The first gasoline-powered car was invented by Karl Benz in 1885, while the first electric car was invented by Robert Anderson in 1832. With the invention of the Edison Lithium battery, electric cars surged and in 1912, electric cars accounted for 38% of all new car sales but were virtually gone by 1940 as gasoline engines improved with innovative features like electric starters.

We are seeing the rebirth of electric cars and the creation of a new lithium mining and refining industry. Lithium batteries have come a long way from the Edison battery with improved battery chemistry and packaging innovations. EV’s are now a practical replacement for gasoline and diesel cars. Operating statistics show that battery safety is solved, and battery life can exceed 500,000 miles. CATL is now the most valuable company in China, and they make batteries with a cell price of $80 and pack price of $100 per kw*hr. Longer range and improving charging infrastructure are making EV’s practical for road trips. Both energy cost and maintenance costs are proving to be much less than for gasoline cars, and with battery costs dropping over 80% in the past five years, EV’s have reached price parity with combustion cars.

The transportation sector accounts for about 28% of human-caused global warming. Why are lithium batteries winning? Hydrogen is an option and while vehicles like the Toyota Maria are brilliant, hydrogen vehicles cannot succeed without low-cost green hydrogen production and distribution which do not exist today. Porsche and Siemens are building an e-fuel factory in Chile that runs on wind and solar, but this complex process will make expensive e-fuels. There are other low carbon vehicle fuel options like compressed air, ammonia, flywheels, and even nuclear power has been considered for vehicles (see Ford Nucleon), but battery electric vehicles are the most compelling option, and they are using NCM, and LFP lithium batteries. Today 80% of lithium batteries come from these five Asian companies:

Contemporary Amperex Technology Co., Ltd. (CATL)

LG Energy Solution

BYD Co., Ltd.

Panasonic

SK Innovation

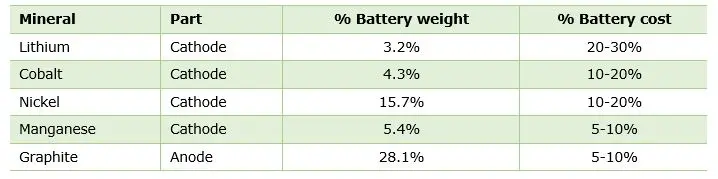

The top five key minerals in lithium batteries are shown in the table below. Other minerals, such as aluminum, copper, and iron, are also used in lithium batteries, but they account for a smaller percentage of the overall mineral cost.

The mineral costs of a lithium battery today account for about 30-40% of the total cost of the battery. The battery is a large part of the cost to build an EV.

There is more than enough lithium in the world to transition to battery powered transportation. You can divide the battery markets into mining, refining, and battery manufacturing. Some lithium deposits are processed using a process called spodumene flotation, which produces a lithium concentrate with a lithium content of 6-7%. Other lithium deposits are processed using a process called brine extraction, which produces a lithium solution with a lithium content of 1-2%. This is the lithium that goes to the refineries. The refineries make lithium carbonate or lithium hydroxide that must have a purity of at least 99.5% to be used in lithium batteries.

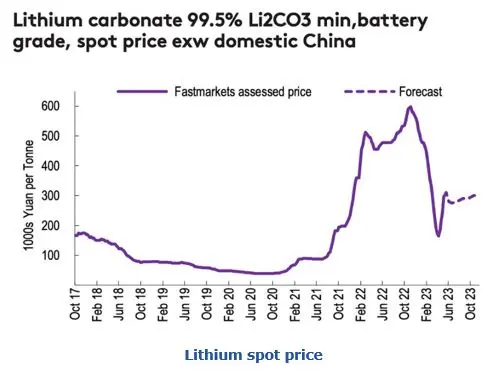

The price of lithium has been on a roller coaster lately and both miners and refiners that invested early made handsome profits over the last 2 years before the price dropped at the end of 2022. Battery makers that had long term fixed price contracts prior to 2021 avoided the big price spike of 2022. EV makers that are vertically integrated with lithium mining avoid the volatility of lithium prices.

The price of lithium has been on a roller coaster lately and both miners and refiners that invested early made handsome profits over the last 2 years before the price dropped at the end of 2022. Battery makers that had long term fixed price contracts prior to 2021 avoided the big price spike of 2022. EV makers that are vertically integrated with lithium mining avoid the volatility of lithium prices.

BYD has lithium mining and refining operations in China and Australia. In China, BYD owns and operates the Qinzhou lithium mine, which is one of the largest lithium mines in the world. Tesla does not own any lithium mines directly, but it has invested in several lithium mining companies. For example, Tesla owns a 9% stake in Lithium Americas, which is developing the Thacker Pass lithium mine in Nevada. Tesla is also a customer of several other lithium mining companies, such as Albemarle and SQM. By investing in lithium mining and refining, BYD and Tesla are positioning themselves to meet the growing demand for lithium and to ensure that they have a secure supply of lithium for their battery production.

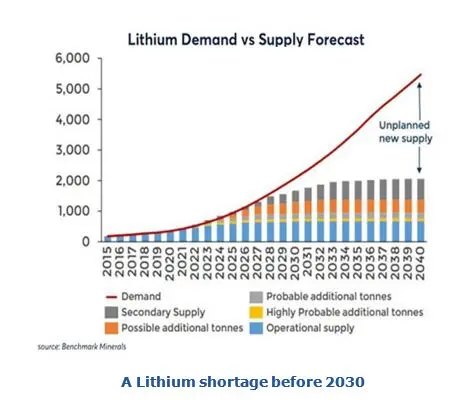

The trend towards LFP batteries which use no cobalt or nickel reduces the need for expensive minerals and is driving down the cost of batteries. The emerging solid state sodium battery technology has the potential for eliminating the need for lithium altogether, however the technology gives less range and has not been proven reliable yet. Even if proven successful it takes years to develop all the mining, refining, and battery manufacturing, so lithium is secure for the next five years. It can take several years to expand lithium mining and refining operations. There are indications that we will see a lithium shortage in the late 2020s as shown by this Benchmark minerals projection in the figure below.

The inflation reduction act of 2022 provides several financial incentives for companies to manufacture batteries in the US, including:

A 10% tax credit to produce battery cells and modules in the US

A $4 billion credit for the purchase of electric vehicles made with US-made batteries.

A $500 million loan program for battery manufacturing companies

These incentives have made the US a more attractive place to manufacture batteries. As a result, several companies have announced plans to build new battery factories in the US. For example, Panasonic and LG Energy Solution are building a $4 billion battery factory in Kansas, and General Motors and SK Innovation are building a $2.6 billion battery factory in Michigan. There is a risk that the US EV battery industry could develop overcapacity, and not all these companies will survive. Just this past week it was announced that Ford is halting work on a $3.5B EV battery factory with China’s CATL.

EVs account for 95% of global lithium-ion battery demand in 2023. Utility storage accounted for just 5% but is growing fast. See more content from Rick Rys at Rick Rys Reports.