The Industrial Private Networks (5G & 4G) Emerging Market Analysis Report provides a concise analysis of the market for private wireless networks, including 5G and Long-term Evolution (LTE)/4G technologies. The report provides market size and forecast information for major regions, hardware, software, and services and discusses addressable market scenarios, potential applications, and anticipated use cases. Suppliers are identified while key strategy points and trends driving this market are discussed. Though the report titles 5G, it also covers 4G as both 4G and 5G are expected to co-exist and complement each other for appropriate industrial applications.

5G is the first wireless technology likely to have a large impact on the industrial world. While Wi-Fi and 4G are already used in some industrial applications, their value-add is limited by the fact that they were never designed specifically to meet industrial requirements and, as a result, have been adapted for specific purposes along the way. 5G, on the other hand, is designed to meet industrial requirements with ultra-low latency, high network availability, and high device density capabilities. Looking at the big picture, 5G is a key enabler for initiatives such as Industrial IoT and Industry 4.0 as it supports connectivity of large numbers of devices and allows large quantities of data to be aggregated and delivered from shop floors to remote data centers and cloud-based systems.

2019 was a pivotal year for 5G as mobile network operators (MNO)/communication service providers (CSPs), network infrastructure vendors, software vendors, cloud providers, system integrators, and industrial enterprises began to stake their claim in the technology. Some industrial companies that deployed private LTE and/or non-standalone (NSA) 5G networks for test cases or trail purposes started to realize the benefits of private networks and have made roadmaps for 5G deployments.

2019 was a pivotal year for 5G as mobile network operators (MNO)/communication service providers (CSPs), network infrastructure vendors, software vendors, cloud providers, system integrators, and industrial enterprises began to stake their claim in the technology. Some industrial companies that deployed private LTE and/or non-standalone (NSA) 5G networks for test cases or trail purposes started to realize the benefits of private networks and have made roadmaps for 5G deployments.

ARC believes that with high speed data rates, low latency, high device density, and reliability services, 5G promises better experiences and will likely be widely adopted in numerous industrial applications. 5G is expected to create great commercial value for carrier companies as these companies enter into new business models and services that support Industrial IoT applications.

In addition to providing a five-year market forecast, the industrial 5G market research provides detailed quantitative current market data and addresses key strategic issues as follows.

Availability of Appropriate Spectrum Frequencies: Spectrum is the top concern for operators in the 5G era. Mobile network operators and industrial enterprises require access to sufficient radio spectrum in suitable frequencies, in the sub-1 GHz frequency bands and 5G mid and high or millimeter wave (mmWave) bands, for appropriate use cases. Government policies and regulations on allocating spectrum for private use remain essential for accelerating industrial 5G deployments.

New Technologies and New Business Models: Network operators are increasingly seeking ways to grow revenue and cut costs in a low-growth environment, which is made more complicated by the demanding requirements of 5G services that include high speed, low latency, and high reliability. Network operators and vendors therefore need to evolve their networks offerings with new network technology solutions and services such as virtual radio access network (RAN), multi-access edge computing (MEC), cloud-native solutions, and IoT services through network slicing, software-defined networking (SDN) and network functions virtualization (NFV), and new open architectures and interfaces to meet the demands of the 5G era.

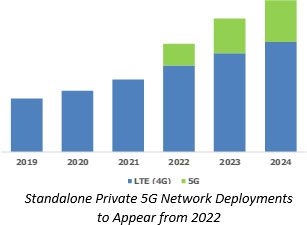

Mobile network operators and network infrastructure vendors are restructuring their business models and making inroads into the 5G enterprise market. On the other hand, some of the large industrial enterprises from mining, electric power, and automotive industries have deployed private LTE/4G networks and made roadmaps for deploying 5G standalone networks.

Deploying Private Networks: Many large industrial enterprises seem to have their own private networks. To realize the full potential of private networks, however, enterprises need to take a strategic approach. When planning to invest in private networks, it is important to think ahead to understand not just the technology but also specific use cases for devices and assets on the network. Although private networks offer greater performance over other network technologies, users need to choose a deployment strategy that fully aligns with current and future application needs. For example, users should consider the various use cases that could be supported by 3GPP Release-17 specifications in the near future.

This market study may be purchased as a concise, executive-level market analysis report in PDF format.

The research identifies all relevant suppliers serving this market.

For more information or to purchase the Industrial Private Networks (5G & 4G) study, please contact us.