The incoming presidential administration has a lot of potential to spur growth in the building automation marketplace and overall smart city technologies for the built environment, from traditional building automation systems to IoT-based systems, building information modeling (BIM), and digital twin technology for buildings, cities, and campuses. Let’s look at the overall Biden energy plan and what it means specifically for the commercial buildings sector.

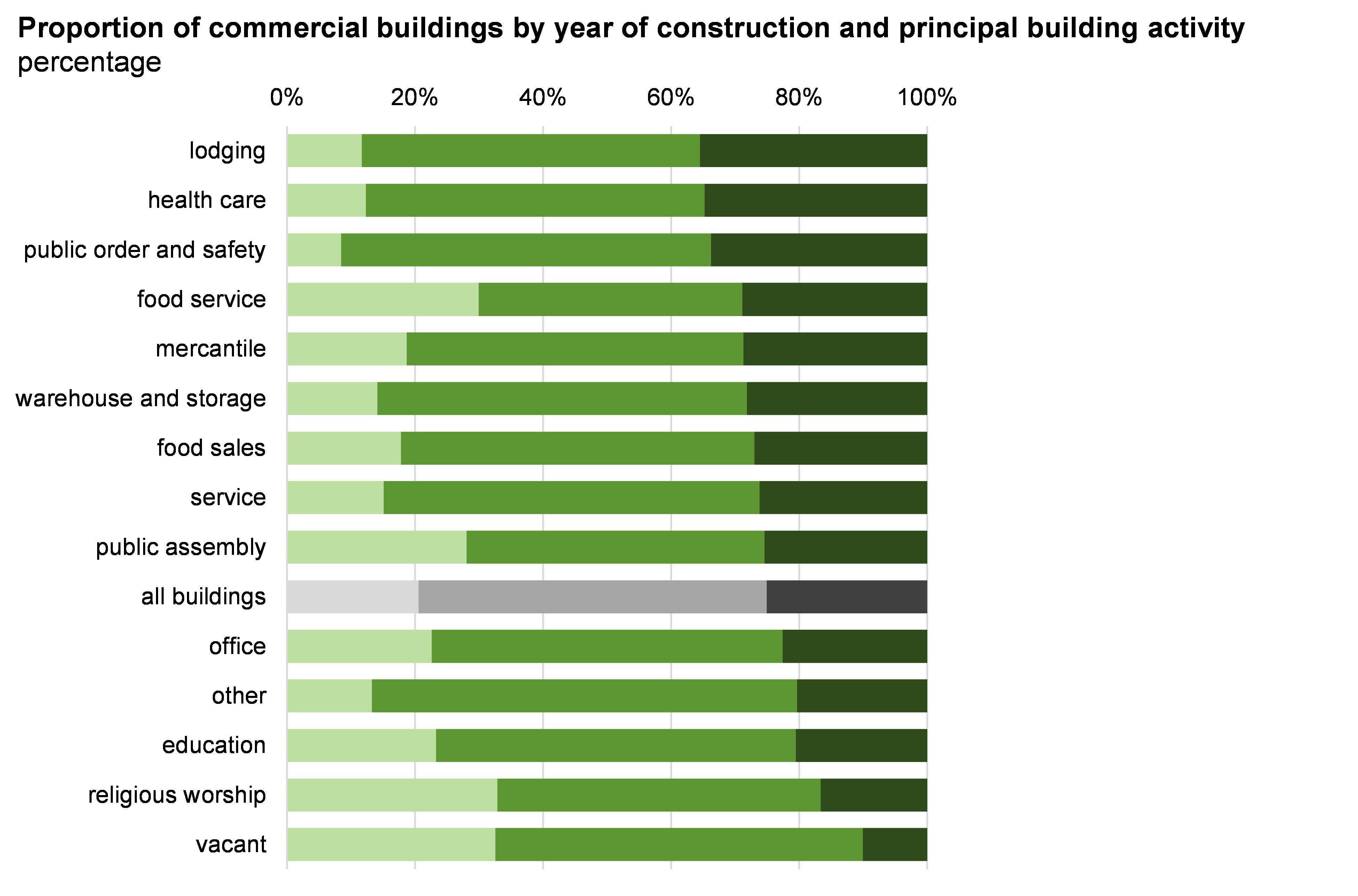

The market for commercial buildings in the US is, overall, an aging one that is ripe for some modern energy efficiency measures. According to the EIA’s recently released preliminary figures from the EIA’s Commercial Buildings Energy Consumption Survey, more than half of the commercial buildings in the US were built between 1960 and 1999. Buildings built before 1960 represent 21 percent of overall commercial buildings. These buildings incorporate various generations and levels of sophistication when it comes to building controls. Many of these buildings are hugely inefficient and represent a lot of low hanging fruit for energy efficiency.

