Calendar Year Q1 2023 is Indian Financial Year Q4 2022-23

In this Insight, ARC Advisory Group includes the most recent quarterly results for India’s IT Companies that publicly report their results.

We translated financials reported in Indian rupees to US dollars using an average exchange rate for the given reporting period. Owing to this translation, some companies may show negative growth.

Companies have substantially increased the hiring of fresh graduates to expand the talent pool of skilled employees, which should hopefully address the shortage of skilled workers and reduce the cost of delivery.

Financial results during calendar period from January 1 to March 31.

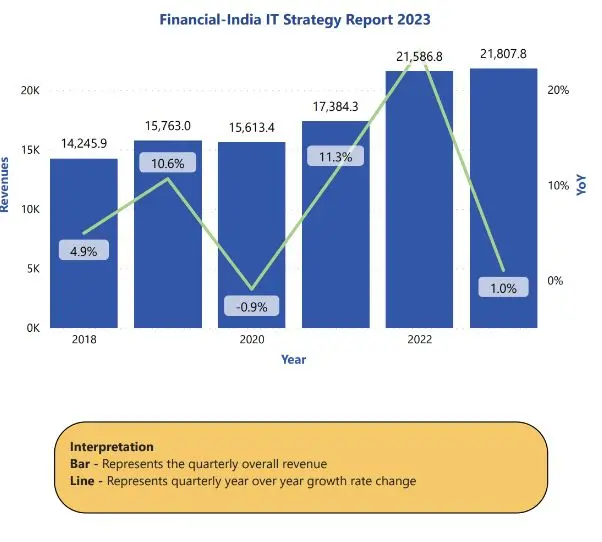

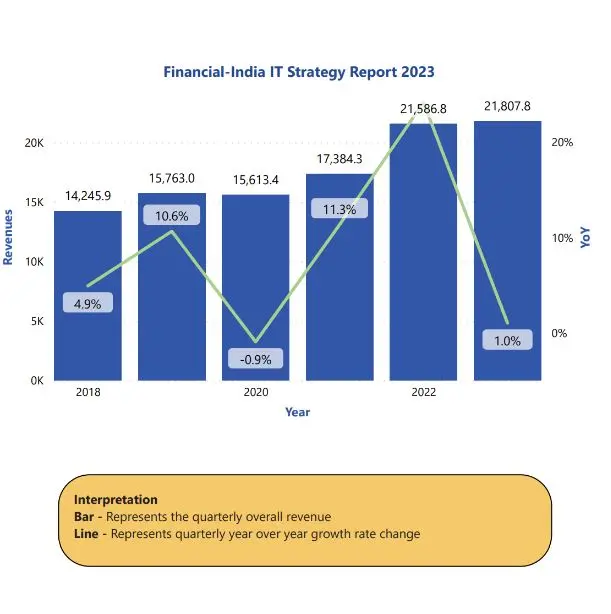

India’s information technology (IT) services industry continues its upward momentum as major of the IT services companies covered in the report exhibited above-average growth.

India's IT services industry may have seen moderate growth in the January-March quarter as a banking crisis in its largest markets weighed on its biggest revenue stream.

Indian IT services companies announced their Q4 FY 2022-23 results, post which they announced variable pay, or performance payouts, to their employees.

The flexibility in earnings from the big IT firms is likely to continue for a few quarters more as many industries, especially tech, restructure and cut costs quite dramatically. In recent years, the tech industry has been a huge consumer of IT services as well as outsourcing.

We expect the companies that we covered to report steady sequential revenue growth on good demand, healthy deal wins, and active mergers and acquisition activities.

The earnings season started on a cautious note with the Q4 scorecards that fell short of expectations. But more importantly the management commentary of India's top two IT services companies cautioned about prevailing customer sentiments across BFSI, technology services and certain other verticals, particularly in the US.

TCS and Infosys are better positioned among Tier-I firms, and LTIMindtree Ltd. among midcaps. Wipro is seen as the most vulnerable due to its higher consulting exposure.

Tier-I IT firms are likely to grow their margins in the coming quarters. Growth is expected to resume in Q2 of this year.

