Calendar Year Q3 2022 is Indian Financial Year Q2 2022-23

In this Insight, ARC Advisory Group includes the most recent quarterly results for major Indian IT suppliers that publicly report their results.

We translated financials reported in Indian rupees to US dollars using an average exchange rate for the given reporting period. Owing to this translation, some companies may show negative growth.

Companies have substantially increased the hiring of fresh graduates to expand the talent pool of skilled employees, which should hopefully address the shortage of skilled workers and reduce the cost of delivery.

Financial results during calendar period from July 1 to September 30.

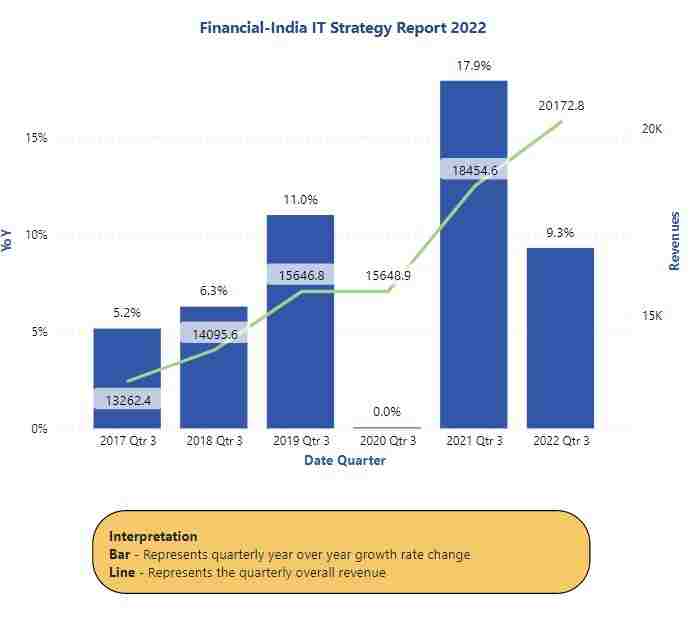

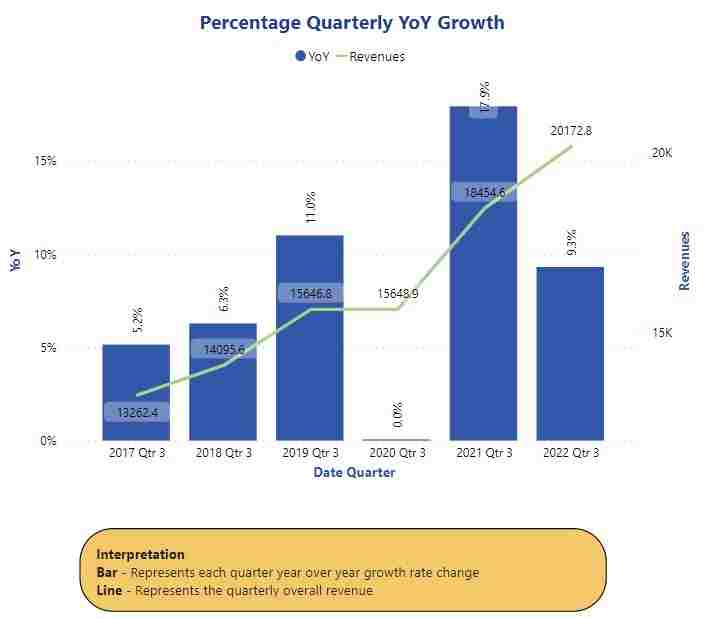

India’s information technology (IT) services industry continues its upward momentum as major of the IT services companies covered in the report exhibited above-average growth.

In this report, we analyze the revenues of India’s IT services sector for the second quarter of financial year 2022-23 and compare these with the same period the previous year. The revenue growth of Indian IT companies continued to show upward momentum in Q2.

