The Rail Asset Management Market Research Study delivers current market analysis plus a five year market and technology forecast. The study is available in multiple editions including worldwide, all regions, and most major countries.

This report can serve as an effective planning guide for suppliers of rail asset management services, such as corrective, preventive, and predictive maintenance solutions; train overhauls and infrastructure renewals; wheels and axles management; maintenance performance analysis; asset management; and continuous improvement methodologies.

The report addresses the market size and forecasted growth on a global scale, market drivers and opportunities in the global market, supplier market shares, product availability, alliances, and strategies for both suppliers and potential users, plus the impact of key trends on this industry.

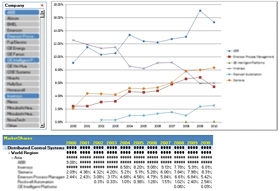

The trend is moving toward analytics and Industrial IoT. Software and analytics vendors are winning projects and taking market share from the legacy rail suppliers, while a bevy of smaller competitors are vying for pieces of each rail transport project, making for a crowded and competitive field.

While single-digit growth is forecast for the market as a whole, tremendous potential exists for systems that meet primary requirements of predictive and preventive maintenance, safety and reliability, and condition-based analysis services.

In the context of the new digital economy, the emerging and innovative technologies such as Internet of Things, mobility, cloud technologies or Big Data, and analytics, including machine learning, have been disrupting legacy operations and asset management strategies of organizations. These technologies should be leveraged by both suppliers and operators.

The market represents a mix of mature and emerging markets such as Europe, China, and India. Asset performance and maintenance remain paramount, including the need to comprehend risks and expenditures over the product lifecycle and earn better return on investments. Key questions addressed include:

The market represents a mix of mature and emerging markets such as Europe, China, and India. Asset performance and maintenance remain paramount, including the need to comprehend risks and expenditures over the product lifecycle and earn better return on investments. Key questions addressed include:

This market study may be purchased as an Excel Workbook and/or as a PDF File. The Workbook has some unique features such as the ability to view data in local currency. Regional studies include country and industry market data. Country studies include market trends and industry data. Studies and formats available are listed below:

| MIRA Workbook | PDF File | |

| Worldwide (includes regional data) | Yes | Yes |

| North America (includes country data) | Yes | No |

| Latin America (includes country data) | Yes | No |

| Europe, Middle East, Africa (includes country data) | Yes | No |

| Asia (includes country data) | Yes | No |

| Country Profiles (includes country data) | No | Yes |

Countries included in each region.

Table of contents for these studies is shown in the following paragraphs.

The research identifies all relevant suppliers serving this market.

List of countries included in each region: MIRA-Country

Contact us for the countries available for this study.