The respective investment activities of companies in different industries varies strongly. In this intermediate update to

Capital expenditures (CapEx) are a leading indicator for automation markets. When confidence in vertical industry markets decline, a decline in investments often follows.

The outlook for most discrete manufacturing industries is good, but especially so for electronics and semiconductors.

ARC has identified the following key points for 2017 and 2018:

2017

2018

In this section, we look at the individual discrete manufacturing industries, with an update of the revenue and CapEx development. We also identify the challenges that affect each industry, the reasons behind them, and provide some recommended solutions.

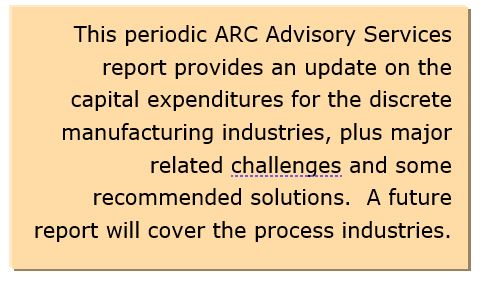

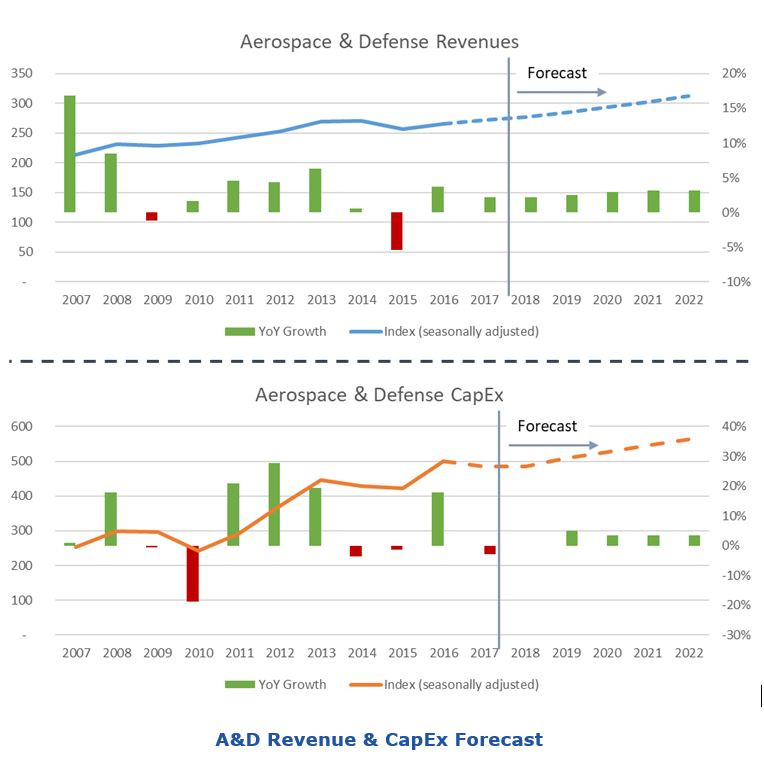

The aerospace & defense (A&D) sector includes both the commercial air-craft industry and the defense sector. 2017 was a good year in revenues. Capital expenditures contracted slightly, but remained on a historically high level. Most major companies in the A&D sector still have large order backlogs, so we expect the revenues to increase further and CapEx to develop roughly in parallel.

Producers are looking more into new materials and face pressure to meet delivery schedules. This creates a positive overall situation for capital and automation expenditures, as end users automate larger share of production. These dynamics will most likely not change over the next five years.

