Key Findings

- COVID speeds up adoption but is not changing direction.

- Around 30% of services is attributed to hardware (spare parts, etc.).

- In future, a large share of services will come from digital services.

- The technical prerequisites for digital transformation are mainly given.

- End users tend to be cautious, when it comes to digital services.

- For end users costs/pricing and measurable outcome are key.

- Large companies are leading the digitalization journey and especially large automation companies are key players in the service ecosystem.

- Partly strong differences in offering between suppliers as well as between OEMs and other companies. Small companies have less capabilities for digitalization services.

- Digital services are expected to grow fast, while traditional service will continue with modest growth.

- Big trend towards outsourcing has ended, further additional outsourcing is driven by cost and strategy.

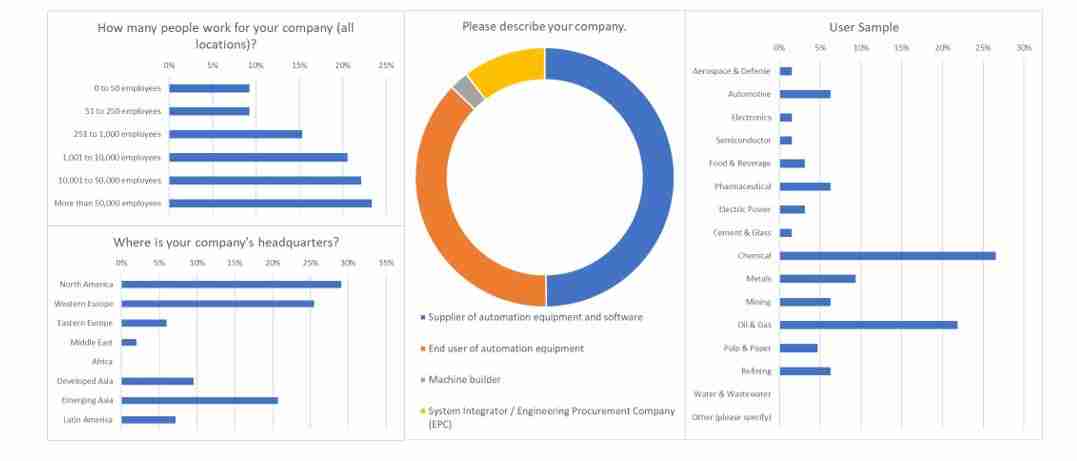

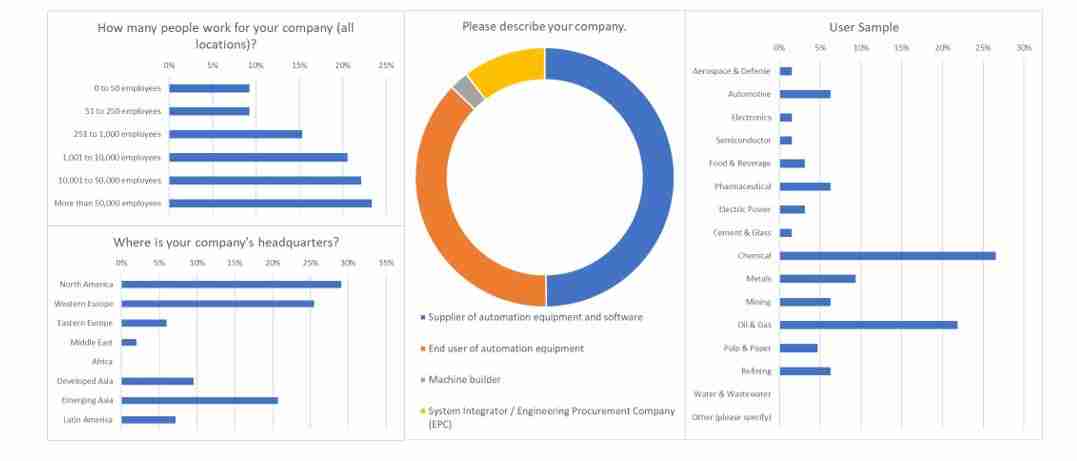

Sample

- We received above 200 responses for the English survey + 50 responses in Chinese. The overall sample is large enough to have significant results.

- We must mention that this survey was performed in English as well as in Chinese.

