The Plant Asset Management market research delivers current market analysis plus a five year market and technology forecast. The research is available in multiple editions including worldwide, all regions, and most major countries. The research covers plant asset management, comprehensive asset management strategies, production assets, automation assets, Industrial IoT technologies, asset health monitoring, preventing unplanned downtime, strategic analysis, market size, industry trends, historical analysis.

ARC defines Plant Asset Management (PAM) systems as a combination of hardware, software, and services intended to assess the health of plant assets by monitoring asset condition to identify potential problems before they escalate. The severity of problem, potential causes, and possible operator actions can be provided to determine necessary actions. Plant asset management provides predictive asset health information by using data embedded in smart field devices, control systems, and various sensors with an intelligent analytical engine to predict potential asset problems. Information derived from PAM systems can be used to optimize maintenance and operations, increase production availability, and enable a predictive maintenance strategy.

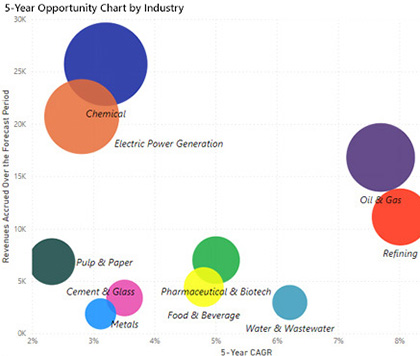

In addition to providing a five-year market forecast, the Plant Asset Management market research provides detailed quantitative current market data and addresses key strategic issues as follows.

In addition to providing a five-year market forecast, the Plant Asset Management market research provides detailed quantitative current market data and addresses key strategic issues as follows.

In the past few years, PAM end users have focused on educating their maintenance and operations teams on the benefits of PAM systems to encourage PAM solution adoption. However, many key functionalities of PAM systems may remain unexplored. To get the maximum benefit out of their PAM investments, users must put in an extra effort on their part to learn and train their staff on how to effectively use PAM systems. End users should involve the maintenance people who will use the PAM system from the beginning of the PAM initiative. End users should also review ongoing asset management practices from time to time and incorporate training as needed. As the COVID-19 pandemic limited operations for many end users, they utilized this time to revisit their training needs and work with suppliers to get the needed training(s).

A lot has changed in the last few years, and many end users now plan and budget for PAM initiatives. However, there are many users that are slow to undertake PAM initiatives. For those, just getting started on their PAM journey, developing a business case for PAM investments should be the first step. Doing so will require the end user to identify the problems PAM solutions will solve and quantify potential savings. From here, the organization can determine the level of investment that they are willing to approve.

Any savings resulting from the implementation of PAM systems can be applied directly to the bottom line, making them good investments regardless of the business environment. When maintenance is incorporated into the overall enterprise strategy, PAM provides a competitive advantage. In the short-term, end users all over the world are going to be cautious about their spending, due to the pandemic and resulting slowdown in global economies. ARC also expects some slowdown in PAM investments in the near future. However, end users should look at the long-term benefits of PAM investments. Many PAM initiatives may also result in short-term savings as well. Moreover, some investments may be needed just to keep the operations going. For example, when the pandemic-related restrictions hit, many end users were able to leverage their Industrial IoT investments to adapt to the new working environment.

Initial target applications for Industrial IoT technologies involve asset health monitoring for preventing unplanned downtime. Future projects, upgrades, or expansions that do not include the ability to monitor asset health is a lost opportunity. At minimum, project design should include the infrastructure to monitor assets in the future, if not immediately to facilitate the addition of monitoring sensors later at a minimal cost.

Owner/operators that have not yet undertaken Industrial IoT pilot projects should do so to obtain a basic understanding of the technologies and communication infrastructure to support it as well as the benefits that can be derived. ARC recommends experimenting with “bad actor” assets to evaluate technologies and redesign work processes. However, be aware that technology alone may not produce the intended results. Digital transformation requires shifts in organizational accountability, culture, and change management. Enterprises that overlook the organizational aspects of transformation may experience challenges in scaling pilot programs into full-scale operations.

Industrial IoT will provide opportunities for owner/operators to improve overall business performance in innovative ways. In this early phase of Industrial IoT maturity, asset management is a popular target among manufacturers. The challenge is to ascertain how to leverage these disruptive technologies to improve asset management processes to reap the benefits of reduced unplanned downtime and extend asset life with lower maintenance costs.

A comprehensive strategy for managing assets should provide owner/operators with an understanding of the effectiveness of assets utilized in the production process. This understanding of the asset base enables the development of maintenance strategies for individual assets according to its criticality to the manufacturing process. Asset management strategies should also include data governance parameters and details on how information will be shared, who should have access, and application integration among operations and maintenance to provide a comprehensive view of production and performance. In addition, owner/operators need to ensure that the infrastructure to support access to asset data is efficient and effective. Training requirements for both maintenance and operations personnel should not be overlooked in strategy development.

This market research may be purchased as a MIRA Service, an Excel Workbook, and/or as a Market Analysis Report (PDF). MIRA Services help unlock the full benefits of ARC’s market intelligence, making the data more actionable for you by adding qualitative context to our market data in an online environment unique to each customer. Regional editions include country and industry market data. Formats available are listed below:

| MIRA Services | MIRA Workbook | Market Analysis PDF | |

|---|---|---|---|

| Annual Subscription | Yes | No | No |

| Worldwide (includes regional data) | Yes | Yes | Yes |

| North America (includes regional data) | Yes | Yes | No |

| Europe, Middle East, Africa (includes regional data) | Yes | Yes | No |

| Asia (includes regional data) | Yes | Yes | No |

| Latin America (includes regional data) | Yes | Yes | No |

Table of contents for these studies is shown in the following paragraphs.

The research identifies all relevant suppliers serving this market.

List of countries included in each region: MIRA-Country

For more information or to purchase the Plant Asset Management Market Research, please contact us.

Learn more about ARC In-depth Research at Market Analysis

Learn more about ARC Strategic Services at Advisory Services for Industry Leaders