In this Insight, ARC Advisory Group includes the most recent quarterly results for India's IT companies that publicly report their results.

We translated financials reported in Indian rupees to US dollars using an average exchange rate for the given reporting period. Owing to this translation, some companies may show negative growth.

Companies have substantially increased the hiring of fresh graduates to expand the talent pool of skilled employees, which should hopefully address the shortage of skilled workers and reduce the cost of delivery.

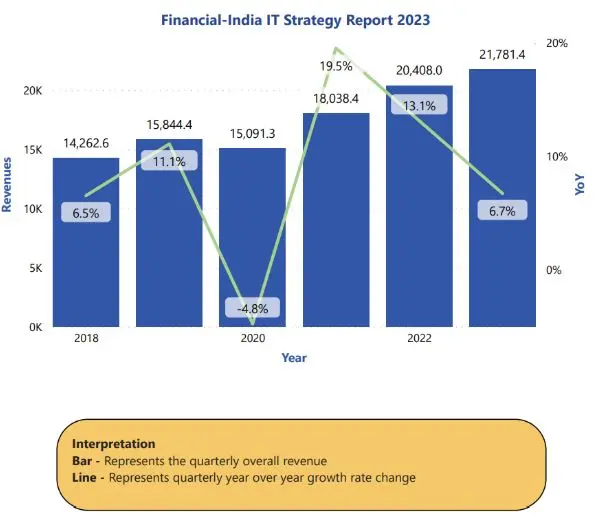

Financial results during calendar period from April 1 to June 30.

India’s information technology (IT) services industry witnessed a sharp moderation in growth momentum due to developing macroeconomic headwinds in key markets of the US and Europe.

Six leading Indian IT services companies that have announced first-quarter earnings recorded the sharpest contraction in headcount in the last three years in the April-June period. The earnings for the first quarter of FY24 were strong and domestic sectors such as companies in BFSI and Automobile sectors drives the earnings growth.

IT Services companies reported muted performance during the quarter with average revenue growth QoQ, in an otherwise seasonally strong quarter.

We expect the companies that we covered to report steady sequential revenue growth on good demand, healthy deal wins, and active mergers and acquisition activities.

The major market concern is the headcount decline. Though the market was expecting attrition to come down and it had to be brought down to pre-pandemic levels, the net decline on employee addition has been very sharp.

Indian IT firms are expected to report moderate earnings for Q1 of FY24 due to weakening macro conditions, wage hikes, and the impact of the US market. Revenue growth is expected to be muted, while margins are expected to be under sustained pressure.

We can expect likely pick-up in the growth momentum once the macroeconomic headwinds subside by the end of the current fiscal.

The IT services sector delivered a flattish median growth compared to the last year. Indian IT & Services industry recorded combined quarterly revenue of $21.8 billion and recorded 7 percent year-over-year (YoY) growth as compared to last year.

Companies in the IT sector are feeling the heat of the slowdown in projects. Tata Consultancy Services (TCS), HCL Tec, and Wipro, after announcement of Q1 results for FY24, huge jump in IT stocks have been witnessed as limited shares are available in the stock market at discounted prices.

Macroeconomic uncertainty in key markets for the IT services sector will drag down growth.

The first-quarter performance of top IT services players, as well as mid-cap firms, has been subdued, reflecting macro uncertainties.

Cyient (Estd: 1991, NSE: CYIENT) is a global Digital, Engineering and Technology solutions company. The company collaborates with its customers to design digital enterprises, build intelligent products and platforms and solve sustainability challenges. Cyient won 6 large deals in DET business in this quarter.

Cyient considers new growth areas in the auto sector due to emerging technologies such as safe/autonomous vehicles and electrification, powered by cognitive and machine learning that is expected to drive the demand for engineering services. Enhancing the customer & field management experience through technical analysis from knowledge management solutions and process enhancements for copper & fiber network is one of the technology solutions of NextGen Connectivity trends.