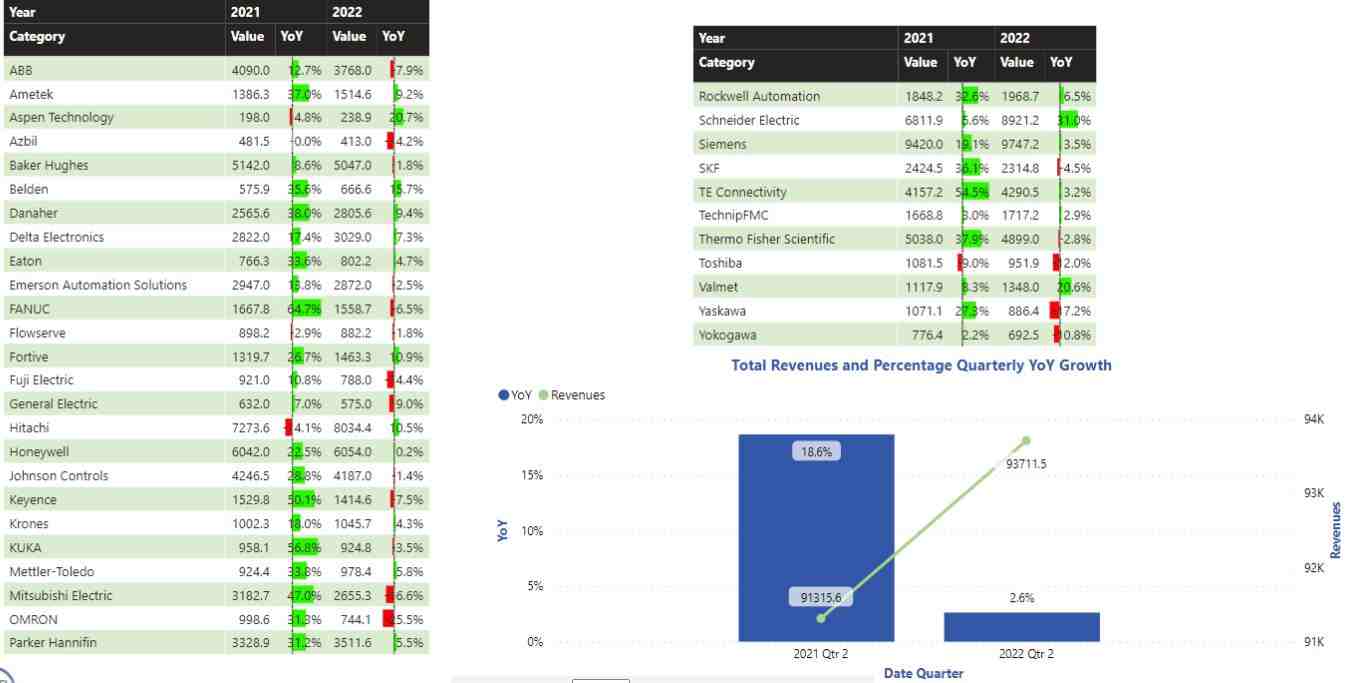

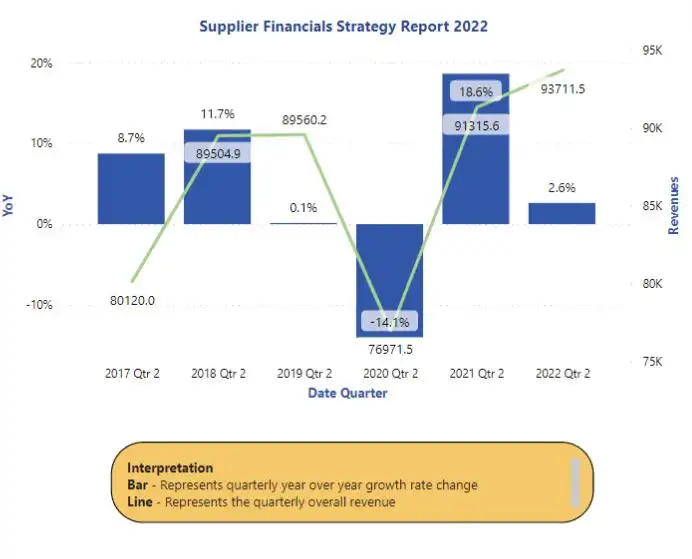

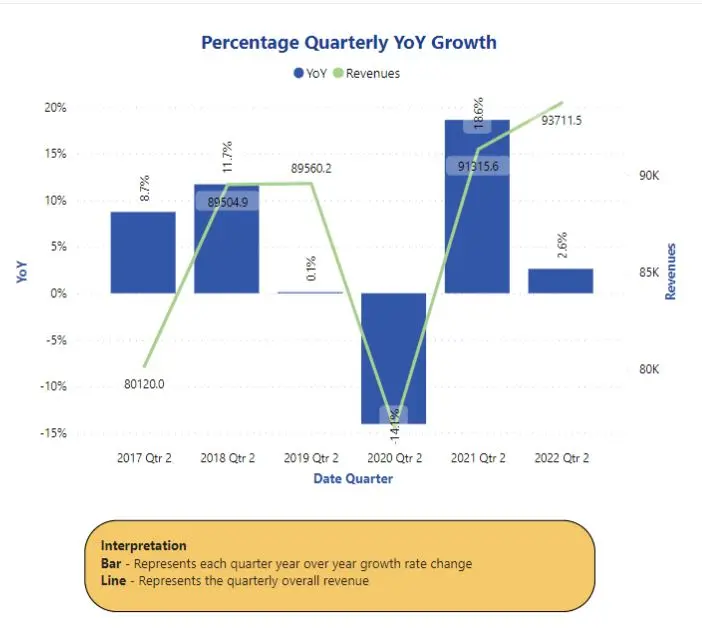

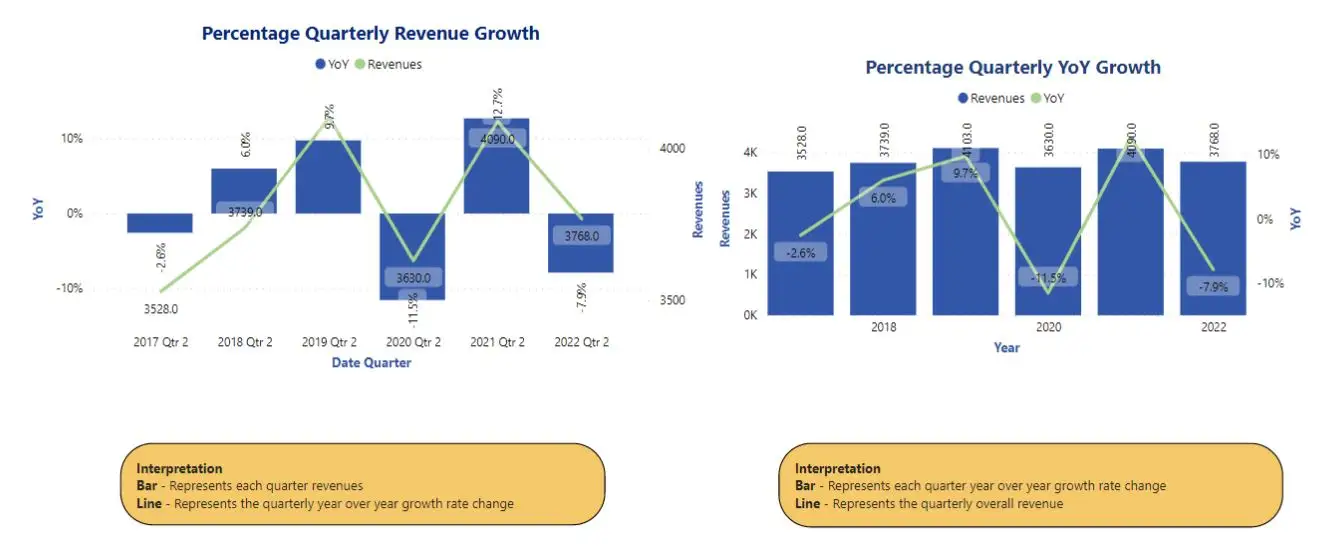

In this Insight, ARC Advisory Group includes the most recent quarterly results for major automation suppliers financials that publicly report their results. To convert the revenues of non-US suppliers to US dollars, we average exchange rates for foreign currencies used for the entire quarter.

With this latest automation supply side-market update, ARC has increased the number and breadth of automation suppliers covered, based on a combination of publicly reported data and ARC’s own extensive research database. We have also added selected business intelligence visualizations. Readers should contact their ARC client managers if they would like to gain additional access to this market intelligence as it applies to both regional and sector-specific supply side automation market trends.

Financial results during calendar period from April 1 to June 30.

High growth was expected for automation products in the automation market; however, growth increased only marginally in Q2 2022 compared with the same quarter last year.

Most industrial companies experienced a recovery for the food and chemical, beverage, pharmaceuticals & biotech, buildings, semiconductor, machinery, and water & wastewater industries in this quarter.

Adoption of Industry 4.0 leads toward smart manufacturing and remote monitoring of plant operations.

Most automation suppliers are showing growth, a clear sign of exit from the pandemic in 2021.

Increased investment in 5G networks has helped electronics and semiconductor industries to grow. Green energy and sustainability will drive the automotive industry with a major demand for electric vehicles from both developed and developing nations.

Machine builders are experiencing strong demand.

The automotive industry is on the verge of recovery with major demand for electric vehicles from both developed and developing nations.

Some of the top growing suppliers, such as Aspen Technology, Belden, Fortive, Hitachi, Schneider Electric, and Valmet witnessed double-digit revenue growth in Q22022, compared with the previous year. Most automation markets are back to pre-pandemic levels.

The deployment of digital technologies, especially when it comes to new business models and remote maintenance & monitoring are becoming popular in automating plants and processes.

Government initiatives and protocols have influenced the adoption of industrial automation.

The implementation of robotics and automation in the food processing, packaging, and retail sectors provides improved safety, quality, and profitability by optimizing process monitoring and control. This automation can help food businesses improve their supply and demand management.

Megatrends, such as urbanization, a rising middle class, and an aging society, are helping the automation market to grow. Industrial IoT and digitalization are the key factors that help boost the growth of the automation market.

Adoption of robotics is on the rise and is managed by both humans and Artificial Intelligence.

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us