Executing on an omni-channel strategy involves ensuring product availability across all channels of operation. This involves integrating the brick-and-mortar experience with the e-commerce experience, especially as the store becomes a fulfillment center of its own. The risk of returns, and how retailers incorporate returns into their planning and forecasting, are also becoming more important. E-commerce growth fuels the global economy and shows no sign of slowing down. Those companies that can align their channels, share inventory, and fulfill customer orders in a timely and cost-effective manner will be the ones “still standing at the end of the day.”

A recent ARC Advisory Group survey on omni-channel fulfillment revealed a few key findings:

Omni-channel fulfillment is all about converging channels to provide a unified brand experience for the customer. Every channel has its unique characteristics that draw consumers to it. However, as more consumers turn to multiple channels for the commerce experience, the key is to provide a seamless and similar experience across channels. This requires connected business processes and technologies. One aspect of fulfilling the unified brand experience is to maintain control over the customer experience at all stages in the buying lifecycle: before, during, and after the sale.

The customer experience begins and ends with the one thing the customer wants – the product. While there are many other components to the customer experience - converged communications, pricing structures, customer service touchpoints, customer loyalty programs, to name a few – product availability is the one thing that cannot be overlooked. Unless customers can get the product they want, when they want it, and through their channel of choice, they will look elsewhere.

Before an organization can begin, rethink, or overhaul its path to omni-channel fulfillment, it needs to understand the current state of omni-channel. The next section will describe the current state of omni-channel fulfillment, the drivers behind an omni-channel strategy, and outline available opportunities to improve omni-channel strategies and technologies.

E-commerce has changed the way people shop and even interact with brands. It also provides opportunities for brand manufacturers to eliminate retail channels and sell directly to consumers. As e-commerce continues to grow, companies are expanding their omni-channel strategies and presence. Retailers are trying to provide full, seamless continuity across all channels of operation for the customer. This is clearly easier said than done. But, with customer loyalty diminishing and more consumers shopping by price, the omni-channel experience is becoming more important than ever.

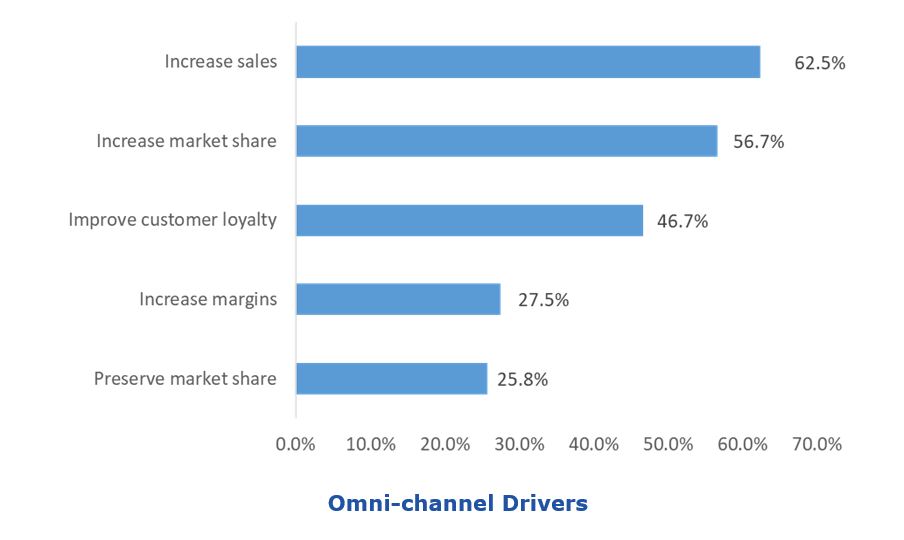

So, what are the key drivers behind this move for retailers to expand omni-channel operations? Our survey respondents indicated three drivers that are well above the rest. These have not changed over the last four years of ARC research.

