In this Insight, ARC Advisory Group includes the most recent quarterly results for major automation suppliers that publicly report their results. To convert the revenues of non-US suppliers to US dollars, we average exchange rates for foreign currencies used for the entire quarter.

With this latest automation supply side-market update, ARC has increased the number and breadth of automation suppliers covered, based on a combination of publicly reported data and ARC’s own extensive research database. We have also added selected business intelligence visualizations. Readers should contact their ARC client managers if they would like to gain additional access to this market intelligence as it applies to both regional and sector-specific supply side automation market trends.

Financial results during calendar period from April 1 to July 31.

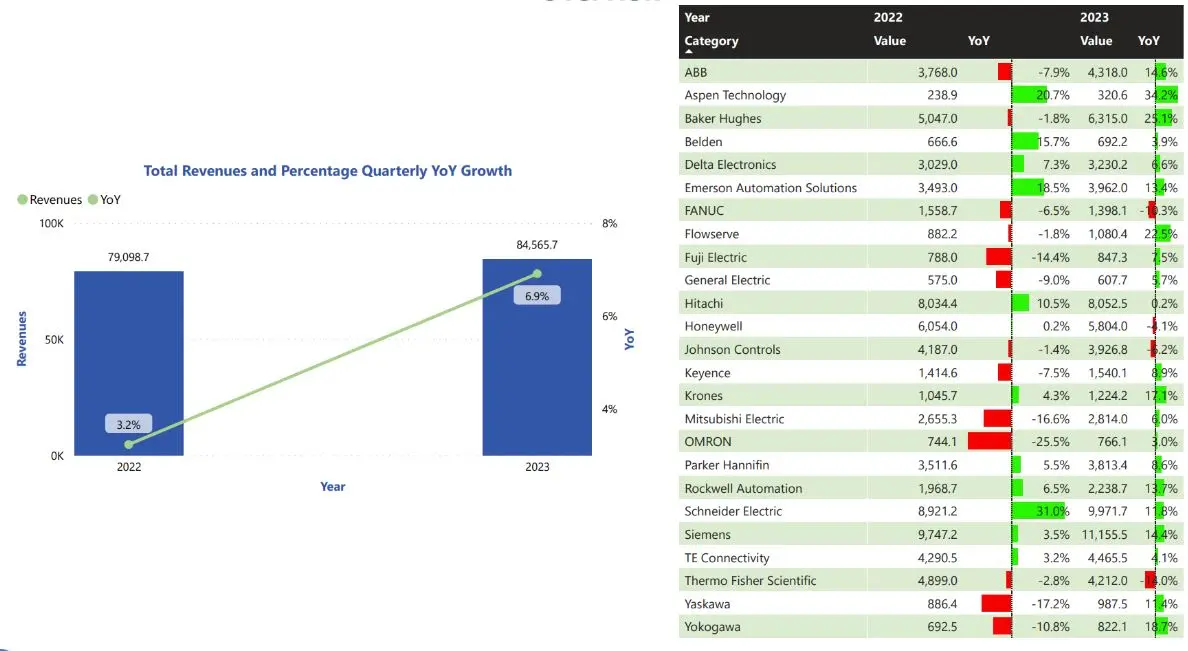

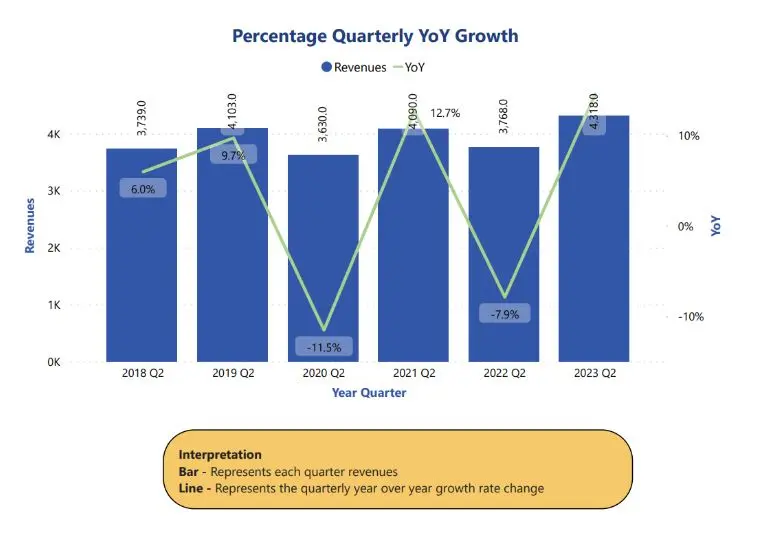

Growth for automation products market was in high single digits in Q2 2023 compared with the same quarter last year.