- All English responses on company HQ are presented as answered

- After analysis of the individual Chinese responses, we decided to present them as “emerging Asia,” as they represent the Chinese market view

- Many of the end user results come from the members of ARC’s Digital Transformation Council: https://www.arcweb.com/digital-transformation-council

- End user results have a high share of process industries, and we must take this into account when interpreting the results.

- There were three different tracks for questions:

- Suppliers

- Machine builders, system integrators, and EPCs

- End Users

- Overall, the participation rate of machine builders/EPCs/System integrators was low and not statistically significant / reliable for a detailed analysis for all questions. Hence, we will only present analysis for this group, when answers are distinct.

- Whenever meaningful, we kept the questions identical.

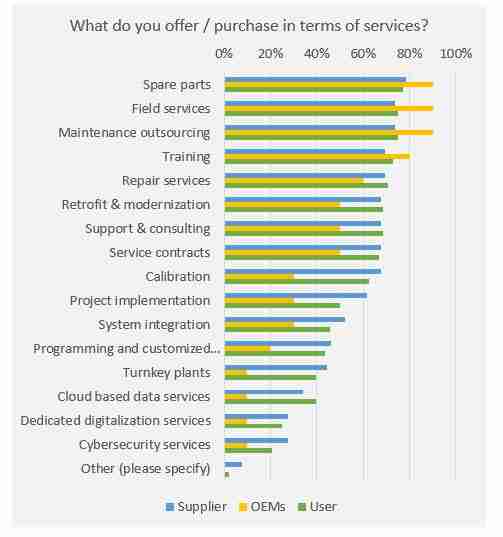

- Color Code:

- Blue means the analysis is for suppliers

- Yellow is Machine builders, system integrators, and EPCs

- Green is for end users

- Grey means that it is a combined analysis

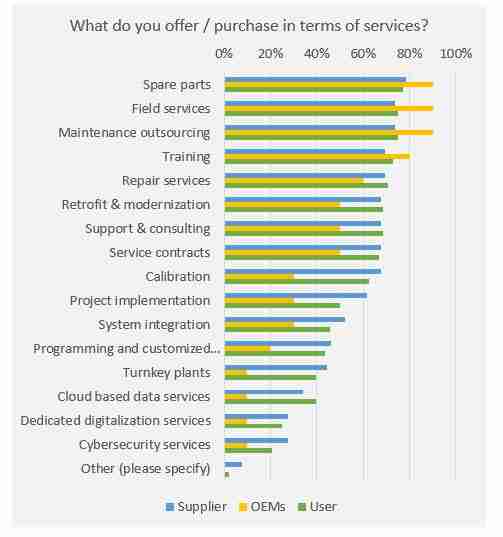

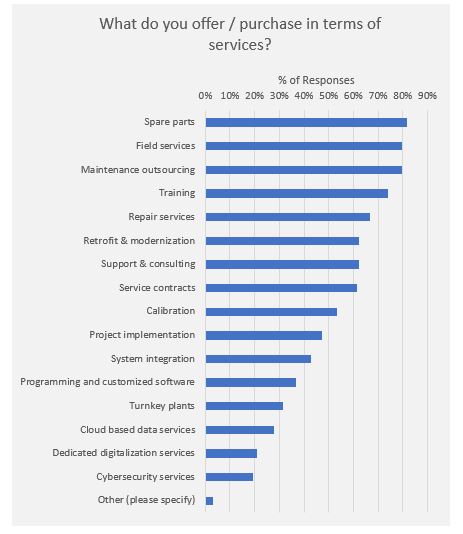

Current Market

- Traditional services are basically a must have for most companies and almost, especially spare parts, maintenance, and field services.

- Services that require special know-how and/or manpower, such as turnkey plants, cloud-based data services, are offered by much smaller number of players.

- Dedicated digitalization services are even rarer, on the one side, there is less offering, but apparently also end users demand it less frequently.

- Especially for the first four services mentioned in the chart, we have a high market saturation and a diverse offering.

- Machine builders

- Focus more on traditional services.

- Many do not have the manpower and know-how and continue with basic offering.

- Often smaller companies, which do not have the capacity and strategy to move into plant wide contracts or turnkey solutions.

- Know-how is often limited on own machinery and not plant wide solutions.

- End users and suppliers show almost identical pattern in terms of supply and demand.

Table of Contents

- Sample

- Current Market

- Growth and COVID Impact

- Digital Transformation

- EaaS

- Ecosystem

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us