The top driver, mentioned by 62.5 percent of respondents, is to increase sales. More channels of sales, plus more inventory available across these channels, equals more sales opportunities. This is especially true if competitors do not offer all products through all channels of sales operations. This is one downside of web-only exclusives, especially for high-touch consumers.

The second business driver, mentioned by 56.7 percent of respondents, is to increase market share. As companies increase sales, they take a larger percentage of the available customer spend. Finally, 46.7 percent of respondents indicated improving customer loyalty as a top driver. This driver has dipped a bit from years past, but this could be because retail customer loyalty is eroding. However, ensuring a seamless experience can help improve loyalty.

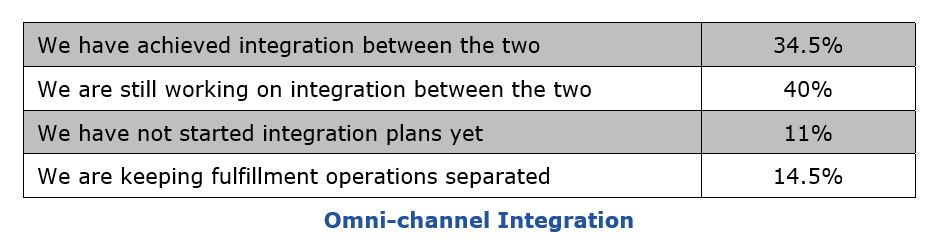

Integrating business processes and technology is critical for a truly omni-channel experience. This is especially important when it comes to integrating fulfillment strategies for e-commerce and brick-and-mortar stores. However, getting to that point is no easy feat. Among survey respondents, 34.5 percent indicated they have achieved integration between the two. This is a bit surprising, given the intricacies of integrating the two. However, as companies move towards using stores to fulfill online orders, more focus is spent on making sure there are no integration issues. The remaining survey respondents indicated they are not where they need to be in terms of integration, with 40 percent still working on integration between the two, 11 percent reporting they have not yet begun the process, and the remaining 14.5 percent indicating they prefer to keep the fulfillment separated.

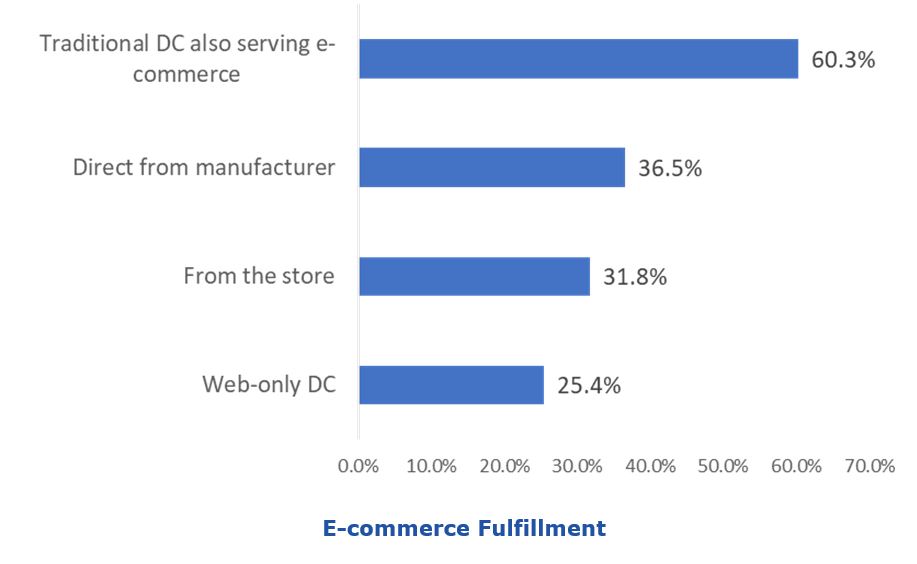

The e-commerce boom is having a large impact on planning and resources. This year, 88.9 percent of survey respondents indicated that they are receiving e-commerce orders, up slightly over last year. Revenues from e-commerce also increased, a consistent trend year-over-year. So how do companies fulfill e-commerce orders? Many survey respondents indicated they fulfill e-commerce orders through a traditional distribution center (60.3 percent), while 25.4 percent indicated they use a web-only distribution center (DC).

