This Automation and Software Expenditures for the Process Industries Market Research Study delivers current market analysis plus a five year market and technology forecast.

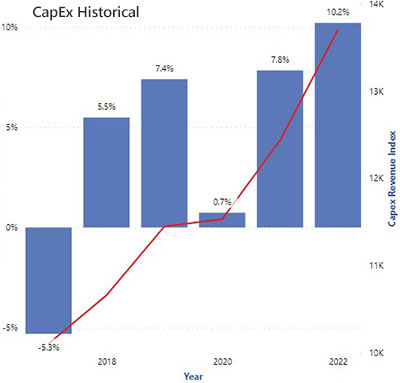

Despite the decline in the capital expenditure in 2020 in process industries, primarily due to the COVID-19 pandemic, the outlook remains positive for capital investments in automation products and software in the process industries. This is because the macro trends that underlie the growth in this market remain in place. These trends include globalization, infrastructure expansion, an aging installed base of automation equipment, manufacturing labor shortages, digitalization, an increasing middle class in Asia, and the ongoing need to improve production and process controllability and reduce energy consumption.

In addition to providing a five-year market forecast, the Total Automation Expenditures for Process market research provides detailed quantitative current market data and addresses key strategic issues as follows.

In addition to providing a five-year market forecast, the Total Automation Expenditures for Process market research provides detailed quantitative current market data and addresses key strategic issues as follows.

Industrial control system (ICS) virtualization offers clear benefits for end users. These include lower TCO, longer ICS life, fewer disruptive changes, and improved ability to manage change and implement continuous improvement. The largest payoff comes from improved operations. End user organizations should study the virtualization strategies of their potential future ICS suppliers, paying special attention to supplier plans for migrating existing installations to a future virtualized environment.

End users should consider adopting the new breed of I/O. Leading automation suppliers have developed new I/O that is either characterizable, configurable, or a combination of the two. Characterizable I/O includes hardware modules that plug into a rack and can represent analog input, analog output, digital input, digital output, etc. The type of module plugged into the rack determines the type of signal. Modules can be plugged anywhere in the rack and are location independent. Configurable I/O solutions take a similar approach in terms of point independence and flexibility, but the I/O points are configured through software rather than hardware modules. Some vendor solutions offer a combination of characterizable and configurable I/O.

The benefits of characterizable and configurable I/O go beyond simply reduced hardware, footprint, and wiring. They allow end users to separate the hardware-related and software-related aspects of the system. With fully adaptable and standard I/O and control hardware, end users can theoretically design and test all the software aspects of the system before it is deployed to the target system hardware. This allows the software to be deployed into the hardware infrastructure at the very late stages of the project. Often referred to as “late binding,” this can compress capital project schedules, reduce risks, and shorten the time to production.

This market research may be purchased as a MIRA Service, an Excel Workbook, and/or as a Market Analysis Report (PDF). MIRA Services help unlock the full benefits of ARC’s market intelligence, making the data more actionable for you by adding qualitative context to our market data in an online environment unique to each customer. Regional editions include country and industry market data. Formats available are listed below:

| MIRA Services | MIRA Workbook | Market Analysis PDF | |

|---|---|---|---|

| Annual Subscription | Yes | No | No |

| Worldwide (includes regional data) | Yes | Yes | Yes |

Table of contents for this research is shown in the following paragraphs.

The research identifies all relevant suppliers serving this market.

To speak with the author or to purchase the Automation and Software Expenditures Market Research, please contact us.

Learn more about ARC In-depth Research at Market Analysis

Learn more about ARC Strategic Services at Advisory Services for Industry Leaders