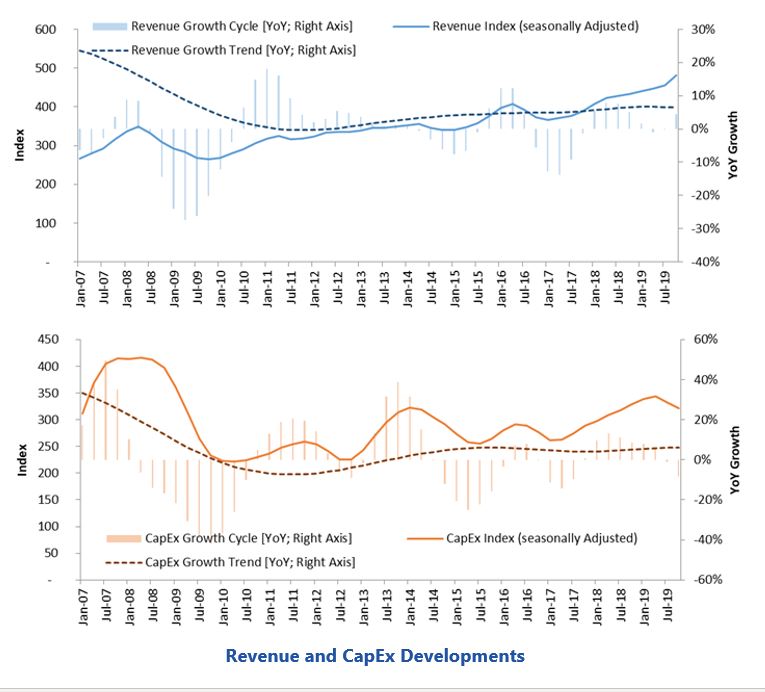

A global upswing in the process and hybrid industries began in 2017, and the momentum continued till 2019. However, growth in the process industries is now flattening with the hybrid industries only increasing by low single digits. The slowdown is expected to continue into 2020 and 2021. This report tracks the developments in the process and hybrid industries and provides a five-year forecast.

ARC Advisory Group looks at different process and hybrid manufacturing industries to identify trends in capital expenditures (CapEx) and their drivers. We calculate our CapEx index using the same rigorous methodology we use for the ARC Automation Index, which is based on publicly available data provided by major companies (end users rather than suppliers in this case).

Capital expenditures (CapEx) are a leading indicator for automation markets. When confidence in vertical industry markets decline, a decline in investments often follows.

A number of headwinds are stalling investment in the process and hybrid industries, firstly political uncertainty and the ongoing trade tensions e.g. US-China trade war, Brexit, etc. The emergence of the novel coronavirus (COVID-19) means that both supply and demand chains are negatively affected with no certainty of how long this disruption will last. The long-term impact on virtually all industries is, as yet, unknown and this too will affect revenues and delay investment decisions.

The growth engine that is China was already slowing down before the outbreak of the Coronavirus (COVID-19), which is having a further negative effect. Now that all major manufacturing countries are affected by COVID-19, global growth will be impacted as supply chains are disrupted.

Among the technologies that are important to the process and hybrid industries are: digitalization because it triggers investments in many other areas from field devices, to MES, to IT/OT convergence, the digital twin which reduces engineering times and helps improve the performance and availability of installed assets. We are also starting to see artificial intelligence (AI) for advanced analytics and both predictive and prescriptive maintenance. Some takeaways from our research for each industry include:

More detailed discussions of the above industries follow.

Overall demand in the cement & glass industry follows the general business cycle. Excess capacity built up in China, Vietnam, and other markets following the crisis in 2008 and 2009 has decreased and the industry is back to normal. Overall revenue development was strong throughout 2019, while uncertainty about the global business cycle significantly lowered investments in the second half of 2019.

The cement market is regional by nature, as transportation costs are high, and the end user landscape highly fragmented. The US is one of the few markets that imports these products. The cement industry is capital- and energy-intensive, with low labor intensity. Capital allocation in the industry averages about $225 million per million tons of production capacity and demand is highly cyclical, making it imperative to run operations efficiently, reliably, and economically across a wide range of production rates. The cement & glass industry demands relatively large investments with strict requirements for power availability and quality. Since 1995, the energy costs associated with operating a cement plant have increased drastically.

Over the last years, investments have been up and down in a two-year cycle, slowly recovering from the excess capacities created previously. On the other hand, revenues of cement and glass companies have increased steadily from 2016 to 2019 pushed by the overall good economic climate.

ARC’s forecast of an increase in investments and revenues through 2019 proved to be accurate, though the investment turned negative in late 2019 due to uncertainty of the overall economy as well as the coronavirus. The latter is especially important as China is by far the country with the highest demand and installed production capacity. Cement demand in China is currently contracting.

ARC expects 2020 to be negative in revenues and CapEx with stabilization starting in late 2020 and 2021.

Countries with rapidly expanding urban areas are driving investments on a global basis. China has closed the gap between capacities and demand and has already started to invest again. China has the largest installed base globally. India’s cement industry is the second largest worldwide. Demand decreased in recent years and government measures were not as effective as the industry hoped.

In North America, the Portland Cement Organization estimates that the future demand for cement will grow by 1.7 percent in 2020. With lower capacity utilization levels than in other developed economies, even with increased consumption, investments are not likely to pick up soon in the US.

Europe’s cement industry has contracted by around one-third com-pared to 2007 output in tons, losing share to other world markets. ARC does not expect any large growth impacts from Europe. Compared to other regions, there is less urbanization as the continent is already highly developed, though there is a shortage of flats (apartments) in many urban areas. Often costs, available labor, and bureaucracy slow construction efforts. The energy intensity is moderate at around 30 percent of variable costs.

In the long run, innovation such as carbon enforced concrete in contrast to steel enforced concrete may be a game changer. Newer research also suggests that recycled concrete and cement is more reliable and robust, and we expect the demand to increase in this area. Urbanization will boost the growth for these industries in the years to come as new infra-structure will be needed to meet the demand of a growing population.

Nearly all KPIs have improved over the last years. Historically, they still have not reached the levels of 2004 and 2005. A long run view also suggests that KPIs are now stabilizing and we expect the industry to get more under pressure starting the first half of 2020.

There is limited product innovation in cement & glass and processes are well understood. Most challenges center around energy costs, energy management, and ensuring uptime. While this industry tends to be very conservative technologically, Industrial IoT solutions around predictive maintenance for crushers and grinders seem to be gaining momentum. Environmental concerns will also drive innovation, especially in the area of recycling cement and concrete.

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us