Survey respondents could select multiple responses, as different items and categories may be housed in different types of DCs. The majority of respondents are using the same facility for both e-commerce and traditional fulfillment. This means that the DC is replenishing stores as well as shipping products to the end consumer. In these cases, the DC generally employs a variety of segregation techniques to ensure that items are picked properly. The most common approach is to segregate by physical layout, with an actual physical separation between the two operations – either a barrier that separates the two, or distinct set-up locations for pickers, packers, and shippers. Other methods include inventory-based segregation, where store replenishment inventory is kept separate from e-commerce inventory; and labor management segregation, where the inventory is common, but workers are assigned to either e-commerce or traditional fulfillment.

According to the survey data, 31.8 percent of respondents indicated that they fulfill e-commerce orders from the store. This is where things can become tricky for retailers. Specific criteria must be examined when deciding whether or not to fulfill e-commerce orders from the store. On top of that, a store can fulfill an e-commerce order in a variety of ways, each with its own merits and drawbacks.

Obviously, if a customer wants to order an item online and pick it up from the store, in-store fulfillment is the only option. However, when the customer doesn’t have a preference, retailers need to lay out the criteria for store fulfillment. One survey question asked for the primary and secondary criteria for this decision and two criteria stood out as the primary reasons for using the store. First, is the distance to the customer delivery location (55.5 percent of respondents). This comes down to meeting the expectations of a prompt delivery for the customer. By shipping from a store that is significantly closer, the retailer can get the item there on time, without worrying about the cost of expedited shipping. A second criterion is inventory constraints/stock outs at local DC (50 percent of respondents). This is where the store becomes the safety net for the retailer if it does not have the item in stock at the preferred DC.

The other piece of the store fulfillment puzzle is how to actually fulfill orders. According to the survey, 65 percent of respondents actively pick orders at the store.

These are then fulfilled in one of two ways (and the percentages are the same for both). First, the order is held at the store for customer pick-up. This gets the customer into the store, which always opens up the possibility of up-sell opportunities. However, this requires both an appropriate staging area where customers can retrieve the order and a store associate to pick the order and then confirm receipt. The other method is to pick the items and ship them from the store. This is most often used when a DC or warehouse has inventory constraints, or if the store has a glut of inventory it is trying to move. In both cases, survey respondents indicated that orders are more commonly picked from the front of the store rather than the back, meaning they are pulling inventory off the shelves.

The third option for store fulfillment is to have an item shipped to the store for customer pick-up (45 percent of respondents). The item can be shipped from a DC or another store. In this scenario, the item must go through the receiving dock, get pulled from other inventory, and set aside for the customer to pick up. This requires a few more steps and is more time consuming than the other methods.

Inventory visibility is a critical piece of the omni-channel experience. This applies to visibility into where your inventory resides (whether in warehouses or in stores), and across your entire distribution network. Inventory visibility encompasses both inbound and outbound shipments. For inbound shipments, inventory is sent from a supplier to either the warehouse or to a brick-and-mortar store. Obtaining visibility into inbound shipments tends to be more problematic for many businesses, since this requires real-time updates from both internal and external (supplier) systems.

