Automation suppliers saw revenue intake slow slightly over the course of 2019, posting a drop of slightly under a third of a percentage point overall; Q4 revenues slipped by nearly 1 percent. Order activity in 2019 cooled, dropping by just over half a percent for both the year and Q4. Process-centric suppliers saw 3.4 percent growth throughout the year, while discrete supplier revenues dropped by nearly 5 percent. The investment climate for automation projects in many discrete industries in Asia remained subdued. Any industry or economic factors that were of primary concern at the end of 2019 have of course given way to the stunning impact of the COVID-19 pandemic, which has rendered any previous forecasts irrelevant.

Compared to the fourth quarter of 2018, the total combined revenues of automation suppliers to both the process and discrete manufacturing industries slipped by 0.7 percent (see Figure 2). Process industry suppliers saw their combined revenues grow by about 3 percent; while suppliers to the discrete industries saw a 5.7 percent drop in combined revenues. Note that due to its large size but relatively small automation component, GE Power has an outsized effect on the overall market, and has been subject to extreme declines in revenues and orders, so we have removed it from the overall analysis, though we will continue to cover that organization in the writeup that follows.

Among suppliers that report order intake, many saw declines in activity. Orders fell by 0.7 percent during the quarter (Figure 3). As with revenues, we have excluded GE Power (which saw a 30 percent drop in orders) from our analysis.

ABB Robotics & Discrete reported a 2 percent drop in revenues and a 19 percent drop in orders during the quarter. For the entire year, revenues fell by 8 percent, and orders dropped by 14. For the entire year, revenues fell by 8 percent, and orders dropped by 14 percent. ABB Motion saw order activity grow by 4 percent with a 1 percent slip in revenues; orders and revenues were up by nearly 20 percent overall for the year. ABB Industrial Automation saw orders grow by 4 percent, while revenues dropped by 12 percent. For the entire year, revenues at the three divisions were off by 3 percent, while orders slipped by over 4 percent.

Aspen’s revenues decreased by about 11 percent during the quarter, driven by a drop in license revenues from the prior period. Maintenance revenue grew by over 10 percent, while service revenues increased by over 50 percent during Q4. Annual spend, the company’s measure of the annualized value of all term license and maintenance contracts (which it believes to be a more accurate measurement of its business performance) reached $564 million during the quarter, an increase of 10 percent. For the entire calendar year, Aspen’s revenues were up by over 11 percent versus 2018.

Azbil saw revenues slip by about 2 percent, while order activity fell off by nearly 6 percent during the quarter. For the entire calendar year, revenues increased by 1 percent, while orders were essentially flat. For the first nine months of the fiscal year, the company’s Building Automation business grew by about 5 percent, while orders slipped by 2.5 percent. The Advanced Automation business saw sales fall by 7 percent; orders fell by slightly under 7 percent during the period. Azbil’s Life Automation business fell by nearly 4 percent, but order activity increased by almost 15 percent versus the same period in 2018.

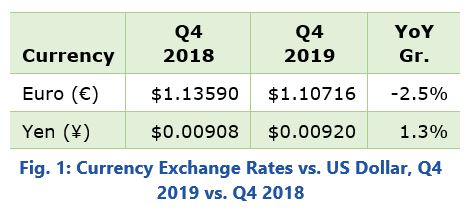

Emerson Automation Solutions reported sales growth of 1.9 percent during the quarter. Underlying sales increased by 1 percent, with unfavorable currency exchange rates sapping 1 percent and acquisitions adding 2 percent. Sales in the Americas slowed as upstream oil and gas activity softened and discrete end markets slowed down. In Asia, the Middle East, and Africa, sales increased by 6 percent, driven by infrastructure investment. Europe posted a 1 percent decline due to softness in discrete end markets. Across all of 2019, Emerson saw revenues grow by 5 percent overall.

FANUC saw revenues fall by nearly 16 percent during the quarter; order activity dropped off by more than 10 percent. FANUC’s Factory Automation Division revenue fell by 31 percent, while the Robot Division saw sales slip by nearly 3 percent during the quarter. The FA division saw a temporary boost in China business based on an expected increase in demand with the Chinese New Year, while sales in other regions declined. The robotic business saw sales increase in the Americas, particularly in the automotive sector; sales in China and Japan fell. For the entire calendar year, FANUC’s revenues in both divisions dropped by over 20 percent, while orders fell by about 15 percent.

