The Oilfield Drilling Optimization System market research delivers current market analysis plus a five-year market and technology forecast. This research provides a concise analysis of the conventional automation and digital technology oilfield drilling optimization systems market segments. The scope of the research is primarily on the upstream oil & gas exploratory and development drilling optimization opportunity. The study is available in multiple editions including worldwide, all regions, and most major countries.

Companies face continued challenges to drill more wells to offset growing decline rates, drill more wells with increasing complexity, improve time to first oil, increase rate of penetration, lower drilling related costs, lower oil extraction and refinement costs, reduce manufacturing operating expenses, and increase return on investment in order to compete in the global market. Optimizing oilfield drilling system performance and key operational metrics can play a critical role in helping companies realize operational excellence and improve profitability. ARC analysis shows a migration towards new digital technologies at the expense of more conventional automation drilling systems.

The oilfield drilling optimization systems market, including software (bundled with hardware modules) and services, is somewhat dynamic with the digital technology segment experiencing strong product innovation and growth. This market has tremendous opportunities with steady growth driven by drilling a growing number of unconventional wells which are exhibiting greater decline rates, and wells which require more complex drilling approaches to reach maximum estimated ultimate recovery (EUR). These oilfield drilling optimization solutions provide new features and functionality necessary to increase ROP and time to first oil by leveraging smart sensors and AI and machine learning based on industrial IoT.

The oilfield drilling optimization systems market, including software (bundled with hardware modules) and services, is somewhat dynamic with the digital technology segment experiencing strong product innovation and growth. This market has tremendous opportunities with steady growth driven by drilling a growing number of unconventional wells which are exhibiting greater decline rates, and wells which require more complex drilling approaches to reach maximum estimated ultimate recovery (EUR). These oilfield drilling optimization solutions provide new features and functionality necessary to increase ROP and time to first oil by leveraging smart sensors and AI and machine learning based on industrial IoT.

Oil and gas operators are increasingly getting involved in the digitalization process to enhance operational efficiency and minimize the cost of oilfield drilling and extraction. The implementation and execution of oilfield drilling optimization solutions and services helps improve knowing not only where (wellbore placement) and what (formation evaluation) you are drilling but also how you are drilling, which is mainly driven by the integration between the operator and the drilling service company.

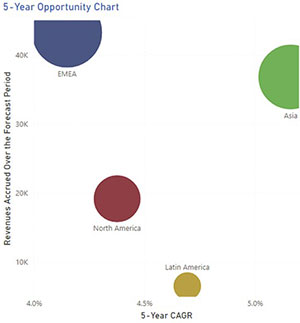

TIn addition to providing a five-year market forecast, the Oilfield Drilling Optimization market research report provides detailed quantitative current market data and addresses key strategic issues for both suppliers and potential buyers of these systems.

In today’s environment of price pressures. increased well complexity, higher drilling costs, and tremendous growth in data, optimizing drilling in real time is an imperative. The drilling optimization process begins with data collected in real time at the rig site, then drilling parameters are monitored, the thresholds are verified, and operators get alerts regarding unexpected trend changes from surface or downhole parameters. This allows users to optimize drilling and prevent any potential problems. Investing in oilfield drilling optimization systems across all six conventional drilling optimization system types and seven digital system types covered has benefited most users, but the demand for each type is shifting.

While the COVID-19 pandemic did not impact the 2019 demand for oilfield drilling optimization systems, the market projections do take into account industry trends with our best estimates for how the COVID-19 pandemic will impact the oilfield drilling optimization systems market in different project locations and regions.

This market research may be purchased as a MIRA Service, an Excel Workbook, and/or as a Market Analysis Report (PDF). MIRA Services help unlock the full benefits of ARC’s market intelligence, making the data more actionable for you by adding qualitative context to our market data in an online environment unique to each customer. Regional editions include country and industry market data. Formats available are listed below:

| MIRA Services | MIRA Workbook | Market Analysis PDF | |

|---|---|---|---|

| Annual Subscription | Yes | No | No |

| Worldwide (includes regional data) | Yes | Yes | Yes |

| North America (includes regional data) | Yes | Yes | No |

| Europe, Middle East, Africa (includes regional data) | Yes | Yes | No |

| Asia (includes regional data) | Yes | Yes | No |

| Latin America (includes regional data) | Yes | Yes | No |

Table of contents for this research is shown in the following paragraphs.

The research identifies all relevant suppliers serving this market.

To speak with the author or to purchase the Oilfield Drilling Optimization Systems Market Research, please contact us.

Learn more about ARC In-depth Research at Market Analysis

Learn more about ARC Strategic Services at Advisory Services for Industry Leaders