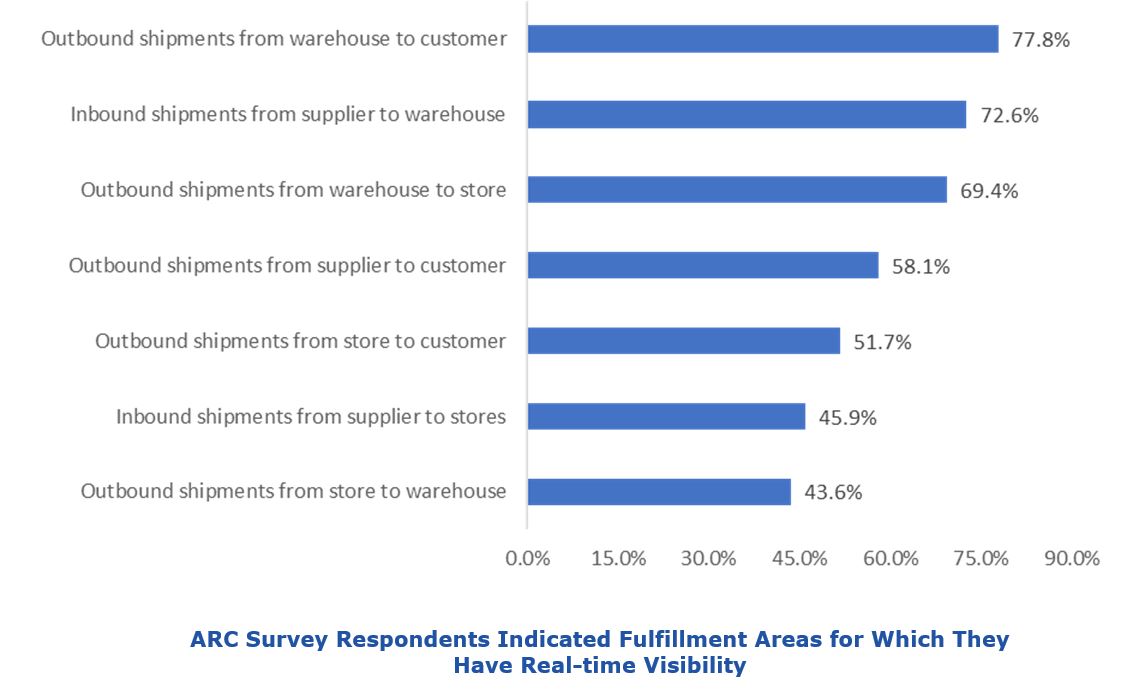

According to survey respondents, 72.5 percent of respondents have real-time visibility of merchandise going from the supplier to the warehouse. However, only 45.9 percent have visibility into shipments going from the supplier to the store. Shipping to the store adds another layer of complexity, as the merchandise does not go through the central hub and often involves much lower quantities than those going to the main warehouse.

For outbound shipments, 77.8 percent of survey respondents indicated visibility from the warehouse to the customer and 51.7 percent have visibility into outbound shipments from store to customer. Considering that customers generally need tracking information to see where their order is and when it will arrive, this percentage seems a little low. This is especially true for the store, which has historically been the weak link in the omni-channel experience.

Survey respondents indicated the following for visibility into other forms of outbound shipments: 69.3 percent have visibility into outbound shipments from warehouse to store, 58 percent have visibility into outbound shipments from supplier to customer (drop shipments), and 43.5 percent have visibility into outbound shipments from store to warehouse.

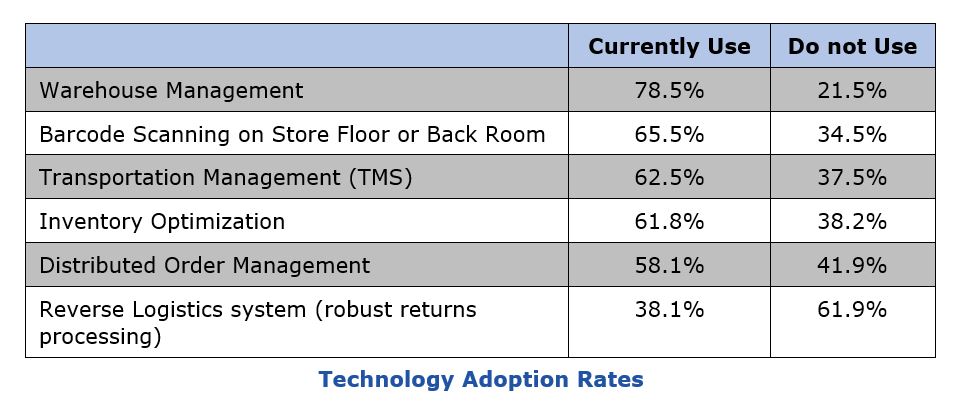

To execute on a true omni-channel fulfillment strategy, companies need the appropriate tools to support advanced fulfillment processes. Unfortunately, a large technology gap still exists for most companies. The table below indicates where companies stand in their technology adoption.