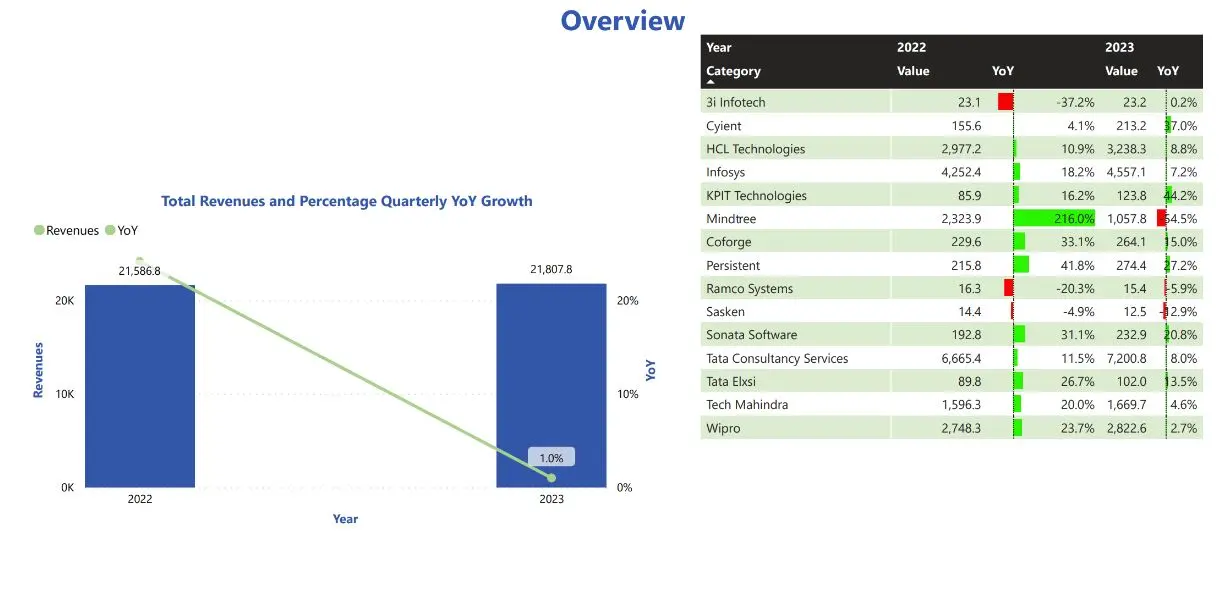

The IT services sector delivered a muted growth compared to the last year. Indian IT & Services industry recorded combined quarterly revenue of $21 billion and recorded 1 percent year-over-year (YoY) growth as compared to last year.

The earnings season started on a serious note with the Q4 scorecards that fell short of expectations. But more importantly the management commentary of India's top two IT services companies cautioned about prevailing customer sentiments across BFSI, technology services and certain other verticals, particularly in the US.

Despite the slowing down of key partners and large cloud providers, the growth rate and order book remain high.

However, if the crisis deepens, Indian IT firms stand to gain market share due to increased offshoring and outsourcing to reduce costs.

Cyient (Estd: 1991, NSE: CYIENT) is a global engineering and technology solutions company. As a design, build, and maintain partner for leading organizations worldwide, Cyient takes solution ownership across the value chain to help customers focus on their core, innovate, and stay ahead of the curve.

Cyient partners with customers to operate as part of their extended team in ways that best suit their organization’s culture and requirements. Cyient’s industry focus includes aerospace and defense, healthcare, tele-communications, rail transportation, semiconductor, geospatial, industrial, and energy. Cyient's subsidiary, Cyient DLM Limited has filed a draft red herring prospectus (DRHP) dated January 9, 2023, with the Securities and Exchange Board of India, BSE and NSE in connection with its pro-posed IPO.

ARC Advisory Group clients can view the complete report at the ARC Client Portal.

Please Contact Us if you would like to speak with the author.

Learn new ideas, establish valuable relationships, and refine your company's strategy at ARC’s Upcoming Forums.