In this Insight, ARC Advisory Group includes the most recent quarterly results for major automation suppliers that publicly report their results. To convert the revenues of non-US suppliers to US dollars, we average exchange rates for foreign currencies used for the entire quarter.

With this latest automation supply side-market update, ARC has increased the number and breadth of automation suppliers covered, based on a combination of publicly reported data and ARC’s own extensive research database. We have also added selected business intelligence visualizations. Readers should contact their ARC client managers if they would like to gain additional access to this market intelligence as it applies to both regional and sector-specific supply side automation market trends.

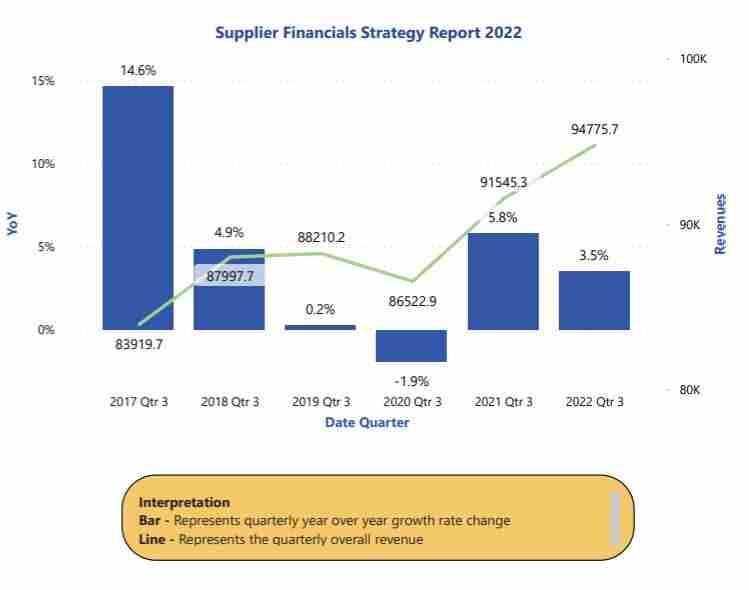

Financial results during calendar period from July 1 to September 31.

Growth for automation products market was in low single digits in Q3 2022 compared with the same quarter last year.

Most industrial companies experienced a growth for the food and beverage, chemical, pharmaceuticals & biotech, buildings & infrastructure, semiconductor, machinery, and water & wastewater industries in this quarter.

Adoption of Industry 4.0 leads toward smart manufacturing and remote monitoring of plant operations

Most automation suppliers are showing growth in this quarter.

Increased investment in 5G networks has helped electronics and semiconductor industries to grow.

Green energy and sustainability will drive the automotive industry with a major demand for electric vehicles from both developed and developing nations.

The automotive industry is on the verge of recovery with major demand for electric vehicles from both developed and developing nations.

Machine builders are experiencing strong demand.

Some of the top growing suppliers, such as Aspen Technology, Belden, Delta Electronics, Fortive, Hitachi, Parker Hannifin, Rockwell Automation, and Valmet witnessed double-digit revenue growth in Q3 2022, compared with the previous year.

Some of the trending technology trends include Artificial Intelligence (AI) and Machine Learning (ML), Robotic Process Automation (RPA), and Edge Computing.

The implementation of robotics and automation in the food processing, packaging, and retail sectors provides improved safety, quality, and profitability by optimizing process monitoring and control.

Sustainability and environment friendly responsible business practices are driving growth.

The deployment of digital technologies, especially when it comes to new business models and remote maintenance & monitoring are becoming popular in automating plants and processes.

Megatrends such as urbanization, a rising middle class, and an aging society are helping the automation market to grow. Industrial IoT and digitalization are the key factors that help boost the growth of the automation market.

Increased focus on cybersecurity: As automation technology becomes more prevalent, ensuring the security and safety of these systems becomes more important.

ABB Group

Changes in exchange rates weighed on total order growth. However, the underlying customer demand was strong, resulting in order growth of 4 percent (16 percent comparable), year-on[1]year. Customer activity was robust for both the short-cycle flow business and the systems business. The strongest contribution to order growth was seen in Electrification and Motion. Process Automation was hampered by a high comparable and timing of order placements. Robotics & Discrete Automation saw protracted lead times in customers’ decision making and normalizing order patterns in anticipation of shorter delivery lead-times due to easing of component constraints. Customer activity was strong across regions. Order intake in the Americas increased by 16 percent (25 percent comparable) driven by the US. Orders in Europe increased by 1 percent (20 percent comparable), supported by all the largest markets in the region. Asia, Middle East and Africa reported a decline of 4 percent (up 4 percent comparable), including a decline of 8 percent (2 percent comparable) in China. However, worth noting is that excluding the impact from large orders received last year the region increased at a double-digit pace, on a comparable basis.

Revenues improved in virtually all divisions. In addition to a generally high flow business demand, volumes were supported by the sequential easing of supply chain constraints facilitating deliveries from the order backlog, not least due to better access to semiconductors. Additional support was derived from lower business disruptions from Covid-related lockdowns in China compared with the previous quarter.

Process Automation

Total order intake amounted to $1,568 million and declined by 6 percent (up 3 percent comparable) year-on-year, as adverse changes in exchange rates more than offset a positive underlying trend in customer activity in most divisions. The timing of customers placing orders somewhat hampered order intake, particularly noticeable in Energy Industries and Marine & Ports. The general order pipeline remains strong. Demand was particularly strong in the segments of mining and refining, with positive developments also noted in areas of marine and gas. In the power generation, pulp & paper and ports segments, the customer activity remained stable, while some initial signs of headwinds were noted in metals due to the high energy prices. Service orders increased by 1 percent (12 percent comparable). Orders in the Americas increased by 6 percent (9 percent comparable). Changes in exchange rates weighed on Europe which declined by 8 percent (up 8 percent comparable) and Asia, Middle East and Africa which reported a sharp drop of 12 percent (4 percent comparable), with the latter also challenged by a high comparable from last year’s order level in China.

Revenues declined with a positive development in customer deliveries in all divisions. While the supply constraints on semiconductors eased somewhat sequentially, some hampering effect is still expected in the fourth quarter. Profit Operational EBITA and Operational EBITA margin improved with contribution from all divisions. The impact from increased volumes with improved gross margin in the order backlog was the main driver for margin improvement. This marks the last quarter when reporting includes the Turbocharging division (Accelleron), which was separately listed on the Swiss stock exchange in early October.

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us