The majority of respondents (78.5 percent) use warehouse management system (WMS) technology. Of the 21.5 percent that do not currently have a WMS in place, more than 50 percent plan to implement one in the next 12 – 18 months. The WMS’s primary mission is to manage a warehouse’s resources, including inventory, space, labor, equipment, tasks, and material flows. At this point, rather than being a differentiation factor for omni-channel success, a WMS is necessary to handle the flow of goods from point A to point B in a global economy.

The remaining technologies in the table represent gaps in the current technology landscape. Barcode scanning technology (not at the point-of-sale) allows companies to quickly and accurately track product information, inventory levels, and pricing at any point in the store, either for replenishment activities or to assist customers. A TMS helps companies efficiently, reliably, and cost effectively move freight from origin to destination. By not implementing a TMS, companies potentially increase their freight spend to levels that could be easily avoided, while delaying the delivery of products.

The final two technology applications listed are disappointing from an adoption rate standpoint. A distributed order management (DOM) allows an organization to capture all information in the order management process across all relevant channels. It doesn’t matter where an order originates - all fulfillment channels have access to the information and the retailer can appropriately allocate the inventory depending on stock levels, demand requirements, and fulfillment timing. And finally, a reverse logistics system enables robust returns processing. Returns management is an essential part of omni-channel commerce, as getting the item back into a selling channel as quickly as possible enables the company to minimize losses.

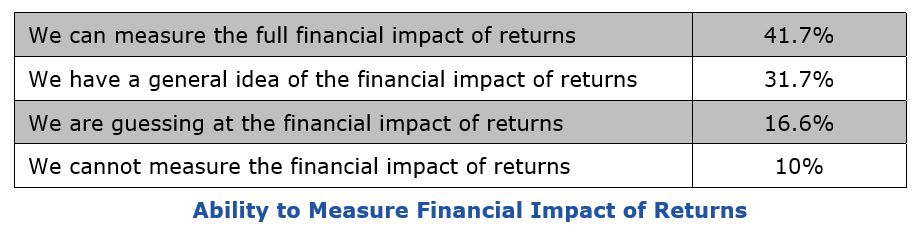

As noted above, survey respondents lack adequate returns management technology and the returns process can be incredibly labor intensive using manual processes. Two essential questions apply to returns management. First, is returns management even part of forecasting plans? Second, can companies measure the financial impact of returns? Only 57.3 percent of respondents indicated that returns are part of their forecasting plans, which shows a lack of foresight into sales operations. Another troubling statistic is that only 41.7 percent of respondents can measure the full financial impact of returns, 31.7 percent have a general idea, 16.6 percent are guessing, and the remaining 10 percent can’t even make educated guesses.

