Globally, we are in a critical time of action on climate change. Energy transition and sustainability are now being woven into the core fabric of business strategies of industrial companies, particularly manufacturing, utility, and oil and gas organizations. What are the market drivers behind this dramatic uptick in board-level attention and the ensuing formalization and execution of environmental, social, and governance (ESG) strategies? How are companies tackling the many complex threads associated with the energy transition and improved environmental stewardship while also balancing financial performance and ongoing digital transformation?

Both the 2021 United Nations (UN) annual climate change conference, COP26 (Conference of Parties) climate agreement and the latest Intergovernmental Panel on Climate Change (IPCC) report call for action on climate change pointing to irrefutable degradation across the Earth’s climate system, atmosphere, oceans, ice floes and on land. This, combined with a shift in corporate mindsets following the past two years of pandemic, is reshaping industry, sparking innovation, and accelerating transformational technological change throughout the sector. COP26 has arguably resulted in the most ambitious international climate agreement to date. Though we still can expect to see 2.4℃ warming, all participating nations did agree to return to COP27 with more aggressive goals.

The financial community is moving ahead aggressively because climate change is seen as a real risk to the global financial system. The Glasgow Financial Alliance for Net Zero (GFANZ), a global coalition of leading financial institutions, committed to accelerating the decarbonization of the economy and to drive their portfolios to net zero by 2050. GFANZ looks after about a third of the world’s assets ($130 trillion). This acceleration will pressure industrial companies, who will increasingly embrace digital transformation as a means of response.

A related development from the COP meeting is the announcement of the International Sustainability Standards Board (ISSB). The ISSB intends to standardize ESG reporting and integrate climate disclosure with financial disclosure. Instead of today’s voluntary and often misleading carbon disclosure, company financial reports will feature audited and assured emissions, climate policies and forward-looking statements. New AI, analytics, visualization, software, and management systems will be needed to develop and report about a company’s carbon footprint, including tracking ESG and greenhouse gases (GHG).

Another interesting recent development is the release of the Global Standard on Responsible Climate Lobbying, developed by global investors’ networks. While many tools have recently become available to help investors understand net-zero transition plans and whether companies are reducing their direct and indirect emissions, a company’s influence on government policy has largely been ignored.

This ARC Strategy Report on Energy Transition and Industrial Sustainability delves into the issues facing industrial organizations with an emphasis on the pressures facing three key segments—utilities, manufacturers, and oil and gas companies. Additionally, it outlines the dimensions through which to consider these issues. It also discusses common starting points and existing and emerging technologies likely to become central to energy transition and industrial sustainability assessment, measurement, implementation, and reporting.

Energy Transition and Industrial Sustainability refers to the management, tracking, and reporting of industrial activities targeting GHG reductions and Environmental, Social, and Governance (ESG) issues. Industrial sustainability covers a range of topics such as energy management and efficiency, net-zero transition, decarbonization, power generation, grid transmission and distribution, renewable energy electrification, circular economy, ethical sourcing, ESG reporting, and more.

Historically, one of the major hurdles to sustainability was agreement across stakeholders and interests as to how to view emissions so that they could be classified in a way that allowed improvement protocols, standards, and metrics to be quantifiably measured. Around the turn of the century, the GHG Protocol was developed by the World Resources Institute (WCI) and World Business Council for Sustainable Development (WBCSD) as a means of defining emissions. Over the course of more than a decade, that definition evolved, leading to what is now the world’s most widely accepted accounting and reporting standards for measuring GHG emissions. Emissions are classified as follows:

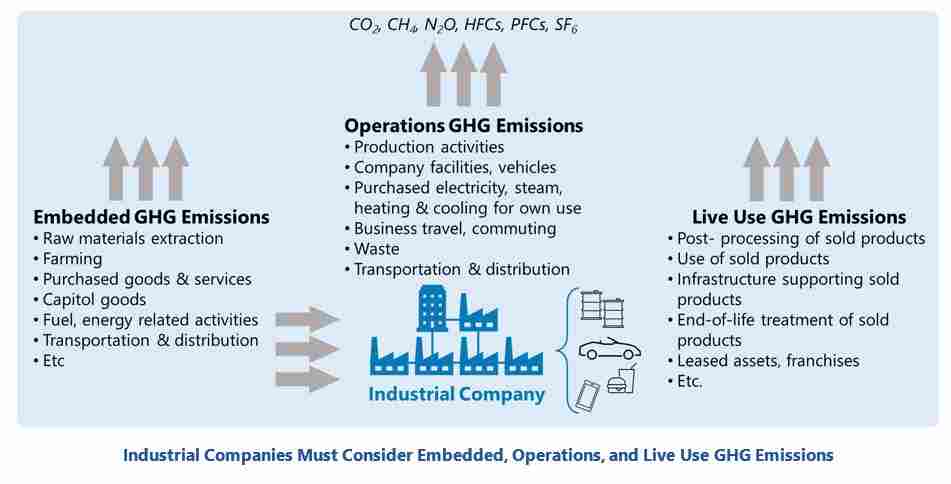

These scopes come into more focus when visualized through the many mechanisms that are familiar to us all as consumers. Below is a graphic provided by WRI and WBCSD that illustrates the overlapping nature of the gases that make up the emission scopes.