A big part of the overall Biden plan is to make these buildings more energy efficient. The plan calls for an upgrade of four million commercial buildings in the US. The goal is to take nearly a quarter of the savings realized from these retrofit projects and return them directly to state and local governments where those buildings are located. Energy efficiency measures touted by the administration as part of their plan include installation of LED lighting, electrical appliances, and advanced heating and cooling systems.

The plan also includes investment in “energy upgrades” for homes, offices, warehouses, and public buildings. The administration states that these measures should create one million jobs in fields ranging from construction to engineering and manufacturing, with big improvements in air quality and overall environmental health. Biden’s plan also calls for a reform the building code process to establish a series of nationwide building performance standards for existing buildings. New funding mechanisms will be provided to states, local governments, and tribes. Other planned infrastructure investments include modernization of school buildings and funding for energy efficient campuses.

According to this paper by National Grid, energy represents about 19 percent of total expenditures for a typical office building in the US. Heating and cooling in a typical office building, including lighting, heating, and cooling, represents between 54 and 71 percent of total use depending on climate, making those systems ripe for considerable energy cost savings. According to the US Department of Energy, commercial buildings consume around 20 percent of all the energy produced in the US, while both commercial and residential buildings produce about 38 percent of greenhouse gas emissions. Buildings consume over 70 percent of the electricity produced in the US according to EIA.

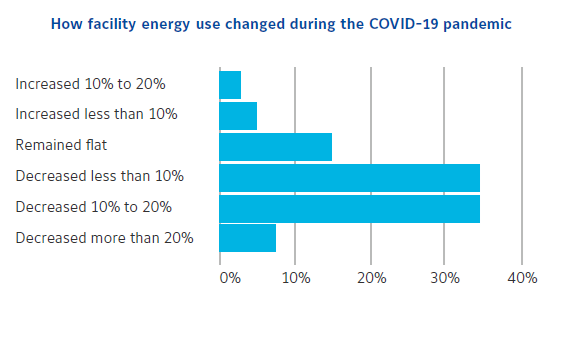

The COVID crisis in the US represents an even greater opportunity for energy savings. Older systems are not as adaptable, and many opportunities for energy savings in buildings that are not occupied or are partially occupied are not sufficiently realized. According to a September survey from Johnson Controls, energy consumption in buildings did not go down significantly, even in the wake of COVID-19 closings.

Most of the installed base of traditional HVAC systems consists of pneumatic controls and aging electronic hardware hardwired together via serial networks. As microprocessors became smaller and more powerful, products with embedded intelligence became easier to manufacture, less expensive to produce, and more widely adopted.

This led to a very competitive price structure for hardware in this largely bid-spec market. Hardware became commoditized, which made the already high cost of wiring and installation appear even more asphyxiating as it became a larger percentage of the total project spend. As the result of high wiring costs and the proliferation of intelligent hardware, system designs that utilized distributed intelligence became popular.

The traditional model of having a large space dedicated to housing all system controllers and running conduits to each physical access point was largely replaced by a model that scattered an appropriate number of controllers throughout the facility. Newer systems are server based, and information can be accessed through the Internet; but even these systems are becoming “lagging technology” as rapid technological advancements continue to revolutionize the industry.

While many installed systems are basic analog electrical systems, most projects that are being designed and commissioned today utilize digital architecture, IP-based communications, and web accessibility to increase the breadth and capabilities of these systems. There is also a strong trend toward the integration of once disparate systems, such as lighting control, access control, and others. Suppliers that develop all these systems on one platform allow information to be exchanged seamlessly between the systems, and data from the systems can be viewed holistically, where applicable.

While many industrial markets are suffering because of COVID-19, the market for OT level digital solutions, including building automation systems and an entire suite of industrial IoT-based offerings, is expected to accelerate in 2021 after the COVID dip in spending. The policies of the new administration should accelerate this trend. Investments in energy efficiency have a good return on investment, this return can be quite rapid. New energy innovations are centered on digital technologies and the strategic use of energy data. New buildings under smart city initiatives and energy intensive industries face a shift from a focus on hardware to the increased importance of software to make systems and assets more efficient, resilient, and digital.