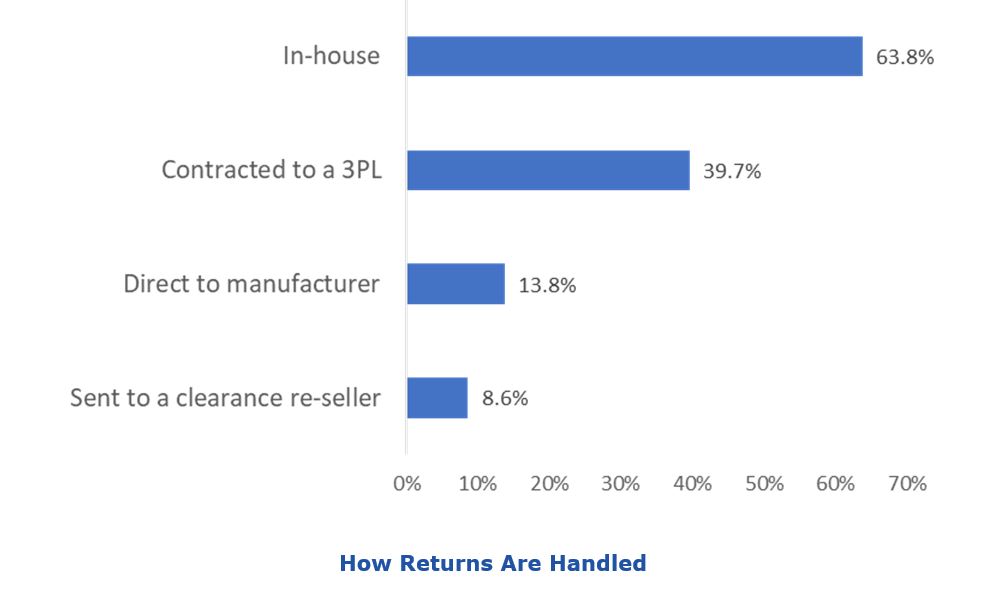

Survey respondents were asked how they handle returns. For this question, respondents could select all the methods they use. The most-used method was to handle returns internally (63.8 percent). This means that the companies are solely responsible for collecting, labeling, packing, shipping, and processing the return. These companies are also nearly twice as likely to handle returns at a centralized facility, rather than at the local or regional level. The second most-used method (39.6 percent) was to contract out to a 3PL. This reduces the effort for the company, but also gives it less control over the experience. The least-used method, with only 8.6 percent of respondents selecting it, is sending the item off to a clearance re-seller.

Sustainability practices are also an important aspect of returns management. Companies need to decide what they will do with the returned item, which will vary based on the type of product. Per our survey, 64.2 percent of respondents indicated they re-use the returned item, and sell it “as is.” This is common for apparel and other non-electronic items. For consumer electronics, things are a little trickier. Here, 53.5 percent refurbish the item and then sell it, while 26.7 percent remanufacture the item, which means the item is held to higher standards than refurbishing. When an item cannot be salvaged, 60.7 percent of respondents recycle it.

