decline for the first time since the growth journey started in Q1 2021.

Demand from process and hybrid industry segments continued to remain resilient, while the demand from discrete industry segments softened due to normalization of order patterns. Oil & gas, refining, petrochemicals, ports, renewables, and low-carbon related energy segments saw good growth.

Growth has slowed. For the first time after Q1 2021, the registered YoY growth in Q2 2023 was at a very low level compared with YoY growth rates since Q1 2021.

Majority of the growth was supported by execution of backlogs, increased volumes, and prices.

Most companies’ orders are at a lower level on YoY basis, and only a few companies’ book-to-bill ratio looks at slightly above 1. However, vendors are quite optimistic about the rest of the year.

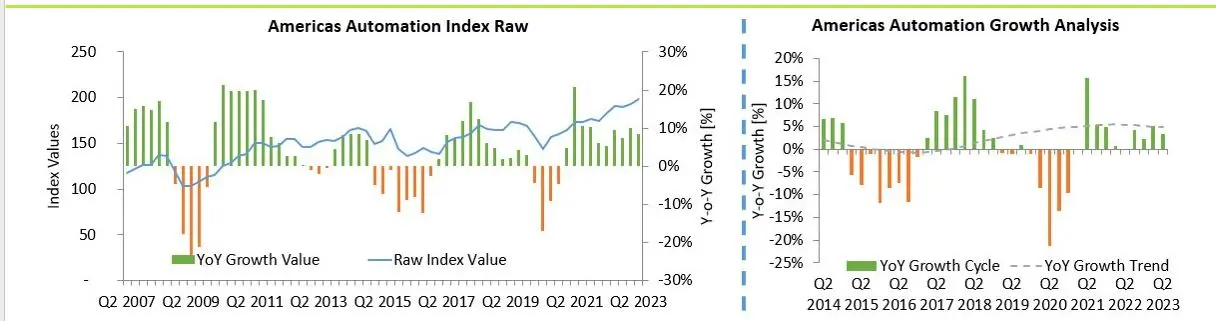

Demand for automation products continued to grow in the US market. The registered growth in Q2 2023 was slightly higher compared with Q2 2022. More than one-third of vendors experienced growth rates with strong double-digits in revenues.

Growth was predominantly driven by project’s related businesses, and from the process industry segments. Strong growth from the US and good growth from the Mexico and Canada markets.

Growing demand from energy transition related segments, renewables, process and hybrid industries and investments in semiconductors, battery, and metal manufacturing further supports the growth.

The YoY growth cycle continued on the growth path in Q2 2023 but is slightly lower than Q1 2023. YoY growth trend remained almost stable in the Americas.

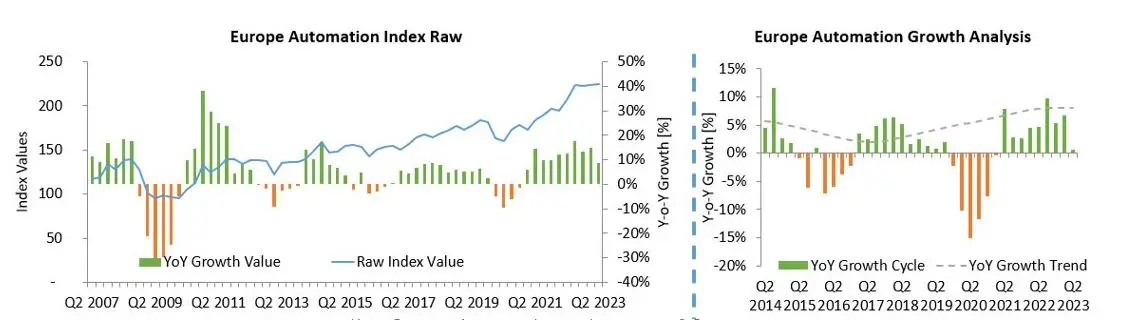

Automation markets in Europe continued to expand at a low level. The market saw growth of about 9 percent in Q2 2023 on YoY basis. The registered growth is the lowest of the past eight quarters, since Q2 2021.

The YoY growth trend shows almost stable growth, but the YoY growth cycle points to almost no growth.

Slower demand for discrete automation segment and normalization of orders from user industries slowed down the growth both in revenues and orders and is expected to continue in the coming quarters.

While strong demand for process automation products, services, and systems from the process industry sector is expected to continue, demand from the discrete industries, including automotive, machine building, electronics, and semiconductors is expected to be slower. However, strong demand for battery manufacturing in the US also supports growth of European vendors. The aerospace & defense sector seems to offer good growth in the discrete industry segment.

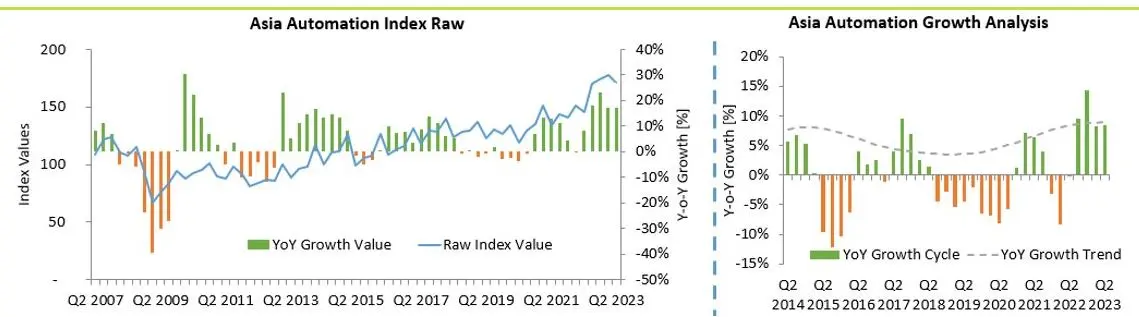

Asia’s automation market continued to expand at double-digit growth rates of over 17 percent for the past two consecutive quarters. However, the registered growth is slightly less than previous two quarters’ growth.

Slow growth in China continued in Q2 as well due to slow economic recovery. High demand from India as the machine building, process industries, infrastructure, and renewables segments continued to expand.

Majority of the growth comes from backlog execution and process industry segments. Slower demand from semiconductor industry.

Investments related to electrification, digitalization, decarbonization, and circularity provide growth opportunities especially in Japan and in developed Asia. Government incentives related to sustainability and energy efficiency further boost the growth.

Automation Markets

Machinery Markets

End User Markets

Sentiment Index

ARC Advisory Group clients can view the complete report at the ARC Client Portal.

Please Contact Us if you would like to speak with the author.

You can learn more at Automation and Software Expenditures for Discrete Industries