Mobile computing in the warehouse is at a crossroads due to the proliferation of the Android and iOS operating systems and Microsoft’s plans to cease support for its mobile operating systems. To learn more, ARC Advisory Group and DC Velocity magazine conducted a study on the current use, important characteristics, and expected changes in mobile

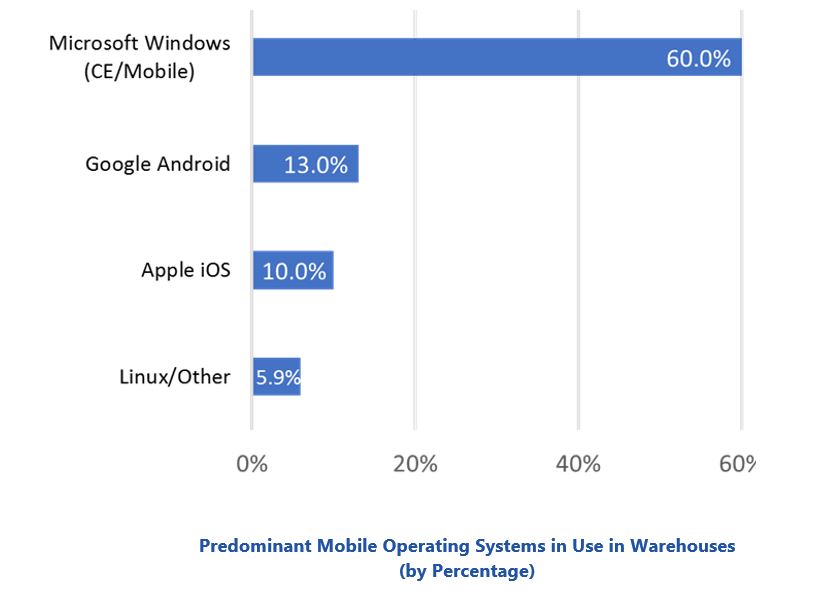

ARC’s research, based on the responses from 34 logistics professionals, confirms that Microsoft is by far the dominant mobile OS in the warehouse. Furthermore, our research indicates that Android is gaining traction, but at a very measured pace. In contrast, Apple iOS use is limited and appears to be positioned for minimal growth. The gradual transition to Android is expected to reduce operating costs over the long term. Users also expect improved support for complementary devices, mobile application development, and usability.

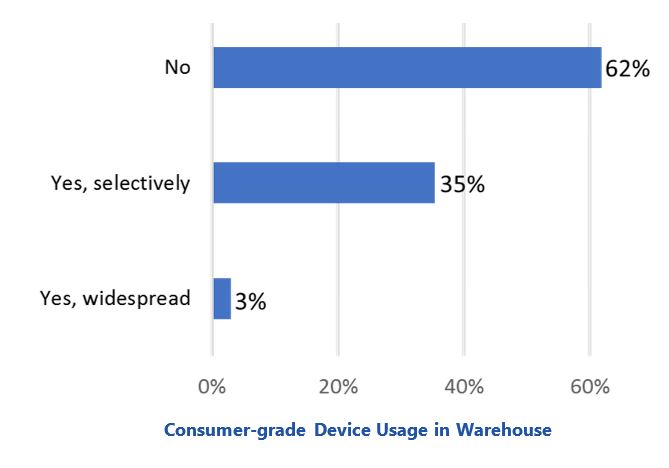

Some organizations are using low-cost, consumer-grade Android devices as an intuitive, cost-effective way to get new workers up to speed quickly, but – other than that - use of consumer-grade devices in the warehouse is still fairly limited. Most organizations equip their temporary/seasonal workers with excess legacy rugged devices that are often already on hand.

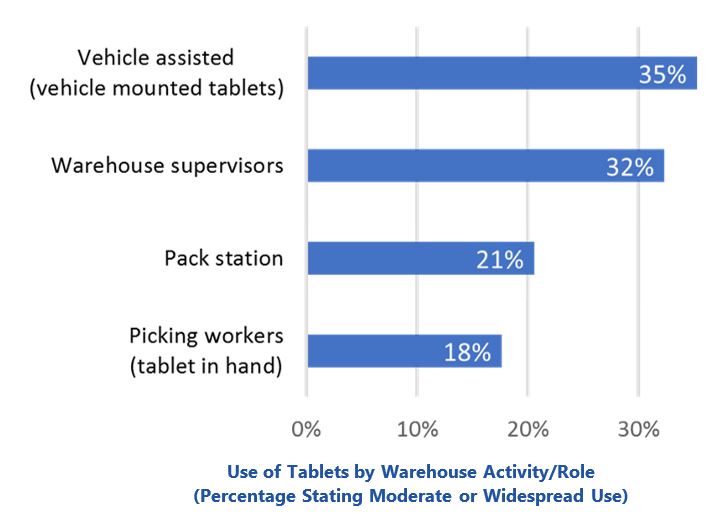

Warehouses also use Android, Windows, or iOS tablets; frequently mounted on forklifts or other vehicles. Tablets are also used to support warehouse supervisors, pack stations, and picking tasks.

