Introduction

To provide our Advisory Service clients with holistic coverage of the various industrial and automation markets we cover, ARC Advisory Group publishes every quarter indices on automation, machinery and user CapEx markets as a Special Report in PowerPoint format. This concise report focuses more on the quantitative than the qualitative aspects of the markets.

Automation Markets

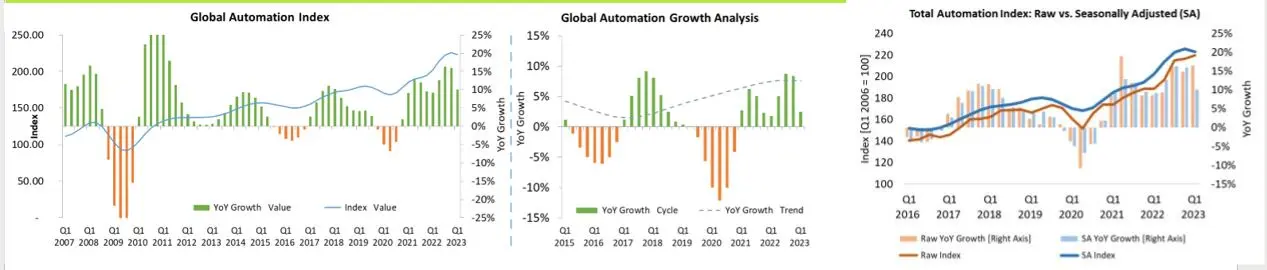

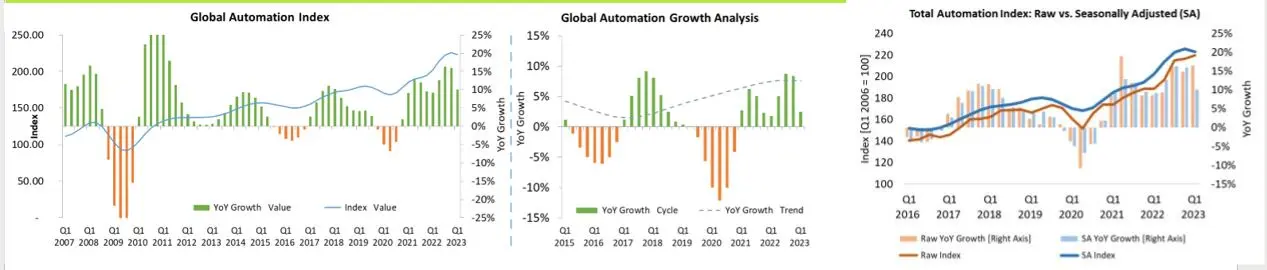

Automation Index: Raw vs. Seasonally Adjusted Data

- After a successful year 2022, automation companies started to see a little lower growth in Q1 2023, compared with the last three quarters.

- Adverse impacts of supply chain issues, high inflation, and energy crisis in Europe appears to have eased or minimized. Overall good situation in revenue growth with double digit growth rates since Q4 2020.

- The registered YoY growth was at a low level compared with the recent previous growth rates. Raw data shows a YoY growth of 17 percent while seasonally adjusted YoY growth shows 10 percent. The YoY growth cycle shows a very low-level growth rate of 2 percent and YoY growth trend shows stable since Q1 2022.

- Growth was driven by volumes, prices, and backlogs. Most of the companies that registered higher backlogs from previous quarters saw growth rates at above higher single-digit and expect to continue the same levels for the next quarters. Some vendors’ orders remained stable, and some saw strong declines on YoY basis.