Industrial companies can usually identify the various sources of GHG emissions arising from their operations – though tracking and managing those emissions may not be at all straightforward. These are emissions generated from daily operations, such as production activities, heating and cooling buildings, operating company vehicles, and the like. It can be helpful to consider embedded (upstream) GHG emissions and live use (downstream) GHG emissions as well. Customers and other stakeholders increasingly want to know a product’s carbon footprint, which necessitates understanding the embedded GHGs, as well as the emissions generated while using the product, which necessitates understanding the live use GHGs.

While the Scope 1, 2, and 3 emissions categorization is generally agreed upon, it can be difficult to follow in practice, making sustainability strategies challenging to implement and measure. The challenge is evident when deciding where to draw the line in public reporting. On one hand, an argument can be made that but for your company producing and selling a given product, none of the ore need be mined, none of the components produced, and none of the shipping undertaken.

On the other hand, an industrial company, even one with considerable market power, may still have little or no control over efficiencies and emissions generated upstream. Similarly, live use practices can greatly impact efficiencies and emissions generated while using a product, again with little or no control possible by the producer. One practical approach is to reach out to stakeholders, to determine what they consider important to report, and including customers, to better manage what they consider critical.

A responsible approach to climate mitigation involves six key activities. First, aggressively seek out and identify GHG emissions – especially those types requested by stakeholders – and disclose the current state. Next, establish public emissions targets, and plan how to meet them, delineating the incremental steps that will unavoidably be necessary. Execute on the plan, decarbonizing where possible and obvious, increasing efficiencies, and reducing emissions. Report progress regularly. Use carbon offsets where necessary to meet your goals, but ensure that the offsets used are quantifiably effective, traceable and have a measurable and positive impact on GHG reductions. Planting trees that you later harvest for use in production is not as good as planting elsewhere. Publicly commit to aligning all climate change lobbying with the goal of restricting global temperature rise to 1.5⁰ C above pre-industrial levels and disclose all climate lobbying activities. Another potential tool is making contributions or otherwise supporting independent climate mitigation activities, acting outside your value chain.

As we have discussed, reducing GHG emissions is crucial for the climate, but reducing emissions alone is not a sustainability strategy. Stakeholders must also focus on a company’s ESG goals and performance. It can be helpful to address overall sustainability goals in five areas: supply chain, production and operations, product, product ecosystem, and live use. These will all vary by industry, type of product, region, and a variety of other factors. A barrel of oil, an automobile, plastic, generated power, a tractor – obviously, these cannot be treated the same, so the distinct role each plays in sustainability must be considered.

We are in a transitional period. Products are beginning to evolve to reflect the changing sustainability expectations of consumers. Consumers’ wishes are evolving as desired characteristics become more widely available. Customers and other stakeholders increasingly want products to have a low carbon footprint, and they expect it to be transparent to them. They want them to be built from ethically sourced materials and components. They want products that generate little or no emissions during their lifetime of operation. They want products that are maintainable, upgradable, and reusable, instead of disposable, planned obsolescence products. Are consumers endorsing these values today? Not yet in great numbers, but in time they will. Companies will be too late to respond effectively if they wait for that sentiment to fully manifest itself.

Here the expectations are already becoming clear – industrial companies are beginning to be held to account for sustainability. Companies are expected to decarbonize and operate efficiently and with low or zero emissions. Specific timelines to do so have been given. They are expected to track, manage, monitor, and report on ESG metrics. Where possible, they should move to a circular economy model, use ethically sourced materials and components, generate low or zero GHGs, sustain the local operating environment, and deliver products that are climate friendly. This will necessitate the use of software and AI, together with connected machines and workers, digitalization, automation, and introduction of new operating and business processes.

A sustainable supply chain will be decarbonized and energy efficient, with emissions tracking and ethical tracking throughout. This should extend from extraction and component production, through production operations, to the final user. To achieve these goals, supply chains will require far greater transparency, co-opetition (competitive cooperation), and data sharing.

After leaving the factory, products may contribute directly or indirectly to GHG emissions. In some cases, an ecosystem is needed to support a product in operation. This could be an EV charging infrastructure or today’s filling station network. It could include brick-and-mortar retail stores, franchised maintenance and repair operations, power grids, connectivity in the cloud, or app-driven product delivery. All of these may have unique environmental, social, and GHG emissions impacts, and should be considered early in the product lifecycle.

In day-to-day operation, products may generate direct or indirect GHG emissions, other environmental or social impacts, and may require regular maintenance to limit these effects. They may require additional infrastructure to be built to perform to their fullest capacity. At the end of life, provisions may need to be made to facilitate re-use, recycling, or low-impact disposal. These factors should be considered early in the product lifecycle.

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us