Overall, our survey results indicate that changes to the mobility landscape in the warehouse are occurring at a measured pace. The pace of change reflects the warehouse community’s tendency to move cautiously when adopting new technologies.

Mobile computing played a vital role in the warehouse productivity increases of the 1980s and 1990s. During this time, Microsoft seized the opportunity to become the dominant provider of mobile operating systems to warehouses. More recently, the widespread growth of smartphone use has extended mobile computing to the masses and disrupted the mobile computing market. Today, the most common operating systems in smartphones, Android and iOS, are widely familiar to the average adult and teen alike. Ecosystems of partnerships and development environments have flourished along with the ubiquity of smartphones. These mobile computing environments also began to “backfill” from consumer use to business use.

Then, in early 2017, Microsoft announced its plans to phase out support for its popular Windows CE and Embedded mobile operating systems. This “punt” by Microsoft created additional uncertainty about the viability of the status quo in warehouse handheld computing. Windows 10 Mobile, that company’s latest offering in the mobile OS space, is largely designed for consumer use and for greater integration with Windows-based PCs.

The changes in the mobile operating system landscape, along with related technology developments such as the availability of tablets, new scanning options, and wireless communication capabilities have created the environment for extensive change in mobile computing within the warehouse.

To develop a better understanding of the current use and future plans for mobile computing in the warehouse, ARC Advisory Group, in partnership with DC Velocity magazine, conducted a study on the topic. The research, based on the responses from 34 logistics professionals, addresses topics such as the current use and anticipated change in use of various mobile operating systems (OS), the relative importance of mobile OS capabilities, the value of scanning capabilities, complementary technology (voice recognition, wireless communications), and more. This report summarizes our findings and associated analysis.

To establish a baseline, we asked respondents for the breakdown of mobile operating systems currently in use on their warehouse devices. Not surprisingly, 60 percent of respondents indicated that the majority (60 percent or more) of their mobile devices currently run on a Microsoft OS; half of that subset indicated that all (100 percent) of their warehouse

But what does the future hold? Leading handheld vendors such as Honeywell and Zebra have begun delivering Android-based handheld devices for warehouse use. It’s likely that these types of devices will begin to eat away at Microsoft’s share of the market. Our survey results support this perspective, as 56 percent of logistics professionals stated that they expect to increase use of Android-based devices in their warehouses over the next three years. In contrast, only 18 percent of respondents expected to increase use of Apple iOS-based devices. Surprisingly though, 29 percent of respondents expect to increase use of Microsoft-based devices over this same period. This suggests that Microsoft has a stronger hold on mobile computing in the warehouse than some of the anecdotal evidence would suggest.

Microsoft’s apparent hold on the market is potentially due to the warehouse community’s tendency to move cautiously when adopting new technologies. For example, one respondent from a third-party logistics provider (3PL) commented that his organization is relatively slow to change due to the need to coordinate with many other distribution centers (DCs). Another respondent, from a wholesaler, noted that his operation is transitioning incrementally as Microsoft CE devices wear out.

However, the changeover in warehousing does appear to be forthcoming. We asked respondents if their organizations are currently transitioning their warehouse mobile devices from Windows to Android. About 40 percent of respondents indicated that this transition is occurring to some degree in their organizations.

How is the transition from Windows to Android devices in the warehouse expected to impact operations? From the

Expected improvements from the transition to Android seem to align with OS capability importance. The greatest expectations involve improved support for complementary devices, mobile application development, and usability. Handheld hardware performance improvements were also widely expected. However, this may relate more to newer devices than a new OS. In aggregate, expectations are mostly positive. However, one respondent commented that the switchover isn’t expected to increase productivity, just costs.

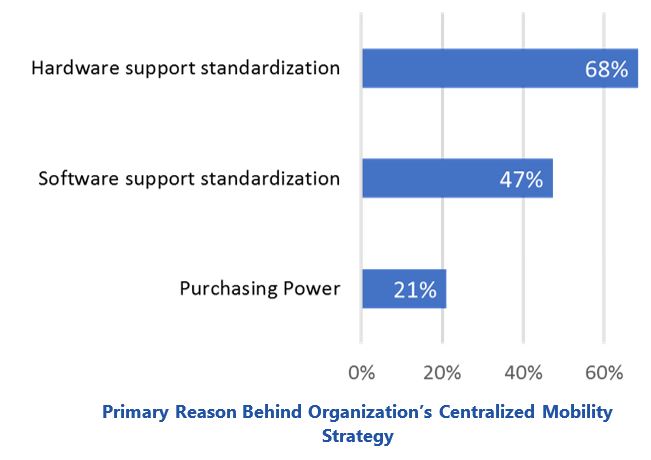

Many organizations have chosen to adopt an enterprise-wide mobility management policy and practice. Such policies

Just over half of respondents indicated that they do have such a centralized policy. While, prior to the survey, we had anticipated that centralized purchasing power would be the primary reason to centralize mobility policies, this research suggests otherwise. Hardware support standardization was the most prevalent primary reason, followed by software support standardization. Purchasing power was a distance third.