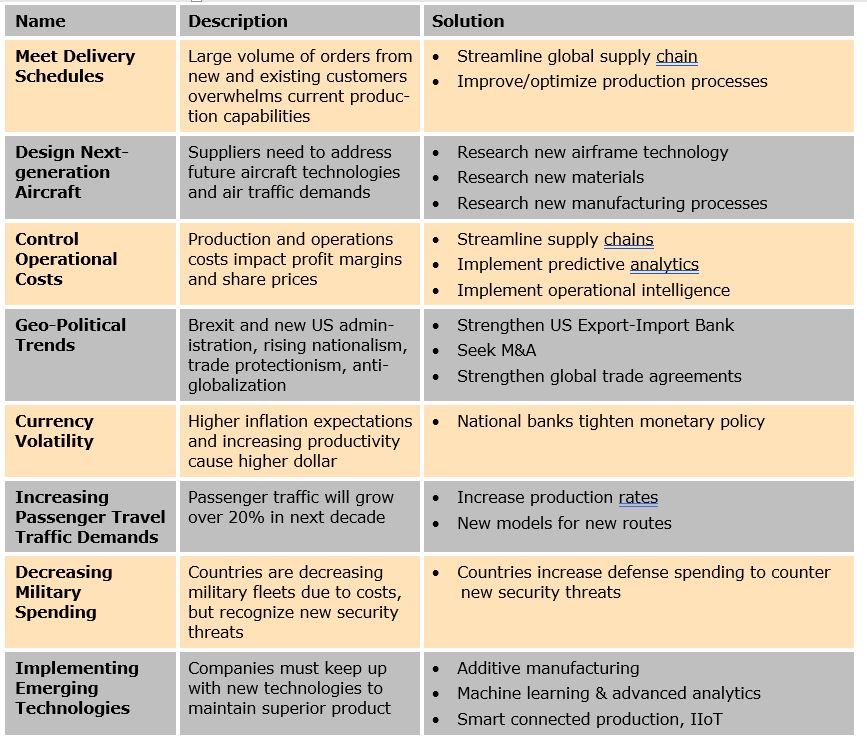

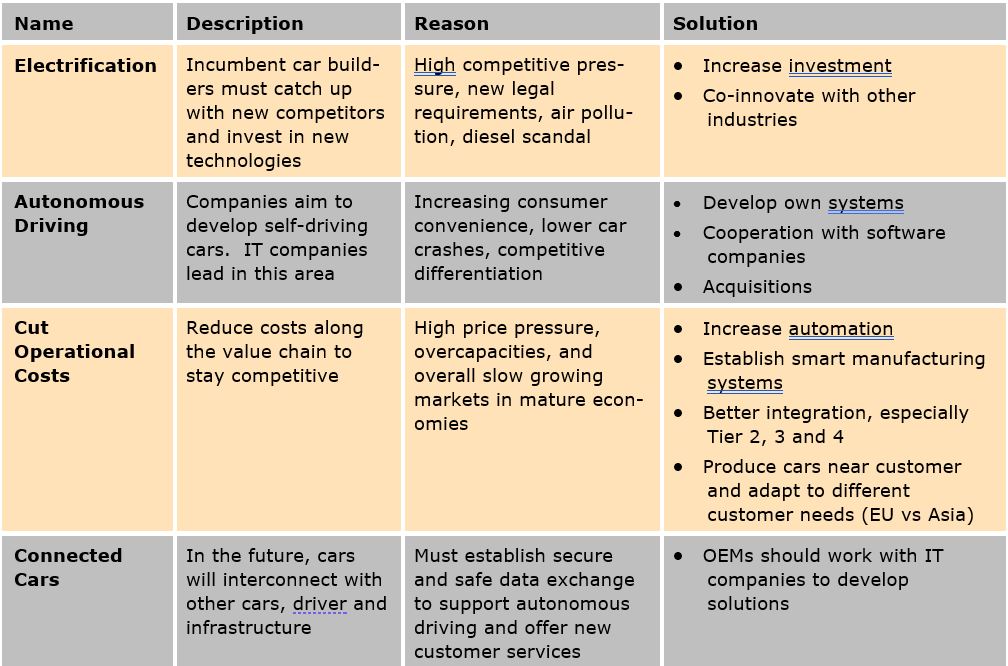

In 2017, revenues and CapEx increased to a new all-time high in the automotive industry. However, it seems that the capital expenditure rally of the last years is slowing down. In the long run, CapEx will slow down slightly as electric vehicles will need less investments. On the other side, investments in battery manufacturing will increase.

