ARC SPECIAL REPORT

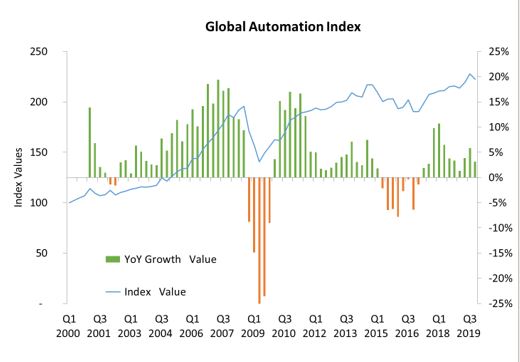

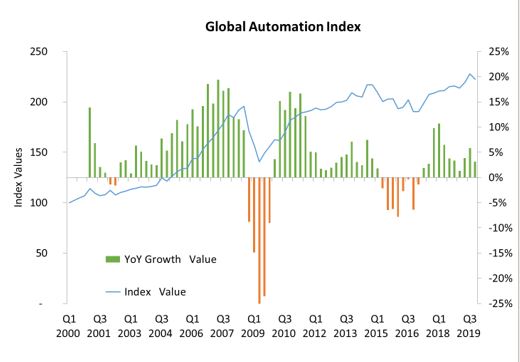

- Global and Regional Indexes

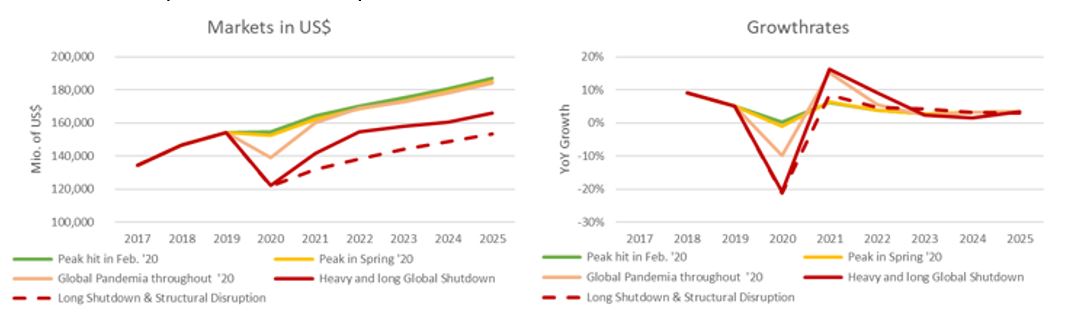

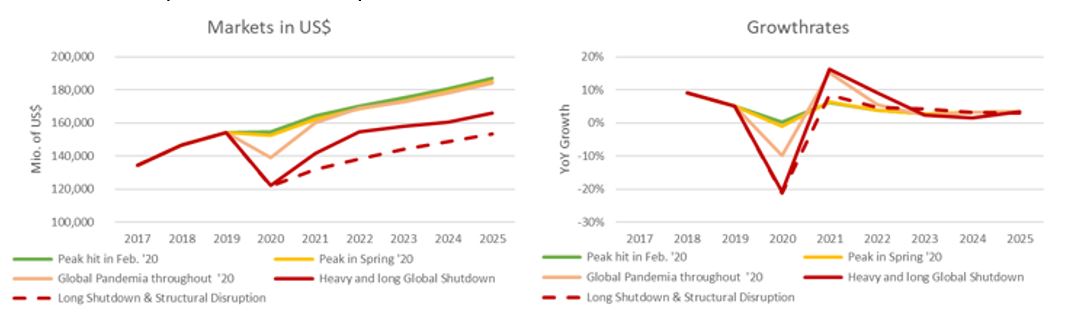

- Scenarios for Coronavirus

- What is the coronavirus and why is it so scary?

- What can happen? A look at the impact of past disruptions on automation markets

Global Market Development

- Where is the business cycle excluding the COVID-19 coronavirus?

- Process industries are doing well but flattening.

- Hybrid markets are up by low single digits.

- Discrete markets are in a downturn.

- Automotive-focused markets are at the mid of a downturn. We expect low point to be reached in Q2/Q3.

- Electronics and semiconductor are flattening and stabilizing.

- Machinery markets are contracting but will stabilize in mid 2020

- All these developments could be quickly negated, depending on development and impact of the COVID–19 virus.

Why Is the Coronavirus So Scary?

- COVID-19 (coronavirus) spreads quickly with either few or no obvious symptoms

- The virus is related to the SARS and MERS viruses, but more contagious

- Originated in Wuhan Province in China in a live animal market

- Incubation time is around five days

- Virus spreads like influenza (cough, sneeze, aerial droplet infection) and is highly contagious

- COVID-19 is deadlier than SARS and influenza. Total death toll is lower than influenza because the total number of infections is still significantly lower

Quantification: Summary

- Scenarios vary widely, but in the worst case, COVID-19 will have a long-term negative impact that destroys some supply chains and causes productivity losses

- Impact will likely be limited to 2020 with a catch up in 2021

- Global pandemic can cause revenue losses of up to $18bn in automation markets

- Scope: All products covered by ARC market studies (power markets and non-industrial markets excluded)

Example of Supply Chain Vulnerability

Supply Chain Disruption, Robert Bosch GmbH, 2005

“Robert Bosch GmbH, currently the world’s largest auto-parts supplier, faced a severe supply chain disruption in January 2005. At that time, Bosch failed to detect a defect in the Teflon coating on a 1.5 cm small socket (worth only a few Eurocents) that goes into some of its diesel injection pumps supplied to automotive OEMs such as Audi, BMW, and DaimlerChrysler. What makes this example noteworthy is that the socket was not produced by Bosch but by its US supplier Federal Mogul which in turn sources the Teflon from DuPont.

“Downstream the supply chain, the defective Teflon coating inside the diesel injection pumps resulted in a standstill of some of the OEMs’ assembly lines, a product recall of several thousand cars, consequential costs in the three digit million euro area, and a negative impact on the brand image of Bosch and the involved OEMs (Wagner, 2006).”

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us