The Indian IT sector benefitted from outsourcing, offshoring and digitalization on the back of accelerated cloud migration. Indian IT sector USD revenue growth will start to materially slowdown based on the above. Indian IT services companies are expected to log steady sequential revenue growth in September quarter.

We expect the companies that we covered to report steady sequential revenue growth on good demand, healthy deal wins, and active mergers and acquisition activities.

The demand environment is expected to be strong in the second half of the current calendar year due to continued deal momentum led by sectors like BFSI, insurance, and retail.

The second quarter of the year 2022-23 reports that Tata Consultancy Services (TCS),HCL, Infosys, Tech Mahindra and Wipro maintained their annual revenue, and margin guidance. This quarter margins will remain under pressure due to the high staff churn and increased costs from back-to-office initiatives and more travel.

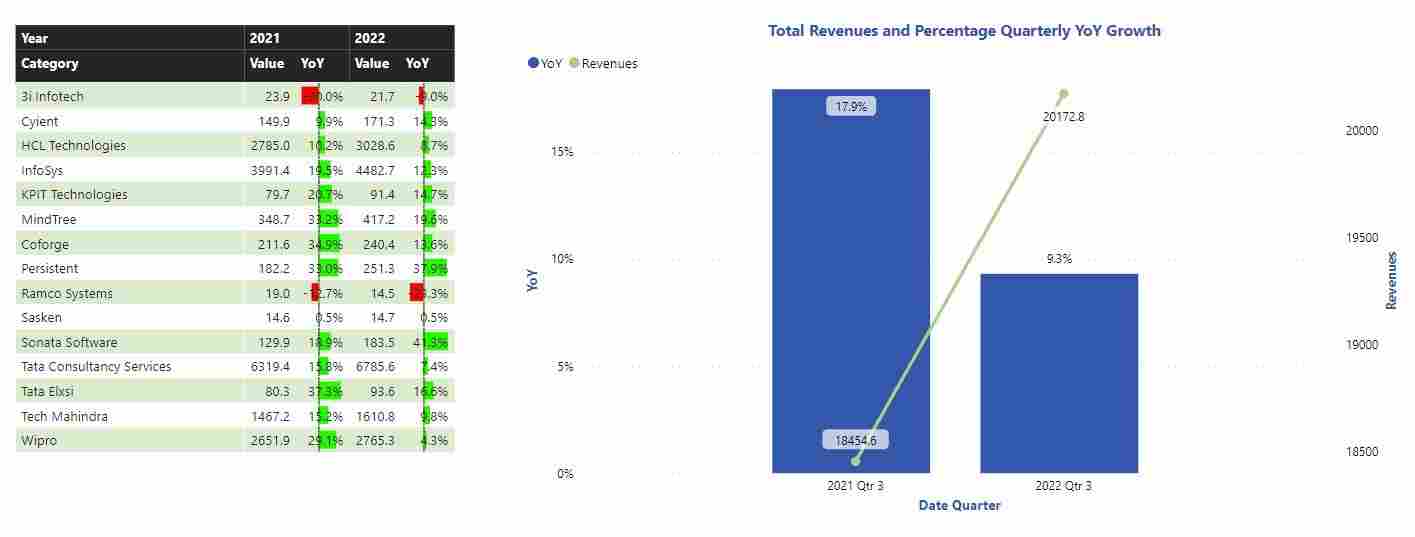

The IT services sector delivered an upward momentum compared to the last year. Indian IT & Services industry recorded combined quarterly revenue of $20billion and recorded a 9.3 percent year-over-year (YoY) growth as compared to last year.

Margins would be impacted by factors such as salary hikes, higher subcontracting costs, an uptick in attrition, and higher recruitment costs for some companies during this quarter.

This Q2 represents reasonably strong growth quarter for Indian IT firms despite challenging macroeconomic scenario in the US and Europe. But there are a few warnings on slowdown in coming quarters. The demand outlook is slightly lower than the last quarter due to global uncertainty but remains fairly strong.

