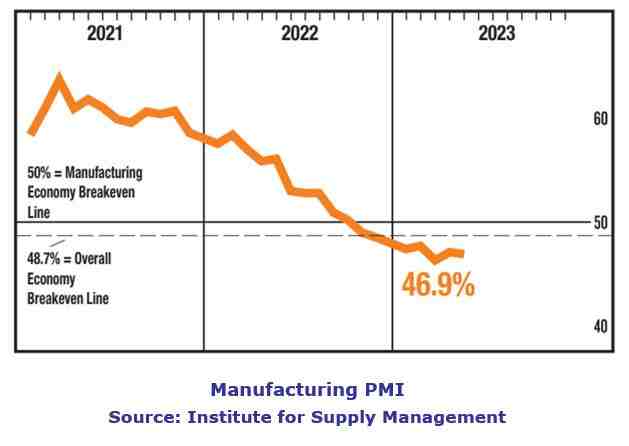

The Manufacturing ISM Report On Business is published monthly by the Institute for Supply Management (ISM), the largest supply management organization in the world, as well as one of the most respected. Economic activity in the manufacturing sector contracted in May for the seventh consecutive month following a 28-month period of growth, say the nation's supply executives in the latest Manufacturing ISM Report On Business.

The U.S. manufacturing sector contracted in  May, as the Manufacturing PMI registered 46.9 percent, 0.2 percentage point lower than the reading of 47.1 percent recorded in April. This is the seventh month of contraction and continuation of a downward trend that began in June 2022.

May, as the Manufacturing PMI registered 46.9 percent, 0.2 percentage point lower than the reading of 47.1 percent recorded in April. This is the seventh month of contraction and continuation of a downward trend that began in June 2022.

ISM’s New Orders Index contracted for the ninth consecutive month in May, registering 42.6 percent, a decrease of 3.1 percentage points compared to April’s reading of 45.7 percent.

The Production Index registered 51.1 percent in May, 2.2 percentage points higher than the April reading of 48.9 percent, indicating a return to expansion after five consecutive months in contraction.

ISM’s Employment Index registered 51.4 percent in May, 1.2 percentage points higher than the April reading of 50.2 percent. “The index indicated employment expanded again after two months of contraction.

The delivery performance of suppliers to manufacturing organizations was faster for the eighth straight month in May, as the Supplier Deliveries Index registered 43.5 percent, 1.1 percentage points lower than the 44.6 percent reported in April. This month’s reading indicates the fastest supplier delivery performance since March 2009, when the index registered 43.2 percent.

The Inventories Index registered 45.8 percent in May, 0.5 percentage point lower than the 46.3 percent reported for April, indicating manufacturing inventories contracted at a faster rate compared to April.

ISM’s Backlog of Orders Index registered 37.5 percent in May, a notable 5.6-percentage point decrease compared to April’s reading of 43.1 percent, indicating order backlogs contracted (faster) for the eighth consecutive month after a 27-month period of expansion.

The four manufacturing industries that reported growth in May are: Nonmetallic Mineral Products; Furniture & Related Products; Transportation Equipment; and Fabricated Metal Products. The 14 industries reporting contraction in May, in the following order, are: Wood Products; Primary Metals; Apparel, Leather & Allied Products; Textile Mills; Paper Products; Printing & Related Support Activities; Petroleum & Coal Products; Chemical Products; Food, Beverage & Tobacco Products; Computer & Electronic Products; Electrical Equipment, Appliances & Components; Plastics & Rubber Products; Miscellaneous Manufacturing; and Machinery.