The transformation of the automotive industry is happening in a highly competitive environment. While car manufacturers are typically on the forefront, tier 2 and tier 3 suppliers typically lag in terms of technology adoption.

While outsourcing has been a major trend since the 1970s, many car manufacturers now seek to keep and increase their level of production and value add. For these, operational excellence and further automation are key.

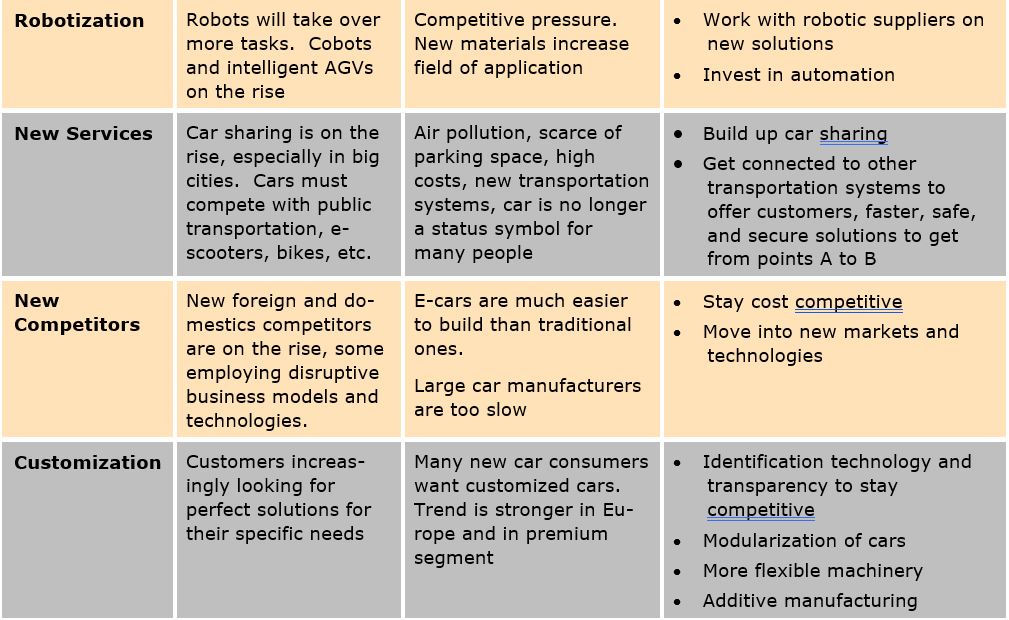

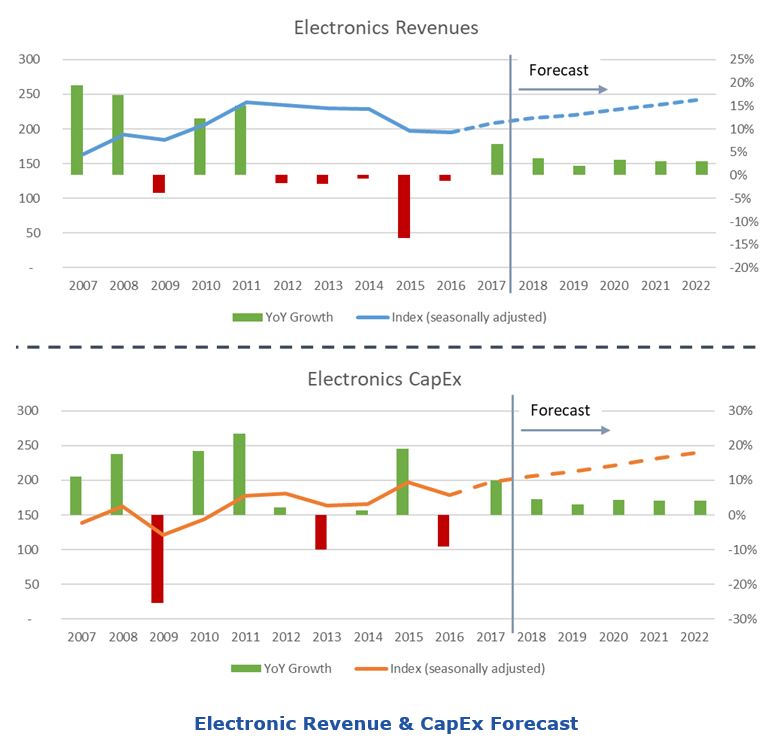

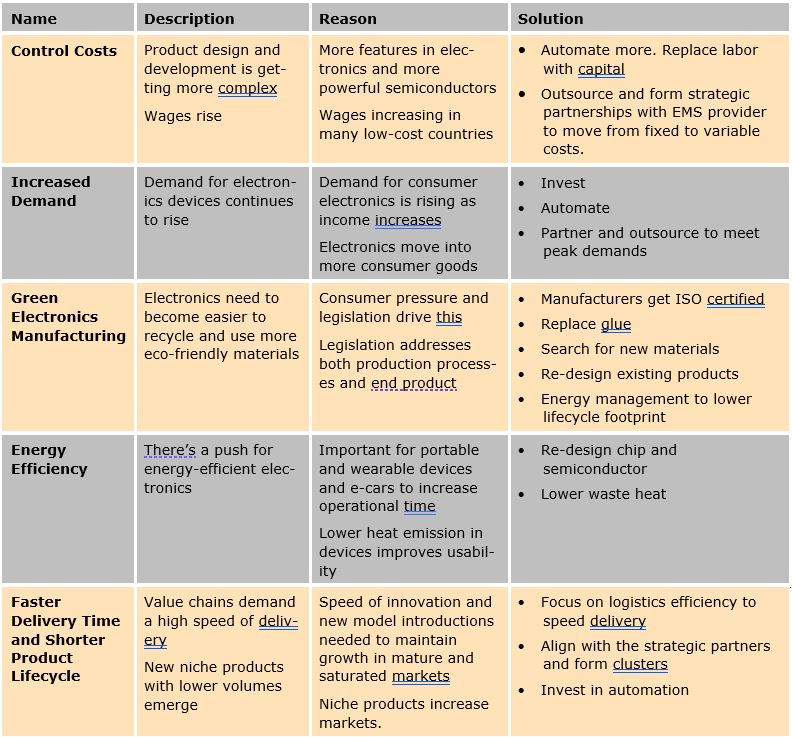

In 2017, the electronic product manufacturing industry developed well. A strong expansion in all regions and the improving world economy boosted end user revenues. Capital expenditures grew even stronger. For years, investments outpaced the revenues, as many end users replaced manual labor with automated production to reduce costs. This trend will continue.

Electronics manufacturers also benefit from the IoT trend. More consumer products are connected and have an increasing amount of electronics built in – from toasters to sportscars. This also creates new challenges. Electronic products need to get smaller, more rugged, and - most important – more energy efficient to increase battery lifetime and reduce heat generation.

Electronics manufacturers face high competitive pressure, even though the market is currently growing at a robust pace. The market is driven by a high speed of innovation, making close collaboration with semiconductor suppliers key. In some cases (i.e., Samsung and Hitachi) the companies are totally integrated. As product lifecycles are short, manufacturing excellence and a quick ramp up are keys to success.

Currently, many end users are investing more in automation to replace manual labor to ultimately lower and control costs, decrease time to market, and improve quality.