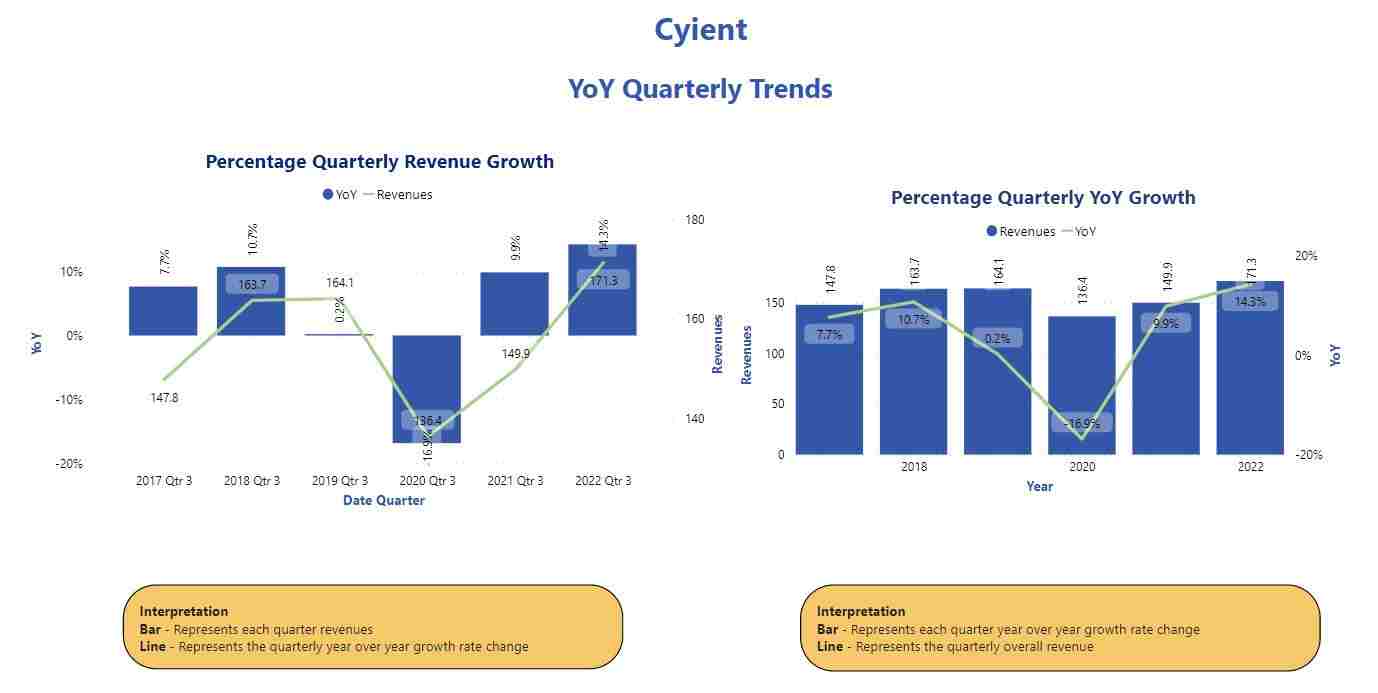

Cyient, a leading consulting-led, industry-centric Technology Solutions company, announced its financial results for Q2 FY23.Cyient's second-quarter growth was primarily driven by strong momentum in services and increased margins across different businesses.

During the quarter, Cyient closed the acquisitions that were announced at the start of the year, strengthening its sustainable engineering capabilities. The impact of these acquisitions is expected to be more visible in the year's second half.

Cyient partners with Honeywell to manufacture Honeywell Anthem, the First Cloud-Connected Cockpit System. Cyient has inked a multi-year deal with Honeywell for this project. Cyient combines industry expertise and a robust partner ecosystem to address key IoT challenges.

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us