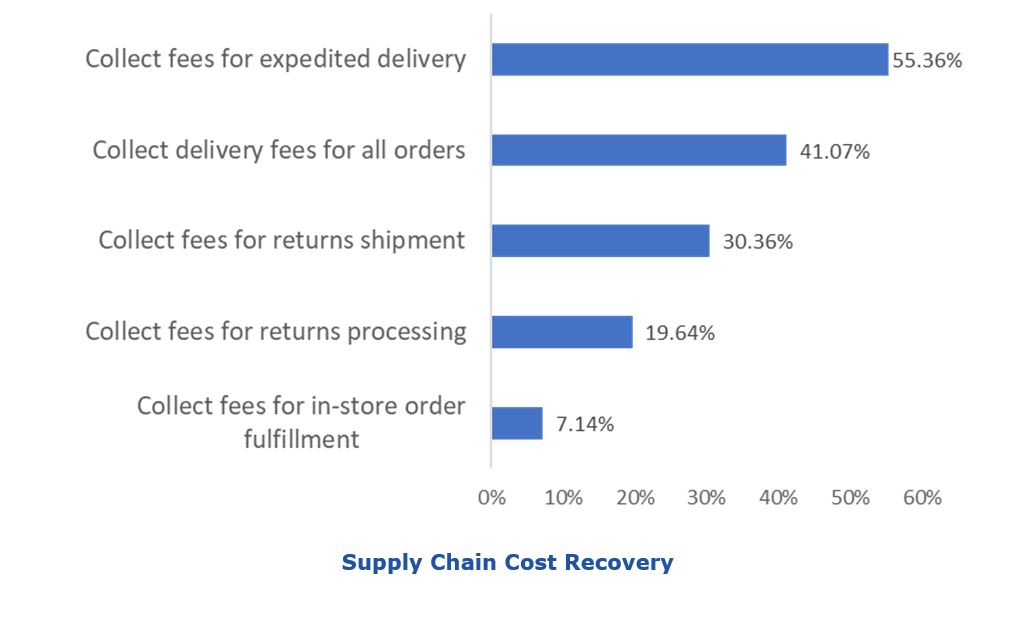

Recovering supply chain costs is crucial for companies, and this applies to deliveries as well as returns. Companies generally have policies in place to help recover the basic costs of doing business. For example, even though consumers increasingly expect free and fast product delivery, companies will charge for certain delivery options, such as expedited delivery or for large items. The same is true for returns. According to the survey, 30.3 percent of respondents collect fees for return shipments. Unlike Amazon where you can just print a return label and drop it back in the mail, these companies charge consumers for the cost of return shipping. Additionally, 19.6 percent of respondents collect fees to process returns. For fulfillment criteria, 55.3 percent collect fees for expedited delivery, 41 percent collect fees for all orders, and 7.1 percent collect fees for in-store fulfillment.

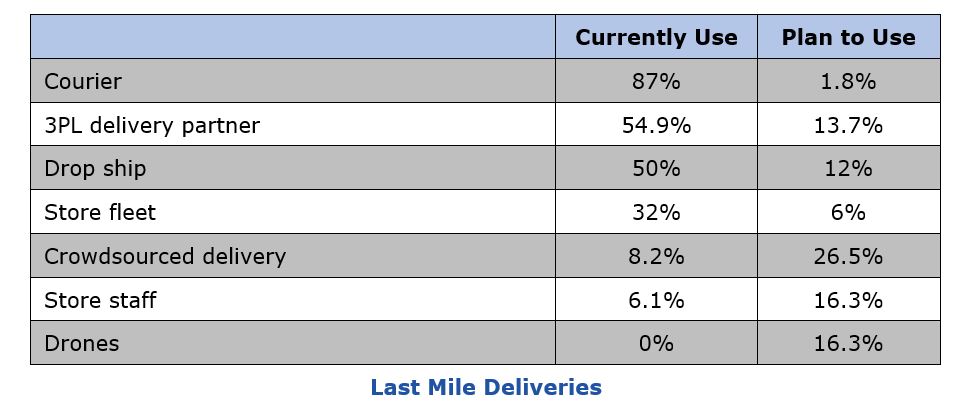

The final piece of omni-channel fulfillment is one that has been getting a lot of attention lately – the last mile dilemma. In this survey we asked respondents how they handle last mile deliveries. The most commonly used methods were courier delivery services (87 percent), 3PL delivery partners (54.9 percent), and drop shipped by partners (50 percent). Courier delivery services (FedEx, UPS, etc.) were built to deliver small packages to your doorstep in a short timeframe. They are also affordable for small and large retailers alike. Many companies outsource their last mile deliveries to a 3PL delivery partner. This partner may control a private fleet or handle the company’s freight. Retailers also use drop shipments to reduce their inventory carrying costs. Instead, the order is sent directly to the manufacturer for delivery to the customer. This is especially common for large appliances and shipments.

Crowd-sourced deliveries are gaining steam in many places, but the survey respondents indicated they are not currently using them. However, 26.5 percent have indicated future plans to include them. And despite all the hype, drones are not being used for deliveries. This is due to current FAA regulations. Even though the FAA is looking to ease the regulations, only 16.3 percent of respondents are even considering using drones in the future.

This report provides a high-level overview of current omni-channel fulfillment processes and technologies. It should also allow organizations to see where they fall in the overall maturity model of omni-channel operations and identify their own strengths and/or weaknesses. The following recommendations represent the building blocks for expanding omni-channel fulfillment practices:

If you would like to buy this report or obtain information about how to become a client, please Contact Us