The Emission Monitoring Systems (EMS) Selection guide is designed to help organizations make informed choices when selecting emission monitoring systems. It includes both selection criteria and strategies for choosing the correct system, technology and supplier.

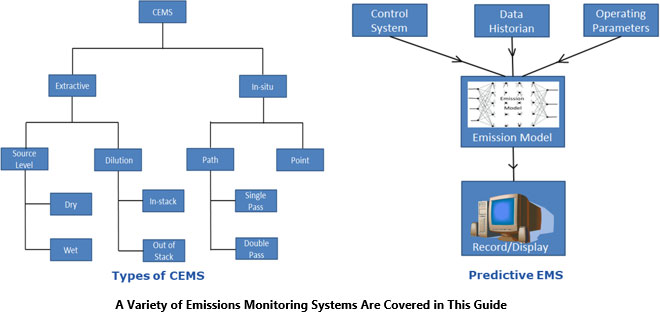

Continuous Emission Monitoring Systems (CEMS) are the traditional method of monitoring green-house gas emissions. CEMS is required by the majority of national environmental regulatory authorities. Now, Predictive Emission Monitoring Systems (PEMS), an environmental protection agency (EPA)-approved EMS, is being accepted by many countries. PEMS is a software-based emission monitoring solution that uses an emission model to predict emission levels. PEMS offers a less expensive alternative to CEMS; however, it needs to be validated with portable/actual analyzers.

Many suppliers are focusing on a services strategy that will center on the significant potential offered by the Industrial IoT. The use of connected and cloud-based solutions services across their broad product portfolio will provide improved uptime, reduced safety risks, and optimized processes. Suppliers are investing in products to be a part of the Industrial IoT and Industry 4.0. Industrial IoT-enabled connectivity, data management, and predictive analytics capabilities further increase customer value.

Extracted from ARC’s most recent Emission Monitoring Systems Global Market Research report, and drawing on our years of EMS market coverage, this guide will reduce your RFP development time and provide a sound foundation for expediting your product and supplier selection process.

The following are a few of the strategic issues specifically covered in the Emission Monitoring Systems Selection Guide:

Today, many users want more than what the traditional system provides. Users want centralized data storage with contextualized global data accessibility for all levels of their organizations to enable the highest collaboration and effectiveness. There are changes in the way the leading users are deploying new-generation smart EMS.

Users need to evaluate a supplier for not only its product portfolio, but also its solution capabilities for automation solutions. End users need to evaluate suppliers for the important aspects of application. These important aspects are described in the selection guide.

End user organizations continue to face a shortfall of qualified personnel, as fewer new workforce entries perceive process automation, process engineering, chemical engineering, or similar technical fields as attractive career paths. Furthermore, it can take up to two years to train a new hire effectively in the field of automation, and once trained, it may be difficult to retain that individual. This “brain drain” is a major challenge for end user organizations, and advanced technology and automation such as Industrial IoT can play a key role in filling this skills gap.

This selection guide explores user objectives, business justification, application scope, selection criteria, and helps answer key selection questions. We understand the challenge companies have in selecting and implementing a solution. These include:

For more information or to purchase the Emission Monitoring Systems Selection Guide, please contact us.