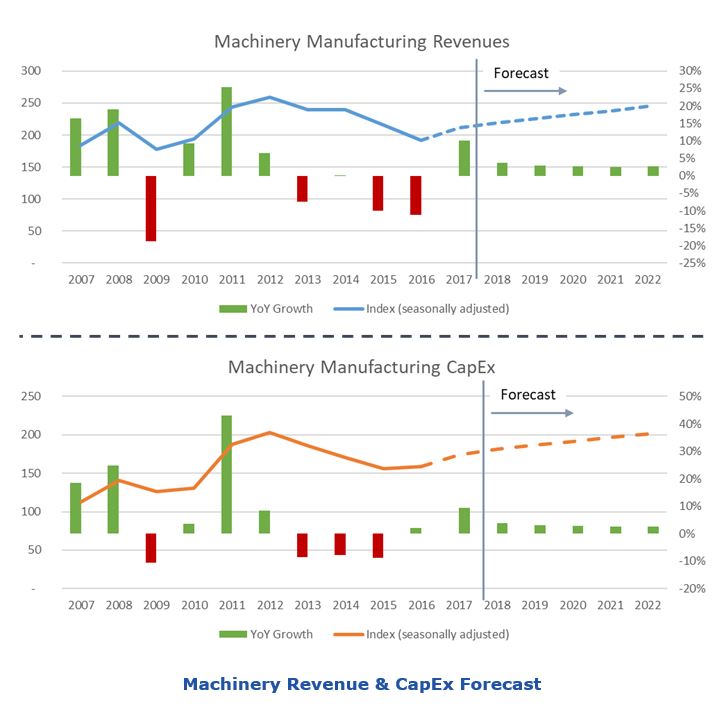

Revenues and capital expenditures increased strongly in 2017 at around 10 percent (measured in US dollars). Strong growth is expected in machinery in 2018, driven by an increase in expenditure in the automotive, electronics, mining, construction, and agriculture industries.

Machinery OEMs had a good 2017. However, many are in a transition phase and worried that they may miss out on talent, digitalization, modularization, or new control technology.

Long run trends, such as rising wages in China, increased demand in quality of consumer products, and flexibility of production also drive adoption of machinery across all main end user industries.

In 2009 many OEMs experienced a sharp drop in revenues, as most business models still relied primarily on selling machinery and on capital expenditures of end users. Now, many OEMs are working on new business models, to smooth out revenue streams.

In 2017 spending on fab equipment investments reached an all-time high, with high chip demand, strong pricing for memory and increased competition driving the investments. Significant CapEx spending is expected to continue into 2018, especially in China as many fabs begin equipping the facilities constructed in 2017.

The semiconductor production industry is quite consolidated, centering on a handful of companies. Samsung, the largest company in our sample, is responsible for a good share of the 2017-18 uptick in capital expenditures, as it invested heavily in production facilities. In mid-2017, Samsung announced a $18 billion investment plan to meet demand associated with IoT, artificial intelligence, and automotive technologies. Other producers have also increased their spending significantly. While it is unclear how long capital expenditures will remain at such a high level, the constant demand in semiconductors (and electronics) will drive investments. In contrast to revenues, which are impacted by price competition, capital expenditures experience less pressure.

After many years of volatile and weak growing capital expenditures, the semiconductor industry is now among the largest growth drivers for global CapEx.

The outlook is good for CapEx spending for all discrete industries over the forecast period. The previous capital expenditure rally for automotive is slowing down and the semiconductor industry is currently the largest growth driver for global CapEx.

