Keywords: Inflation Reduction Act (IRA), Bipartisan Infrastructure Law, Department of Energy (DOE), Carbon Capture (CC), Carbon Capture Utilization and Storage, ARC Advisory Group.

Between the Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law the United States has invested more than $62 billion in the Carbon Capture Utilization and Storage space. Marking a pivotal time in history for law carbon technologies and the United States’ net zero journey.

The Inflation Reduction Act (IRA), signed into Law on August 16th, 2022, jump started new investments and reignited existing investments towards reducing carbon emissions in the US. The Act provides significant federal funding for climate efforts in domestic manufacturing, encourages procurement of critical supplies, and aids the commercialization of innovative technologies such as carbon capture, storage, and clean hydrogen.

The IRA provides $400 billion for clean energy projects with the goal of lowering the nation’s emissions by half by the end of this decade and eventually net zero by 2050. Businesses, end users, consumers, and organizations are eligible to access IRA funds through loan guarantees, tax credits, and grants. Outlined within the IRA are extended and expanded tax credits for carbon capture, storage, and sequestration.

To achieve net zero emissions by 2050, the US would have to capture an estimated 1.85 billion tons of CO2 a year. Before the US can reach those levels, further research and development must be done to ramp up commercialization of these developing technologies. Policies such as the Bipartisan Infrastructure Bill passed in 2021 and the IRA will make investments in carbon capture projects more feasible and will incentivize decarbonizing those “hard to decarbonize” sectors such as steel and cement. The IRA funds will be distributed and allocated through multiple federal government agencies including the Loan Program Office, Department of Energy, and the Environmental Protection Agency.

The Inflation Reduction Act and the Bipartisan Infrastructure Law was a historical moment in the history of clean energy, carbon capture, and low emission technologies. CCUS technology has been recognized and invested in as a strategy and tool to mitigate CO2 emissions. Currently, the opportunity of growth and investment for carbon capture projects within the United States and abroad is paving the road for industry success.

Carbon capture and storage (CCS) or carbon capture and sequestration describe the process of capturing carbon dioxide (CO2) before it enters the atmosphere, transporting it, and storing it (sequestration). Carbon capture and utilization (CCU) and CCS are commonly grouped together as carbon capture utilization, and sequestration (CCUS) due to the processes of producing a product with an intrinsic low value (CO2). Direct air capture (DAC), which was included in the IRA tax expansion, is a technology that can extract CO2 directly from the atmosphere at any location, unlike carbon capture, which is conducted at the point of emissions. Carbon capture has been applied in a wide range of industries since 1972, beginning at several natural gas processing plants in Val Verde, Texas. Since then, more than 200 million tonnes of CO2 have been captured and stored.

Capture: The separation of CO2 from other gases produced at large industrial process facilities such as coal and natural-gas-fired power plants, steel mills, cement plants and refineries.

Transport: Once separated, the CO2 is compressed and transported via pipelines, trucks, ships, or other methods to a suitable site for geological storage.

Storage: CO2 is injected into deep underground rock formations, usually at depths of one kilometer or more.

Post Combustion: Removes CO2 after combustion of fossil fuel. This is a popular option for fossil fuel power plants which can be retrofitted to include CCS technology.

Pre- combustion: Oxidizes fossil fuel, in a gasifier. The CO from the resulting syngas (CO and H2) reacts with added steam (H2O) and is shifted into CO2 and H2. Making this stage a good option for transporting.

Oxyfuel and Combustion: The fuel is burned in pure oxygen instead of air, reducing fuel consumption.

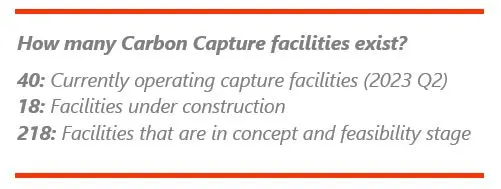

Since its inception, CCUS has been utilized by fossil fuel companies for Enhanced Oil Recovery (EOR). A process that increases yield exponentially by giving the oil ability to flow to a well by injecting water, chemicals, or gases into the reservoir or by changing the  physical properties of the oil. Over the years, more technologies have become available such as Direct Air Capture. Investments in the private sector have grown, from 2015- 2022, global venture capital investment in CCUS was contained mainly in the US, accounting for more than two thirds of total investment, with more than half of projects focusing on capturing CO2 from fuel processing plants. CCUS has been around since the 70s but is clustered largely in the US and historically operates within the “hard to abate” industry.

physical properties of the oil. Over the years, more technologies have become available such as Direct Air Capture. Investments in the private sector have grown, from 2015- 2022, global venture capital investment in CCUS was contained mainly in the US, accounting for more than two thirds of total investment, with more than half of projects focusing on capturing CO2 from fuel processing plants. CCUS has been around since the 70s but is clustered largely in the US and historically operates within the “hard to abate” industry.

Before addressing the most recent expansion of the 45Q tax credit, it’s essential to look at the historical relevance of the one-of-a-kind tax credit for carbon sequestration. It began with The Energy Improvement and Extension Act of 2008, which added a credit for CO2 sequestration to the tax code. The legislation included several provisions designed to encourage cleaner, more efficient and “environmentally responsible” use of coal specifically, and to encourage GHG emissions reductions broadly. CO2 captured using equipment placed in service before February 9, 2018, was eligible for tax credits until tax credits were claimed for 75 million metric tons of CO2. The Bipartisan Budget Act of 2018 expanded and extended the Section 45Q tax credit.

ARC Advisory Group clients can view the complete report at the ARC Client Portal.

Please Contact Us if you would like to speak with the author.

Obtain more ARC In-depth Research at Market Analysis