Flowserve reported an 8 percent increase in revenue; orders increased by nearly 1 percent during the quarter. The company’s Pump Division saw revenues grow by over 11 percent, while orders grew by almost 4 percent. Flowserve’s Flow Control Division saw revenues increase by over 1 percent; bookings slipped by about 6 percent. Looking at 2019 as a whole, Flowserve’s revenues rose by 3 percent; bookings increased by about 6 percent.

Fortive saw revenues grow by nearly 14 percent during the quarter. The company’s Professional Instrumentation business sales increased by 23 percent (acquisitions significantly boosted an organic drop of 2.1 percent, with currency translation sapping 0.5 percent), while the Industrial Technologies division saw revenues grow by about 2 percent (3.6 percent organic growth, with 0.1 percent from acquisitions and minus 1.8 percent from unfavorable currency exchange).

GE Power saw revenues flatten during the quarter; order activity dropped by 30 percent. The segment reported a profit of $302 million, versus a $786 million loss during the same quarter in 2018. Order activity was impacted ty timing issues, as large turnkey orders from 2018 were not repeated. For all of 2019, GE saw revenues fall by over 23 percent.

Honeywell’s Performance Materials and Technologies (PMT) group saw revenues increase by 2 percent versus Q4 of 2018. Within PMT, Honeywell Process Solutions sales grew by about 4 percent to $1.33 billion during the quarter. For the entire year, PMT revenues rose about 1.5 percent, while Process Solution sales grew by over 3 percent.

Metso’s Flow Control division saw revenues slip by just over half a percent during the quarter; order activity fell by about 2 percent. Revenues grew on timely backlog execution and strong activity in the equipment and services businesses, particularly in support of Asia’s oil & gas sector. For the entire year, revenues were up by nearly 10 percent.

Mitsubishi Electric’s Industrial Automation group reported a 9 percent drop in sales during the quarter. Orders fell by nearly 6 percent. The company’s factory automation business declined due to a slowdown in capital expenditures in the semiconductor, machinery, display, and smartphone sectors. Mitsubishi’s automotive equipment business saw reduced demand in Japan and other parts of Asia despite increased activity in sales of electric vehicle- related equipment in other parts of the world. For the entire calendar year, revenues fell by over 5 percent.

Moog’s industrial revenues grew by about 4 percent during the quarter, driven by sales of equipment to the medical sector. Automation revenues declined by $2 million versus Q4 2018, while Simulation and Test sales were off by about 2 percent. A slowdown in capital investment in Europe reduced orders for automation components. Sales for the Energy business unit were up by 2 percent on increased demand in the offshore exploration sector. Moog saw industrial revenues decline by about 1 percent across all of 2019.

OMRON’s Industrial Automation Business (IAB) saw revenues slip by nearly 10 percent during the quarter versus the previous year. OMRON reported a slight recovery in digital industries, but saw a weak investment climate across general industry, particularly the automotive industry. OMRON also cited a stronger yen as a factor in lower sales. For the entire year, sales were down by nearly 11 percent.

Parker Industrial revenues fell by 3 percent versus the same quarter last year. North American sales slipped by 1 percent to $1.6 billion, while international revenues dropped by 6 percent to $1.2 billion, with currency effects siphoning nearly 5 percent. The Motion Systems segment saw revenues fall by over 12 percent, while Parker’s Flow and Process Control business slipped by about 7 percent. The Filtration and Engineered Materials business grew by about 9 percent. Parker reported that order activity dropped by 7 percent in North America and slipped by 6 percent overseas. Parker’s revenues were down by over 6 percent for the year.

Rockwell Automation saw revenues grow by 2.6 percent during the quarter. Architecture & Software sales were essentially flat, while sales of Control Products and Solutions increased by 4.9 percent, driven in part by “inorganic investments,” likely its stake in PTC and the company’s recently announced Sensia joint venture. Rockwell Automation’s overall organic growth was closer to minus 1 percent. Currency headwinds sapped 0.9 percentage point from overall revenues; acquisitions contributed 4.5 percent. For the calendar year, the company’s revenues were flat.

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us

Keywords: Automation Suppliers, Quarterly Results, Asia-Pacific, Europe, Middle East & Africa (EMEA), Latin America, North America, ARC Advisory Group.