India's shift from an emerging to a developed market economy is being driven by the digital sector. India has one billion mobile phone users and 700 million internet subscribers. Over the last few years, the country has experienced remarkable growth in digital commerce, digital entertainment, and social media usage. India leads the world in mobile data consumption, and this trend is showing no signs of slowing down.

Recent rapid changes driven by the government's Digital India initiative have catapulted India into one of the world's fastest-growing major economies. Government programs like E-Aadhaar, Digi Locker, Crime and Criminal Tracking Network and Systems (CCTNS), e-Courts, Goods and Services Tax Network (GSTN), and more have generated massive data with a citizen-centric focus. The government is actively promoting online payment systems for all financial transactions, leading to the need for more data centers to accommodate this growing data influx.

In the past five years, India has witnessed an astonishing annual growth rate of over 50 percent in digital payments, with the Unified Payments Interface (UPI) system, a real-time, mobile-enabled platform, experiencing an even more remarkable annual growth rate of about 160 percent. When UPI was initially introduced in April 2016, only 21 banks were on board, but as of June 2022, this number has surged by 44 percent to include 300 banks, as reported by the RBI.

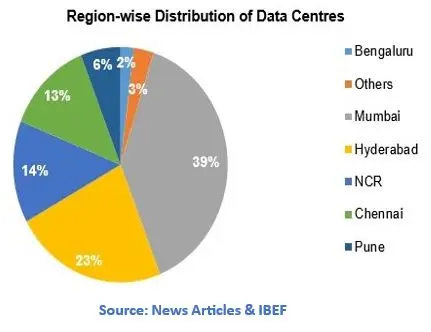

In response to the escalating demand, the National Informatics Centre (NIC) has established cutting-edge national data centers in key locations which are—Delhi NCR, Mumbai, Bengaluru, Pune, Hyderabad, Chennai, and Bhubaneswar. Additionally, there are 37 smaller data centers strategically located in state capitals, all geared toward serving government entities at every level. These data centers operate 24/7 and have on-site skilled personnel, which is pivotal for India's e-governance infrastructure by supporting various government initiatives. The Indian data center market, which stood at 540 MW in 2019, has surged to over 800 MW in 2022, and there are intentions to expand it to a capacity of 1,700 MW by 2025, as reported by the Ministry of External Affairs, India.

In response to the escalating demand, the National Informatics Centre (NIC) has established cutting-edge national data centers in key locations which are—Delhi NCR, Mumbai, Bengaluru, Pune, Hyderabad, Chennai, and Bhubaneswar. Additionally, there are 37 smaller data centers strategically located in state capitals, all geared toward serving government entities at every level. These data centers operate 24/7 and have on-site skilled personnel, which is pivotal for India's e-governance infrastructure by supporting various government initiatives. The Indian data center market, which stood at 540 MW in 2019, has surged to over 800 MW in 2022, and there are intentions to expand it to a capacity of 1,700 MW by 2025, as reported by the Ministry of External Affairs, India.

Some of the policies aimed at creating a favorable climate for investments in the data center sector, including both domestic and foreign direct investments (FDI) have been mentioned below.

The Indian government has granted infrastructure status to data centers with a minimum 5 MW IT load capacity, facilitating easier access to institutional credit, attracting foreign investments, and fostering growth in the sector. This development follows the Finance Minister's 2022-2023 budget announcement.

Data centers are set to be categorized as an essential service under the "The Essential Services Maintenance Act, 1968 (ESMA) ". This recognition acknowledges that the uninterrupted operation of data centers is vital for the ongoing provision of services and the maintenance of everyday routines. By including data centers within the scope of ESMA, it ensures the uninterrupted delivery of services, even in the face of emergencies or crises, ensuring seamless continuity during such times.

Furthermore, the Government of India intends to establish a minimum of four Data Center Economic Zones (DCEZs) across the nation as part of a Central Sector Scheme known as the DCEZ scheme. These DCEZs will serve as concentrated and specialized zones with optimal infrastructure for both non-IT and IT requirements, including connectivity, power, and regulatory support. The envisioned DCEZs will foster an ecosystem comprising hyperscale data centers, cloud service providers, IT firms, research and development units, and related industries. The implementation of the DCEZ scheme will involve soliciting proposals from various states.

An Investment Information and Credit Rating Agency (ICRA) report estimates a significant investment of ₹1.05 to 1.2 lakh crore in data center capacity expansion over the next five years. A recent Coldwell Banker Richard Ellis (CBRE) report revealed that the Indian data center market witnessed US $14 billion (₹1.15 lakh crore) in investments over the last five years, with the cumulative funding projected to exceed US $20 billion (₹1.64 lakh crore) by 2025 as investors seek stable income-generating assets. Some of the notable investments are:

Prominent global players like NTT, Google, Microsoft, Amazon, as well as domestic companies like L&T and the Hiranandani Group, are gearing up to construct new data centers or expand their existing ones within India. Over the next six years, it is anticipated that approximately 4,900-5,000 MW of data center capacity will be developed, with investments totaling up to US $18.16 billion (about ₹1.5 lakh crore).

In 2023, Adani is set to make a substantial investment of over US $2.42 billion (approximately ₹20,000 crores) for the development of India's inaugural integrated data center and technology business park in Andhra Pradesh. This state-of-the-art facility is expected to house an impressive 300 MW of data center capacity.

Reliance, a major Indian telecom company, currently operates nine cutting-edge data centers across the country and has established itself as a significant player in outsourcing data center infrastructure. They are set to build two hyperscale data centers in Maharashtra and Gujarat, with a total capacity of 12.5 MW. Additionally, Reliance entered a 10-year partnership with Microsoft in 2019 to construct more data centers in India. The collaboration with Microsoft to operate Azure services within Indian data centers through Jio has solidified Reliance's position as a leading investor in the data center industry in India.

India's journey toward becoming a developed economy is powered by digital transformation, driving economic growth, enhancing services, and boosting productivity. The data market is rapidly expanding, increasing the demand for reliable and scalable data centers. The government's support, coupled with international interest, is propelling India's data center industry forward.