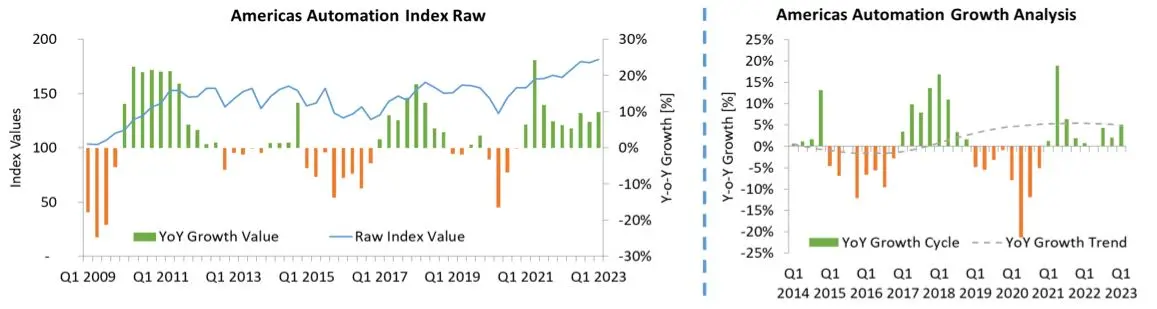

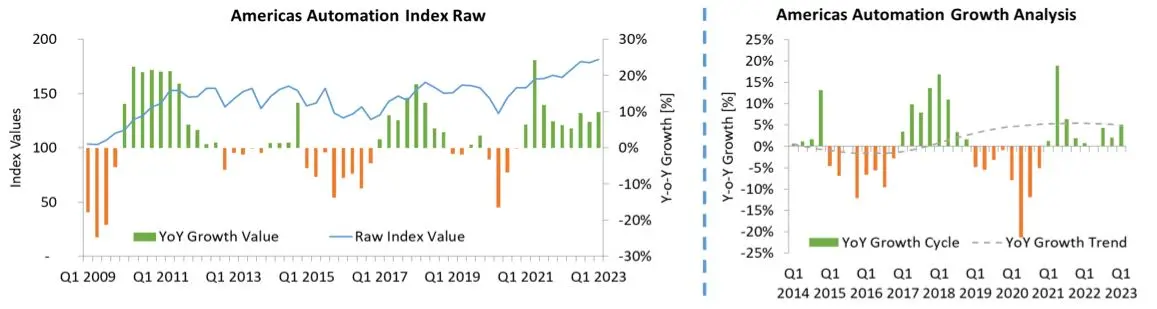

Americas

- Demand for automation products continued in the US market, with a higher growth rate compared with Q4 2022. Most of the vendors experienced growth rates between high-single digits to lower double-digits in revenues.

- The YoY growth cycle showed a slow growth in Q4 2022, but the cycle now shows a higher growth as in Q3 2022 and the YoY growth trend remained almost stable in the Americas.

- Growth was driven by process industries: strong growth in oil & gas, refining, chemicals, water & wastewater, and electric power. Investments on energy transition, renewables, and battery manufacturing continued to expand.

- Growth in marine, buildings, defense and transportation sectors further supported the growth. Slow or moderate growth was seen from discrete industry sectors.

Europe

- Automation markets in Europe continued to expand. The market saw a little higher growth of about 15 percent in Q1 2023 on YoY basis compared with the growth of 13 percent in Q4 2022.

- The YoY growth trend and the YoY growth cycle show almost stable growth.

- High order backlogs and price increases supporting growth of the major automation suppliers. However, normalization of orders from users will see slower orders in the coming quarters.

- Strong demand from end user markets as supply chain issues ease. Strong demand from automotive, renewables, pharmaceutical & biotech, chemicals, oil & gas, commercial buildings and stable food & beverage, aerospace & defense, semiconductors, and electronics sectors.

- Healthy demand from machine building sector.

