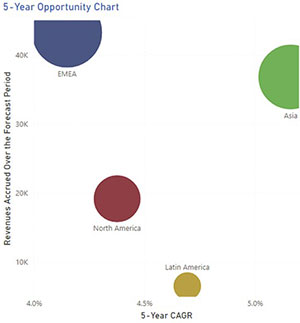

The Robotic Inspection Services Market Research delivers current market analysis plus a five year market and technology forecast. It is available in multiple editions including worldwide, all regions, and most major countries.

Traditional non-destructive testing (NDT) and inspection rely on conventional manual NDT approaches which are often unsafe, manual, and inefficient. These methods are also subject to variation in the quality of the inspector and their ability to provide consistently accurate and reliable measurements. Robotic Inspection Services help keep employees safe, can reduce inspection times, automate data collection, and ensure greater data consistency. These tools can reduce the overall cost of inspections since users can outsource their requirements, rather than bear the overhead of an internal inspection staff for inspections that may occur every couple of years or more.

In addition to providing a five-year market forecast, the Robotic Inspection Services market research provides detailed quantitative current market data and addresses key strategic issues as follows.

In addition to providing a five-year market forecast, the Robotic Inspection Services market research provides detailed quantitative current market data and addresses key strategic issues as follows.

For those users that cannot afford to make the investment in an inspection robot, or perhaps may be challenged to justify the investment and/or lack the internal resources to manage the integration and operations of inspection robots in the field, seeking out robotic service providers or suppliers that offer Robot-as-a-Service (RaaS) is an option worth considering. RaaS can be a win-win for both the users and suppliers that have the necessary resources, R&D strength, and internal expertise (or a strong partner ecosystem) to fully support a user’s requirements.

Users benefit as they save on the initial upfront investment, avoid having to deal with maintenance issues, get ongoing software updates and support, and can scale operations as demand and need warrant, within the limits of the contract. Shifting from a CapEx to an OpEx budget can shorten the purchasing cycle and typically simplify ROI criteria; there is no need to train or hire robotic experts; the customer enjoys a close relationship with the supplier who is incentivized to design robust and reliable robots (since they are responsible to repair and/or replace) and keeps evolving and improving their hardware and software capabilities faster and more precisely in order to maintain a competitive advantage.

Robotic inspection service providers offer a complete outsourcing service, including providing automated inspections by experienced technicians and inspectors using robots they typically design and manufacture themselves. The user simply pays for the data collected and reporting and any analysis that may be requested or required.

One of the main reasons most end users initially deploy robotic inspections services is the need to keep employees from doing dangerous tasks or completing tasks in hazardous environments or hard-to-reach areas. Therefore, users are recommended to select such an application and “test drive” the robot to determine whether it can perform the tasks required and whether the service provider can meet the inspection requirements cost effectively. If successful, the rollout of robots to serve other applications for which employee safety or safe access is deemed critical is recommended.

The automation of tasks by using robotics may also provide additional benefits such as saving time and money from not deploying scaffolding or other equipment such as lifts or cranes. In addition, many companies can reduce their reliance on manual NDT inspection methods which involve confined space entry into a tank with hazardous chemicals and the time and cost to have employees conduct inspections manually with protective gear, in addition to the safety concerns. The consistent and repeated data collection from robotics is also expected to improve the quality of inspections and reduce potential errors vs. traditional approaches, as well as reduce the time to conduct the inspections.

This market research may be purchased as a MIRA Service, an Excel Workbook, and/or as a Market Analysis Report (PDF). MIRA Services help unlock the full benefits of ARC’s market intelligence, making the data more actionable for you by adding qualitative context to our market data in an online environment unique to each customer. Regional editions include country and industry market data. Formats available are listed below:

| MIRA Services | MIRA Workbook | Market Analysis PDF | |

|---|---|---|---|

| Annual Subscription | Yes | No | No |

| Worldwide (includes regional data) | Yes | Yes | Yes |

| North America (includes regional data) | Yes | Yes | No |

| Europe, Middle East, Africa (includes regional data) | Yes | Yes | No |

| Asia (includes regional data) | Yes | Yes | No |

| Latin America (includes regional data) | Yes | Yes | No |

Table of contents for this research is shown in the following paragraphs.

The research identifies all relevant suppliers serving this market.

List of countries & currencies included in each region: MIRA-Country

To speak with the author or to purchase the Robotic Inspection Services Market Research, please contact us.

Learn more about ARC In-depth Research at Market Analysis

Learn more about ARC Strategic Services at Advisory Services for Industry Leaders