New ARC Advisory Group research reveals that the integral horsepower (IHP) medium voltage (MV) portion of the industrial motors market saw growth in 2019. This was due largely to capital investments in the mining, metals, oil & gas, refining, and water & wastewater industries. Looking ahead, Asia will experience the strongest increase in investments in medium voltage motors over the five-year forecast period. ARC anticipates that government policies in emerging economies in Asia will continue to focus on improving infrastructure, which should help create continuous demand for MV motors. Emerging technologies will also contribute to market growth.

“The deployment of new technologies such as 5G networks, edge computing, and technology for electric vehicles and related infrastructure will drive the need for new network infrastructure. This, in turn, should drive growth in the electrical & electronics, metals, mining, and semiconductor industries, which all require the type of motors explored in this market research,” according to Naresh K. Surepelly, Senior Analyst at ARC Advisory Group and key author of ARC’s Integral Horsepower Medium Voltage Motors Global Market Research report.

Leading Suppliers to the IHP Medium Voltage Motors Market Identified

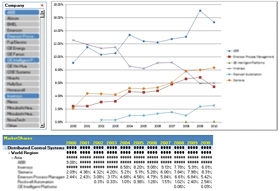

In addition to providing specific market data and industry trends, this ARC market research also identifies and positions the leading suppliers to this market and provides and summarizes their relevant offering. In alphabetical order, these include ABB, Siemens, and Wolong Electric Group.

About the IHP Medium Voltage Motors Research

This ARC research explores current and historical market performance and related technology and business trends, identifies leading suppliers, and provides five-year global forecasts for the MV motors market across the entire spectrum of power and voltage ranges. Power ranges are segmented into, up to 200kW, >200 to 600kW, >0.6 to 3MW, >3 to 7.5MW, >7.5 to 10MW, >10 to 20MW, and >20MW. Voltage (kV) ratings are segmented into, 1 to 2.3kV, >2.3 to 3.3kV, >3.3 to 5kV, >5 to 7.2kV, >7.2 to 11kV, and > 11kV. This new research is based on ARC’s industry-leading market research database, extensive primary and secondary research, and proprietary economic modelling techniques. The research includes competitive analysis, plus five-year market forecasts by power ranges, voltage ratings, motor end equipment type, industry, machinery segmentations, sales channels, and customer type.

This ARC research explores current and historical market performance and related technology and business trends, identifies leading suppliers, and provides five-year global forecasts for the MV motors market across the entire spectrum of power and voltage ranges. Power ranges are segmented into, up to 200kW, >200 to 600kW, >0.6 to 3MW, >3 to 7.5MW, >7.5 to 10MW, >10 to 20MW, and >20MW. Voltage (kV) ratings are segmented into, 1 to 2.3kV, >2.3 to 3.3kV, >3.3 to 5kV, >5 to 7.2kV, >7.2 to 11kV, and > 11kV. This new research is based on ARC’s industry-leading market research database, extensive primary and secondary research, and proprietary economic modelling techniques. The research includes competitive analysis, plus five-year market forecasts by power ranges, voltage ratings, motor end equipment type, industry, machinery segmentations, sales channels, and customer type.

This new research is available in a variety of formats to meet the specific research and budgetary requirements of a wide variety of organizations. These include a:

- Market Intelligence Workbook (Excel) – This personalized spreadsheet includes up to two years of historical data in addition to the current base year market data and five-year market forecast. The workbook enables licensed users to freely manipulate the latest data to make it easier to analyze for business intelligence and generate custom reports.

- Concise Presentation Market Analysis Report (PDF) – This wide-screen presentation format makes it much easier to find detailed information on a market. This new format provides executives, business unit managers, and other authorized users with immediate access to in-depth market analysis, including analysis associated with every market data chart and figure. Included is an executive-level summary of the current market dynamics, five-year market forecast, and competitive analysis, plus an overview of strategic issues. The PDF is available with a comprehensive set of charts with associated analysis.

For more information on this and other available ARC market research, please visit our Market Data & Studies section.