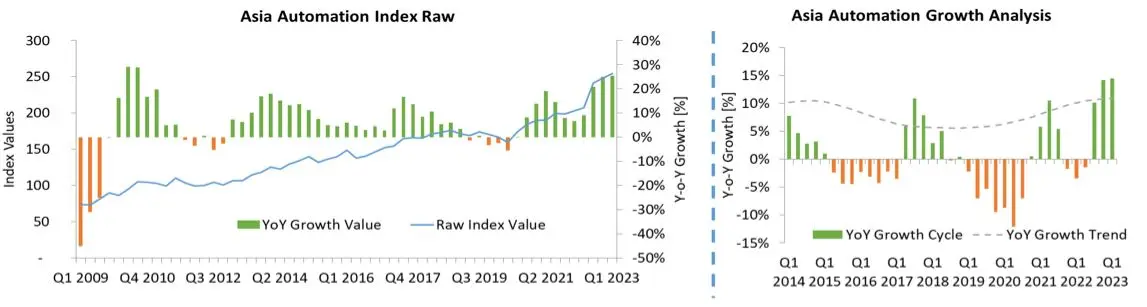

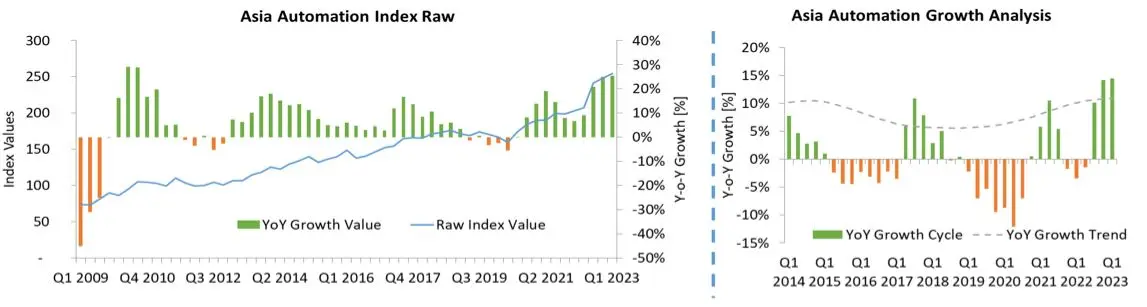

Asia

- Registering a high growth of 25 percent in Q1 2023, Asia’s automation market continued to expand at double-digit growth rates of over 20 percent for the past three consecutive quarters.

- Slow growth in China due to the impact of COVID-19, however there is a sign of rebound. High demand from India, especially from machine building segments. Also, strong demand from Japan and South Korea due to electrification, digitalization, decarbonization, circularity and sustainability related investments.

- Strong demand from automotive EV segment, battery manufacturing, oil & gas, mining, metals, machine building, power generation, renewables, chemicals, food & beverage, water & wastewater and building sectors.

- Government incentives related to decarbonization, energy transition, and energy efficiency boost the growth.

