No longer confined to a manufacturing company’s design/build processes, product lifecycle management (PLM) now represents an essential and core element for most companies’ overall business strategy. The scope of PLM has expanded significantly. Today, the product development process can be executed and managed from concept to end of life within a collaborative, holistic framework. Current PLM solution sets address all the design/build/support/maintain product lifecycle domains that define the manufacturing and business processes across a broad range of industries.

Currently, the PLM space encompasses a diverse array of solution providers. These include product design authoring suppliers; manufacturing process creation and management suppliers; digital simulation suppliers; computer-aided design (CAD), computer-aided manufacturing (CAM), and computer-aided engineering (CAE) suppliers; plus enterprise resource planning (ERP), and enterprise business solution providers.

Industries are moving into the era of the digital enterprise, where all product design, manufacturing processes, services and support, and customer experiences are connected by a digital thread that merges the virtual and physical worlds. PLM solutions provide the structure and framework for implementing the digital twin, a strategy that is becoming an integral part of the overall digital transformation.

Today, the overall product lifecycle can be divided into three distinct solution set sectors that are connected across the digital thread:

PDM has evolved into a comprehensive collaborative platform that connects all aspects of design/build/maintain lifecycle and includes a range of enterprise solutions essential to a user’s overall business model.

The PLM market is driven largely by the increasing complexity of products and product portfolios and the demand for continuous improvement of new product development and management processes in the discrete manufacturing industries. As a necessary tool for the engineering enterprise, the health of the PLM market also reflects regional support of new engineering-centric businesses and healthy competition within industries. PLM software was conceived in the automotive industry, which remains the largest PLM market, followed by industrial equipment & machinery, electronics & electrical products, and aerospace & defense. Combined, these industries account for roughly two-thirds of the entire PLM market.

The solutions that drive today’s PLM platform represent leading-edge technologies across multiple engineering and scientific disciplines. PLM suppliers are also leading the way with technologies and solutions that enable their customers to evolve new business models based on the digital twin, generative design for additive manufacturing and material science, and industrial IoT edge platforms that drive next-generation analytics.

Software-as-a-Service (SaaS), subscription licensing models, and cloud deployment options continue to offer new, more appealing avenues for PLM adoption. This is especially significant for small- and mid-sized manufacturing companies for whom the flexibility of cloud-based deployment can lower the cost of entry; provide near-limitless scalability; and manage software maintenance, integration, and updates. This eliminates much of the cost and overhead associated with owning and maintaining in-house IT infrastructure.

PLM suppliers now offer subscription licensing in lieu of the older perpetual per-seat licensing model. Some PLM suppliers have moved to an exclusive subscription model with all cloud-based deployment, while others are in various states of transition. The subscription/cloud deployment model is particularly attractive for the small to mid-sized PLM users because it provides them with a high degree of flexibility in terms of cost, deployment to project, and a pay-as-you-go approach that fits their business requirements and future growth. Additionally, the large enterprise-level users in industries such as automotive, aerospace & defense, and machinery benefit from the efficiencies and flexibility of subscription licensing and cloud-based deployment.

The adoption of cloud services will play a significant role in the increased adoption of PDM solutions among small engineering firms, which historically relied on disjointed tools and ad hoc processes to manage their data and programs. Readers should note that most PLM providers regard cloud services as SaaS. They make a distinction between licensing models and deployment models (cloud, on-premise, hosted). Subscription licensing, for example, is being applied to both cloud-based SaaS and per-seat pricing. SaaS continues to grow in providing on-demand computing resources for complex simulation applications.

A growing number of industries are adopting additive manufacturing (AM), which is becoming an essential component of the overall manufacturing process. The increasing use of additive-manufactured parts is being driven in part by the emergence of more advanced generative design solutions that allow product engineers to design specifically for AM-produced parts.

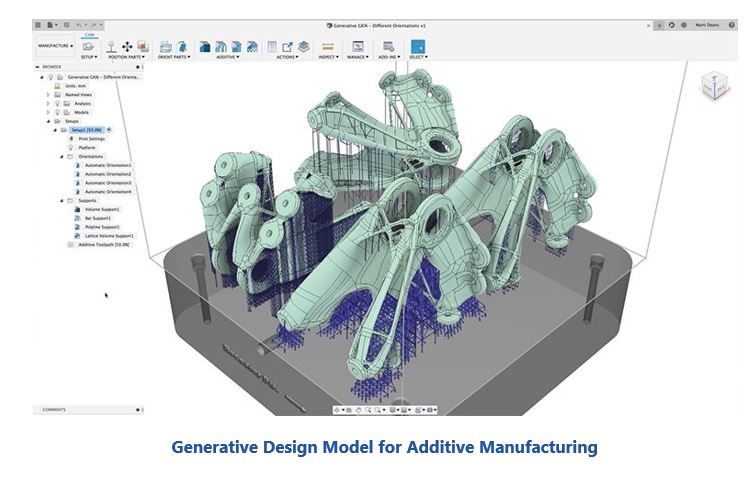

Generative design is an iterative process that generates multiple design possibilities and outputs that meet predefined design constraints based on fit, form, and function requirements as well as material and performance constraints. By defining these constraints, design engineers can achieve lighter weights, performance enhancements, and part consolidation to optimize this area.

To explore design possibilities based on constraints and requirements, generative design software relies on artificial intelligence (AI) and machine learning (ML) to mimic a natural evolutionary approach to design. The software explores all possible combinations to come up with a design most suitable to meet the fit, form, and function of the part based on design constraints and requirements. Typically, the designs generated can only be fabricated using AM techniques and processes and could not be made using traditional fabrication processes such as forging, machining, and forming.

Generative design is especially applicable for fabricating AM-generated parts and assemblies. PLM solution providers now offer generative design solutions as “design for additive manufacturing” techniques for an end-to-end AM process. This process includes material science applications for new material development, function-driven generative design, virtual simulation design validation, fabrication process definition and production planning, and post-production simulation part testing. This comprehensive end-to-end AM process now allows printed parts to move from one-off prototypes to full-scale, volume production of a new generation of optimized parts.

When the automotive industry gets back on track following the global pandemic, there will be a clear focus on increasing the production of electric cars. This will drive a new set of engineering design requirements for systems unique to electric vehicles. This would include a range of new design areas such as battery research, material science and discovery, electric power train drives, power electronics, new chassis design, and new cabin features like HVAC systems for battery power.

Additionally, the design and development of autonomous vehicles (AV) continues with a new set design requirements and product complexity challenges. AVs will usher in a new set of engineering requirements unique to its functions and performance criteria. These include vehicle dynamics, performance in adverse conditions, connected vehicle communications, electronics performance, intelligent sensor performance, and signal and power integrity.

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us