Introduction

To provide our Advisory Service clients with holistic coverage of the various industrial and automation markets we cover, ARC Advisory Group publishes every quarter indices on automation, machinery and user CapEx markets as a Special Report in PowerPoint format. This concise report focuses more on the quantitative than the qualitative aspects of the markets.

Automation Markets

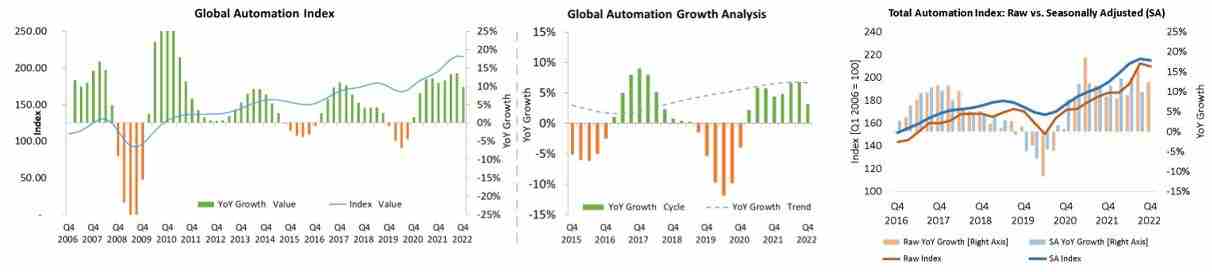

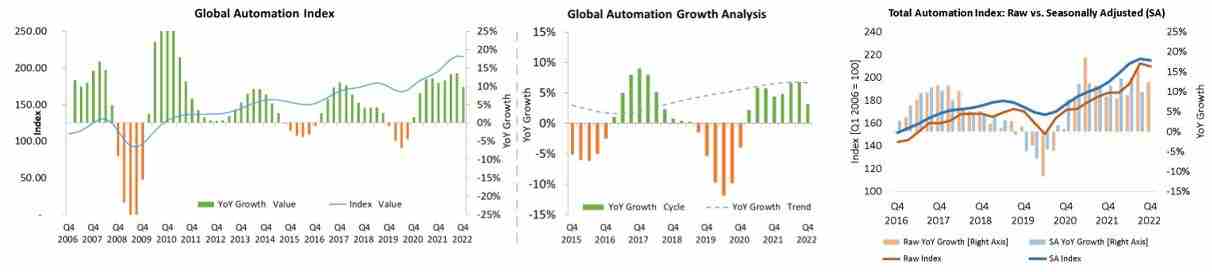

Automation Index: Raw vs. Seasonally Adjusted Data

- The year 2022 was another successful year for automation companies. Despite adverse impacts of supply chain issues, lockdowns in China, high inflation, energy crisis in Europe, and volatile exchange rates the automation markets continued on the growth path in 2022 as well.

- Overall good situation in revenue growth with eight consecutive growth quarters, seven of eight quarters saw double digit growth rates since Q4 2020.

- The registered YoY growth was at a low level compared with the recent previous growth rates. Raw data shows a YoY growth of 12 percent while seasonally adjusted YoY growth shows 10 percent. The YoY growth cycle shows a very low-level growth rate of 3 percent and YoY growth trend shows stable since Q1 2022.

- Growth was driven by volumes due to higher backlogs and rise in prices. Most of the automation companies experienced good growth rates at lower double-digits and very few companies saw declines but at a lower rate.

Americas

- Demand for automation products continued in the US market but was slightly lower compared with Q3 2022. Most of the vendors experienced growth rates between high-single digits to lower double-digits in revenues.

- After three consecutive slow growth quarters, the automation market in the Americas saw a good growth of 10 percent on YoY basis in Q3 2022.

- The YoY growth cycle showed a slow growth but higher than the first two quarters of 2022, and the YoY growth trend remained almost stable in the Americas.

- Growth was driven by process industries: refining, oil & gas, water & wastewater, power, and pulp & paper. Investments on energy transition and renewables continued to expand. Growth in marine, ports, buildings and transportation sectors further supported the growth.