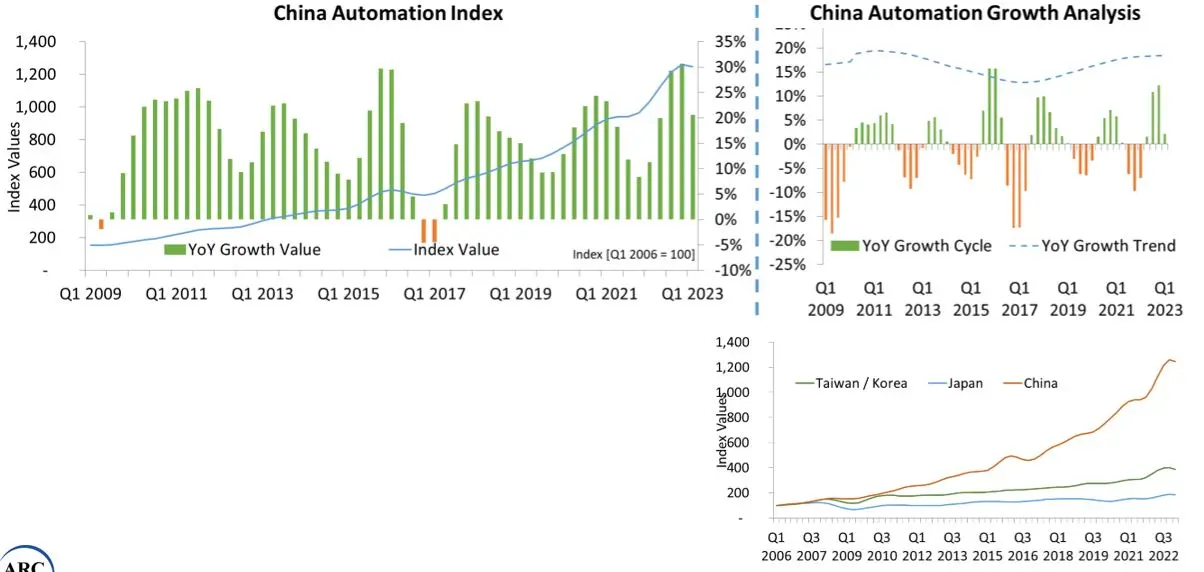

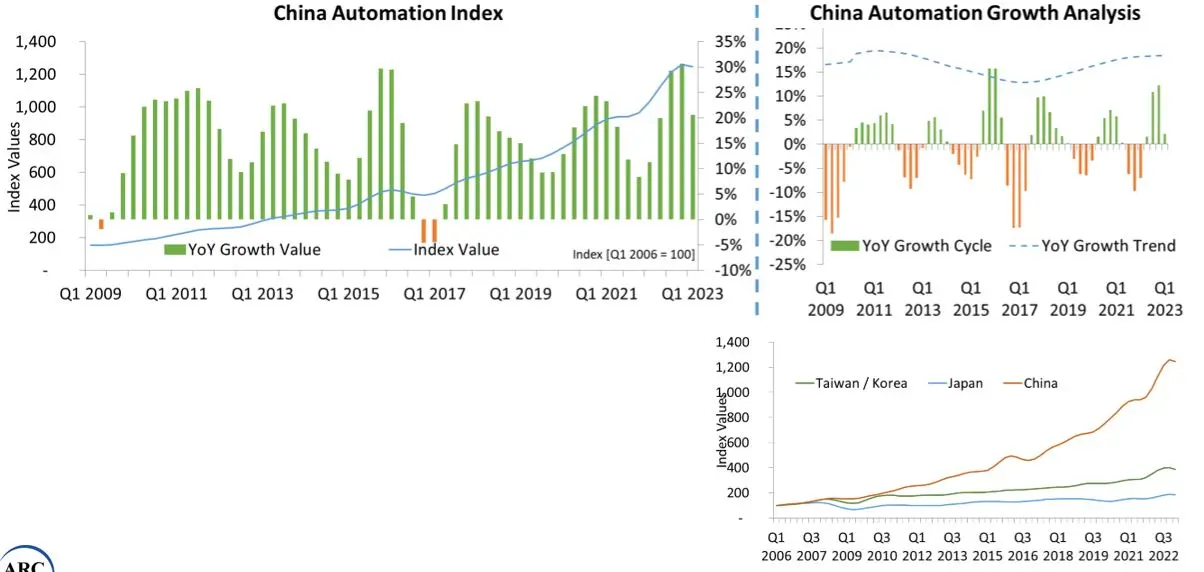

China

- Increase in number of automation players from China was phenomenal in the last decade.

- It appears that China based automation players have been seeing the highest growth rates at double-digits almost all the time on YoY basis since late 2009.

- China based automation players expanded their footprints outside China, even beyond Asia, to Europe, US, and Latin America markets. Some acquired local players in Europe, in the US, some made partnerships, and have distributor channels.

Table of Contents

- Automation Markets

- Machinery Markets

- End User Markets

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us

Obtain more ARC In-depth Research at Market Analysis

Learn more about ARC Strategic Services at Advisory Services for Industry Leaders