The Automation and Software Expenditures for the Mining Industry global market research study delivers current market analysis plus a five year market and technology forecast.

Mining industry revenues picked up strongly, while CapEx lagged. ARC believes this provides a good indicator of the years to come. Mining investments have been underfunded for several years. However, these are expected to pick up over the next couple of years. High commodity prices are expected to continue, leading to greater confidence over the coming quarters.

After facing many challenging years, the mining industry will continue to focus on improving operational excellence to maximize asset availability and performance.

After facing many challenging years, the mining industry will continue to focus on improving operational excellence to maximize asset availability and performance.

The mining industry also faces a technological change. In harsh and often remote locations, IIoT-enabled solutions can significantly contribute to the performance of assets with remote monitoring and remote control, as well as contribute to the safety of mining employees by limiting exposure to hazardous environments.

This market study may be purchased as an Excel Workbook. The Workbook has some unique features such as the ability to view data in local currency.

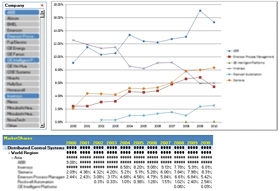

The research identifies all relevant suppliers serving this market.