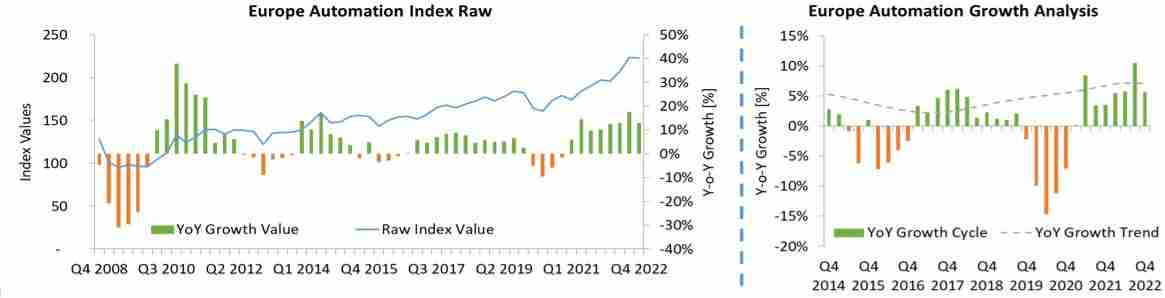

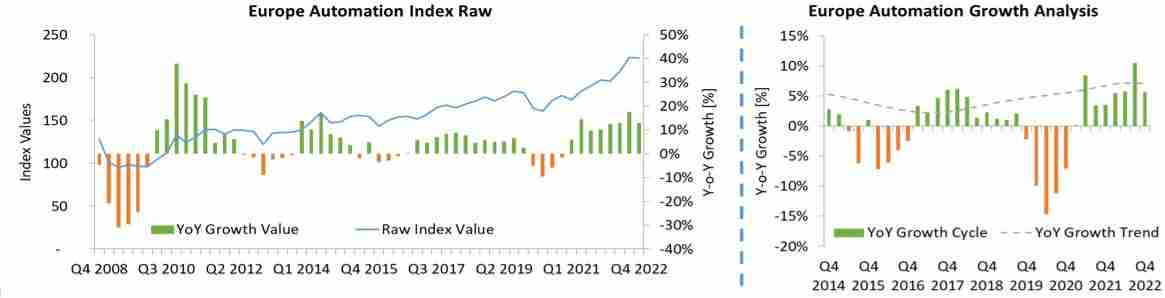

Europe

- Automation market in Europe continued to expand. After registering a strong growth of over 18 percent in Q3 2022, the automation market saw a little lesser growth of about 13 percent in Q4 2022 on YoY basis.

- High order backlogs and price increase are supporting growth of the major automation suppliers. However, normalization of orders from users will see slower orders in the coming quarters.

- While demand from some of the machine building segments reported slower growth compared with previous quarters, robotics segment performed with double-digit growth rate YoY basis.

- Slowdown in China limited the growth of Europe-based machine building and automation companies.

- Continued demand from automotive, pharmaceutical & biotech, chemicals, commercial buildings, and stable food & beverage, electrical & electronics, semiconductors and aerospace & defense sectors.

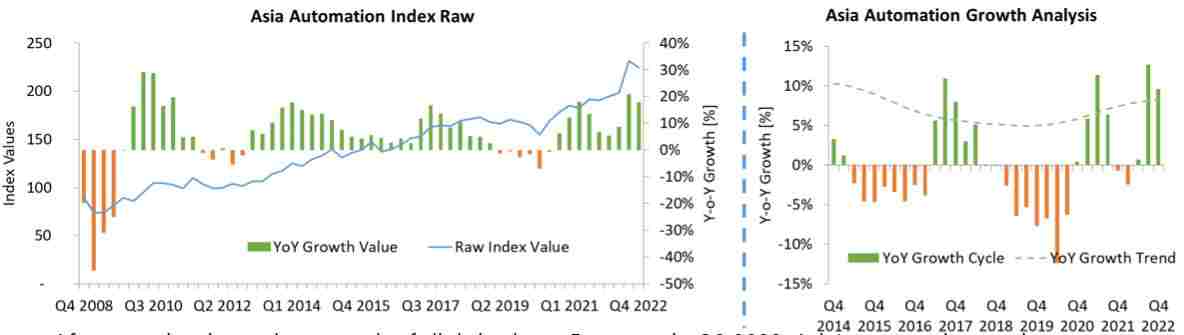

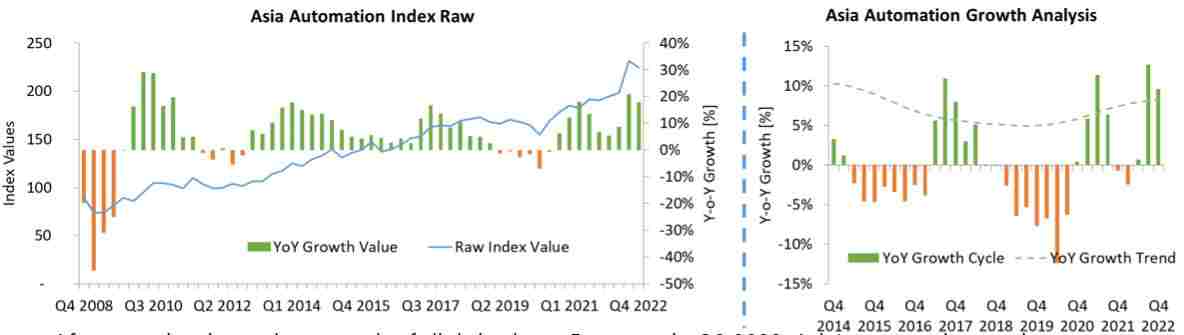

Asia

- After experiencing a slow growth of slightly above 5 percent in Q2 2022, Asia’s automation market saw a very high growth of 20 percent in Q3 2022 and continued almost at the same level with over 18 percent growth in Q4 2022.

- Slow growth in China due to the impact of COVID-19 and measures to curb its spread. High demand from India, especially from machine building segments. Good demand from Japan and South Korea due to high order backlogs.

- Automation markets continued to see global demand for capital expenditures related to energy transition, decarbonization, semiconductors, EV and lithium-ion batteries sectors. Strong demand from automotive, oil & gas, power generation, renewables, chemicals, food & beverage, and buildings sectors.

Table of Contents

- Automation Markets

- Machinery Markets

- End User Markets

- Sentiment Index

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us