Introduction

To provide our Advisory Service clients with holistic coverage of the impact of the COVID-19 pandemic on various markets, ARC Advisory Group publishes the latest Automation Index as a Special Report in PowerPoint format. This concise report focuses on the quantitative rather than qualitative aspects.

We have adopted our CapEx calculations to line up with the automation indices, but this did not result in significant changes to the overall dynamics.

Automation Markets

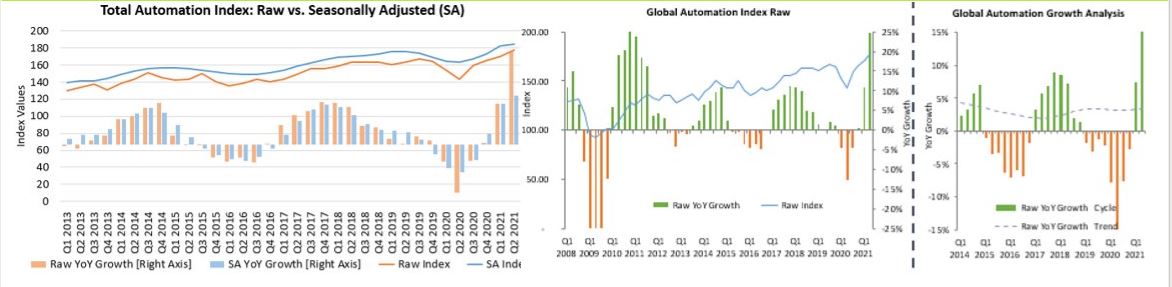

Automation Index: Raw vs. Seasonally Adjusted Data

- Almost all the automation companies continued on their recovery path, some experienced double-digit growth rates in Q2 2021. All regions (America, ASIA, and Europe) registered growth rates of over 20 percent in Q2 2021.

- Since the COVID-19 pandemic, Asia region was the main growth engine until Q1 2021, but with a growth rate of about 25 percent, both Europe and America markets outperformed in Q2 2021 and helped the global automation market to register a growth rate of about 21 percent.

- Demand increased significantly in Q2 2021 compared with Q2 2020, when the COVID-19 pandemic impact on the market or economy at peak.

- Hardware segment continued on its growth path and with a strong growth rate of about 26 percent, hardware segment outperformed than software segment in Q2 2021.

Americas

- In the Americas, the raw index shows that quarterly YoY development has seen a market recovery with a growth rate of about 7 percent in Q1 2021. The market continued on its growth path and registered a strong growth rate of about 25 percent in Q2 2021.

- Some major automation companies reported double-digit growth rates. Growth was mainly due to the recovery in some of the major end user markets and a positive development in several process-related markets: pulp & paper, water & wastewater, mining and chemicals.

- Demand in the oil & gas and electric power generation segments improved but at low levels.

Europe

- Automation markets in Europe experienced double-digit growth values of about 14 percent in Q1 2021 and 25 percent in Q2 2021 on YoY basis. This is the highest growth rate for Europe since 2012. The strong growth in Europe is the result of a very small basis as the consequence of Europe-wide lockdowns in Q2 2020.

- Automotive and machinery industry sectors are the key sectors for Europe region and these sectors started experiencing recoveries from Q1 2021. Some major machine builders reported strong growth rates in Q2 2021 mainly due to the rise in demand for packaging and material handling equipment.

- Strong demand from electronics, semiconductors, and cement & glass in the Asia region also helped European automation companies as major European automation companies have strong presence in Asia.

Asia

- Asian automation market experienced a growth of about 23 percent in Q2 2021 on YoY basis.

- In Q2 2021, discrete and hybrid industry segments registered strong growth rates while process industry segments registered a bit lower growth rates compared with discrete and hybrid segments.

- Asia’s semiconductors, electronics, cement & glass, automotive, and life sciences segments performed with strong growth rates and continued to be the key drivers for the growth.

- Increased demand for factory automation systems due to an increase in demand relating to semiconductor, electronic components, smartphones, tire manufacturing, EV, and lithium-ion battery.

Hardware vs. Software

- Software segment was a bit resilient to COVID-19 pandemic and saw a minimal impact on growth.

- After experiencing a recovery with good growth rates in Q1 2021, the hardware segment continued on its growth path and performed better than software segment with a YoY growth value of about 26 percent in Q2 2021.

- Overall, hardware market is back to its growth path and performed better than pre-COVID pandemic levels in Q2 2021.

- ARC expects software and services markets to continue to grow as industrial companies invest in digitalization for remote maintenance and operations, asset optimization, machine learning, artificial intelligence, analytics, IoT, edge, and such other emerging technologies.

Machinery Markets

Machinery Markets: Overview

- Market recovery in almost all machinery segments since last two quarters.

- Machine tools, printing, and textile were most impacted markets, but show signs of recovery as well.

- Recovering automotive industry boosts several machine building segments.

- Electronics and semiconductor growth now slowing down, after peak development.

- Construction business which impacts GCS also shows signs of slowdown in growth due to continuous high material prices.

Machinery Markets: Automotive related markets show sign of recovery

- Both metal-cutting and robotics depend strongly on the automotive and aerospace & defense industries.

- Robotics have been booming for several years but are now suffering in automotive – adoption in other industries will continue and may even increase due to higher degrees of automation.

- Metal-cutting machinery was in a deep structural crisis well before the pandemic as electric car production requires less machinery.

- Machinery demand in automotive will alter sustainably over the next years.

- Metal-cutting machinery may never return to previous levels.

Table of Contents

- Automation Markets, Including regional market development, hardware/software market development

- Machinery Markets

- End User Markets - An excerpt from our CapEx and Revenue Index

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us