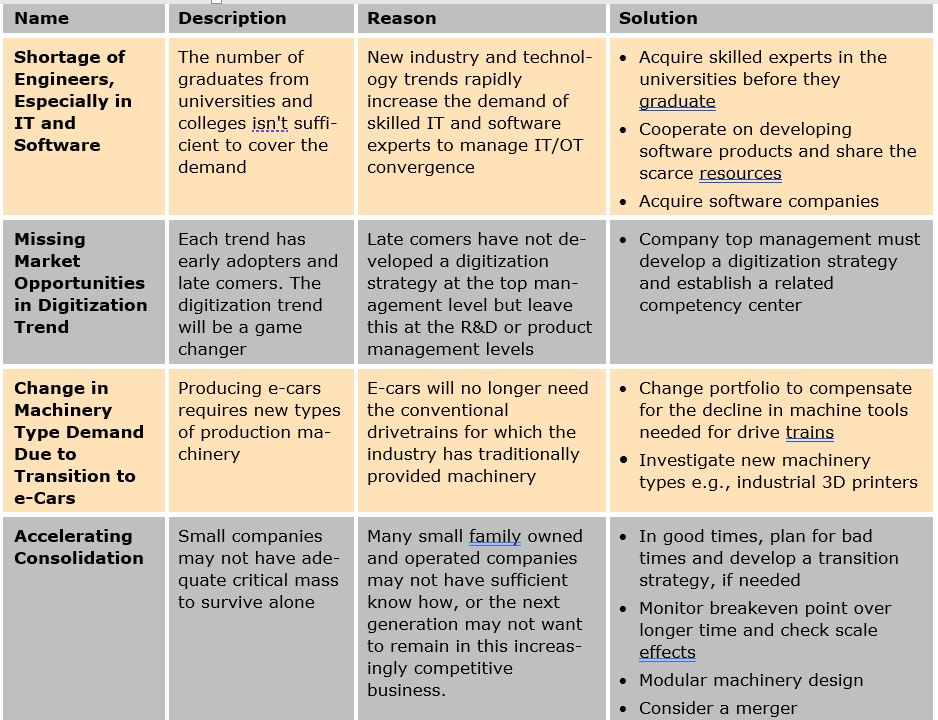

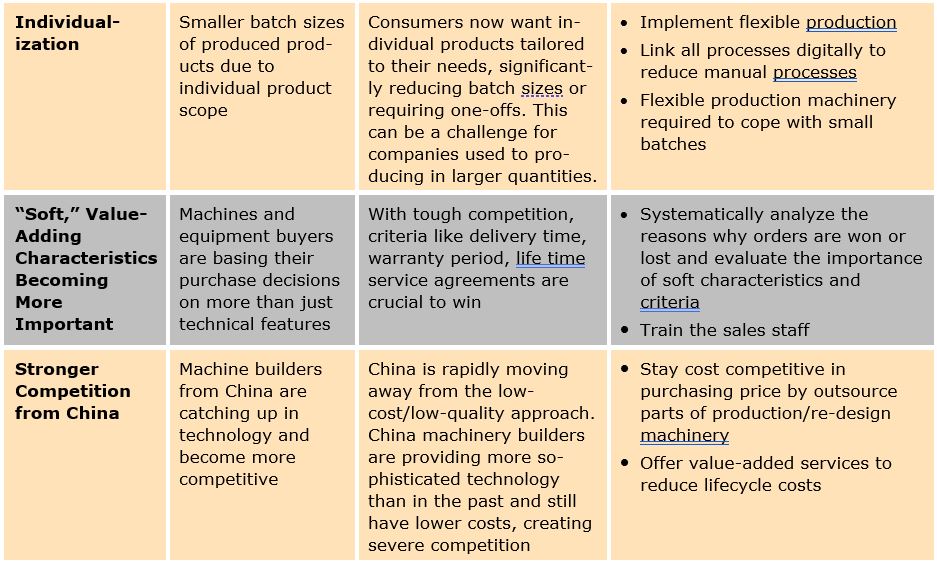

Each industry has its own unique challenges, but several common denominators are at the root of these challenges.

From a top-level perspective, ARC has identified some solutions that cross multiple verticals:

To ensure companies remain competitive, it is essential that decision makers keep pace with the fast moving, and sometimes disruptive, technologies. One thing is certain; the pace of change will not relent and only those with the ability to adapt will survive and prosper.

If you would like to buy this report or obtain information about how to become a client, please Contact Us