The widespread availability of the Android operating system has also brought about the availability of lower-cost,

Since the Android system is intuitive and quick to learn and the devices inexpensive, one would assume that these consumer-grade handheld devices would be a good solution for temporary workers brought in to handle periodic volume increases, such as during the peak holiday season. However, survey participants did not indicate a strong tendency to do so. Our research indicated that warehouses often have excess legacy rugged devices on hand and deploy these when needed to support seasonal warehouse labor surges. And for those organizations that did purchase or lease devices to equip temporary workers, high-performance devices were still more frequently chosen than consumer-grade devices.

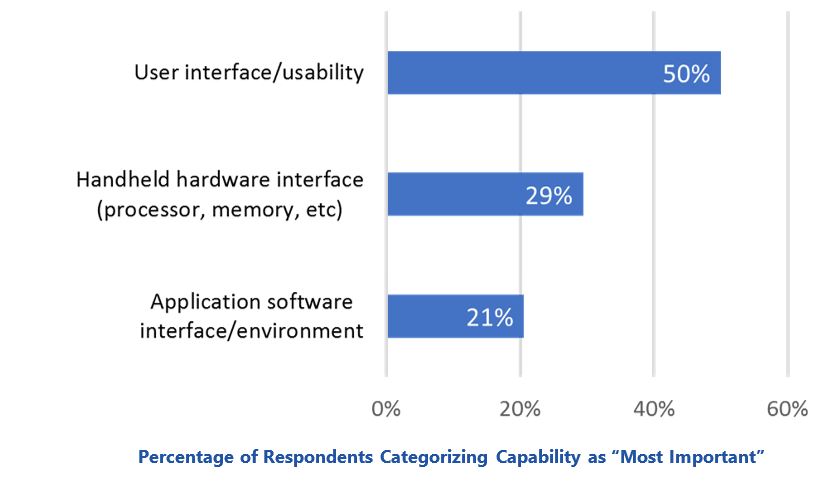

We asked survey participants which handheld computer capabilities are most important to warehouse operations. We

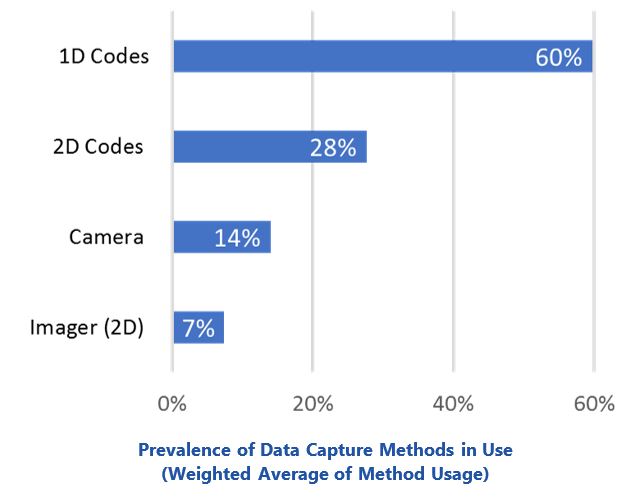

Data representation formats and capture methods are evolving as well with the use of 2D codes, imaging, and cameras. We asked respondents about the degree to which their organizations use various data capture methods with their mobile computing devices. Our findings show that 1D codes are still by far the most prominent data representation and capture method. 2D codes were a distant second, followed by camera and, finally, imager (2D). However, when asked about anticipated use of these methods in three years, 47 percent of respondents indicated that they expect to increase use of 2D codes, while 38 percent expect to increase use of imager (2D). These results suggest that traditional 1D codes are currently sufficient in many cases, but the use of newer capture methods is set to increase, albeit at a measured pace.

Tablets, such as the iPad (iOS) and similar devices running Android or Microsoft operating systems, have experienced

We asked respondents to indicate the degree to which different warehouse workers in their organizations utilize tablets. Surprisingly, vehicle-mounted tablets (i.e., forklifts) was the most prevalent use case, followed by warehouse supervisors, pack stations, and picking tasks. One respondent commented that workers at his company use Microsoft Surface devices for their vehicle-mounted tablets and have had zero damaged units over a two- year period. Clearly, this is an indication that this warehouse at least does not need ruggedized devices.

We followed-up with a question on anticipated change in tablet usage over the next three years. Over 60 percent of respondents indicated that they expect supervisor use to increase. Surprisingly, over 40 percent expect use of tablets to increase for the picking function. Finally, over 30 percent of respondents expected increased use of tablets at pack stations and on vehicles in the warehouse.

This research confirms that warehouses tend to move slowly when it comes to adopting and using new technology. Specifically, the transition from Microsoft-based devices to Android devices is still limited. Furthermore, future changes are likely to occur at an incremental, measured pace. Legacy handheld computers are still in widespread use and excess devices are often used to equip temporary workers. Additionally, 35 percent of respondents stated that most of their workers (still) use alpha-numeric interfaces (as opposed to GUI) when engaged in picking activities. Our results suggest that warehouses are adopting modern mobility, but at a more measured pace than customer-facing business roles.

Key considerations include:

If you would like to buy this report or obtain information about how to become a client, please Contact Us