Most industrial companies experienced a growth in this quarter.

Food and beverage, chemical, pharmaceuticals & biotech, buildings & infrastructure, semiconductor, machinery, and water & wastewater industries are some of the growth contributors in this quarter.

Industry 4.0 leads toward smart manufacturing and remote monitoring of plant operations.

The future of manufacturing is digital and adoption of AI can lead to an increase in productivity.

Energy efficient automation technologies can optimize energy usage by reducing operational costs and environmental impact.

Integration of digital technologies in manufacturing drives the adoption of automation to create connected, data-driven smart factories.

Most automation suppliers are showing growth in this quarter.

Advancements in automation technologies, including AI, machine learning, robotics, and IoT, drive innovation and open up new possibilities for automation across industries.

As supply chains become more complex and globalized, automation helps manage inventory, logistics, and other supply chain activities efficiently.

Increased investment in 5G networks has helped electronics and semiconductor industries to grow.

Green energy and sustainability will drive the automotive industry with a major demand for electric vehicles from both developed and developing nations.

Demand for electric vehicles also leads to automotive industry growth.

Smart automation and AI will continue to reshape machine builders to be more innovative.

Sustainability and environment friendly responsible business practices are driving growth.

Trending technology trends include Artificial Intelligence (AI) and Machine Learning (ML), Robotic Process Automation (RPA), 3D Printing, Edge Computing, Autonomous Vehicles and Drones, Supply Chain and Logistics Automation.

The implementation of robotics and automation in the food processing, packaging, and retail sectors provides improved safety, quality, and profitability by optimizing process monitoring and control.

Autonomous vehicles and drones are being used to optimize routes, reduce costs, and increase speed and accuracy.

The deployment of digital technologies are becoming popular in automating plants and processes.

Industrial IoT and digitalization are the key factors that help boost the growth of the automation market.

Increased focus on cybersecurity: As automation technology becomes more prevalent, ensuring the security and safety of these systems becomes more important.

Technologies like autonomous robots, RFID tracking, and predictive analytics are being used to optimize inventory management, order fulfillment, and distribution.

Smart manufacturing is transforming traditional manufacturing into more flexible, efficient, and data-driven operations.

Hydrogen industry will drive process control instrumentation market.

Order intake declined slightly year-on-year, hampered by changes in exchange rates and in the portfolio, while the comparable orders increased from last year's high base. The strongest order momentum was recorded in the systems and project-related business, linked to the medium voltage customer offering. The short-cycle business softened somewhat from last year's high level, impacted by inventory adjustments and normalizing order patterns under the presumption of further shortening delivery lead times.

Two out of four business areas recorded single digit order growth, with Process Automation declining due to portfolio changes and Robotics and Discrete Automation down from last year's level which benefited from pre-buys in a period of significant component shortages. Order intake increased in the Americas supported by mid-single digit growth in the United States. Portfolio changes weighed on the year-on-year development in Europe while a low comparable growth was recorded for a total decline of 1 percent despite declines in key countries like Germany and Italy. Asia, Middle East and Africa declined by 10 percent as the positive development in countries like India and Saudi Arabia did not offset declines in other countries such as China with a drop of 15 percent.

Automotive remained broadly stable while the general industry and consumer-related robotics segments declined. In transport & infrastructure, there were positive developments in marine & ports and renewables. In buildings there was weakness in all three regions in residential-related demand. In the commercial construction segment weakness was noted in China and Germany, while demand was solid in the US. Demand in the process-related business was strong across the board, with particular strength in oil & gas, and it held up well also for ports, refining, petrochemicals and the energy-related low carbon segments.

Revenues increased by 13 percent and benefitted primarily from increased volumes through execution of the order backlog, combined with a robust price contribution in the mid-single digit range. These benefits more than offset the adverse impacts from changes in exchange rates and portfolio changes. Revenues increased in all business areas.