Thanks to relatively new technologies, such as horizontal drilling and hydraulic fracturing, companies operating in the US shale formations brought over one million barrels per day of incremental oil to global supply over the last year, or more than 1 percent

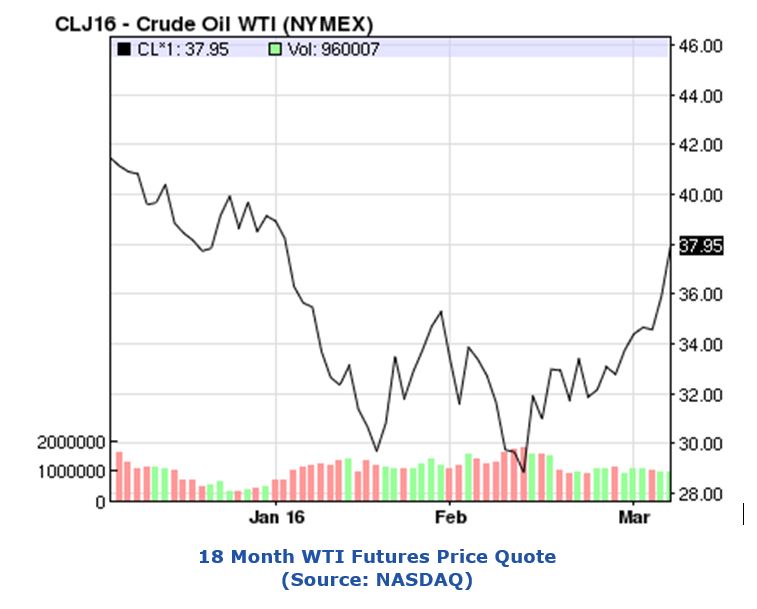

Recent events will likely keep oil prices “lower for longer” than ARC Advisory Group had originally anticipated last year when we issued our earlier reports on the effect of declining oil prices on the automation business. Removal of sanctions on Iran will enable about 500,000 of additional supply to enter the global market in the near term, with the potential for 1 million or more barrels coming online in the next couple of years. Geopolitical tensions in Russia, the Ukraine, and certain areas of the Middle East continue have the potential to further increase oil price volatility. Recently, the market has shown some signs of recovery, suggesting that we may have already seen the bottom on oil prices.

ARC believes that the oil & gas industry will continue to have winners and losers as upstream companies struggle to reduce costs while trying to maintain production in the face of low oil and gas prices, and downstream companies scramble to best take advantage of the current low feedstock and energy costs. Overall, however, the drop in capital spending for automation in upstream oil & gas will continue to drag the market down through the next 12 months. The impact on automation will likely vary by product segment, with instrumentation and valves segments feeling a deeper pinch, more so than software and systems. On the positive side for automation suppliers, ARC sees continued demand for automation services, particularly in industries such as oil & gas where layoffs are mounting and companies try to minimize both OpEx and CapEx in these trying times.

Most major owner-operators in the integrated oil & gas industry reduced capital expenditures significantly in 2015. This downturn is likely to worsen through 2016 with many operators announcing average CapEx reductions in the range of 20 to 25 percent in 2016, as opposed to the 15 to 20 percent in 2015. Some independent E&P firms are cutting even deeper, with some budget cuts reaching over 60 percent. Industry-wide, layoffs have exceeded 300,000 and counting as companies look to drive down costs in an attempt to protect margins and dividends.

Not all subsectors of the oil & gas market will decline. ARC is still seeing activity in certain segments of both the gas market and the midstream sector, which is heavily focused on transportation and storage. Spending in the downstream sector will remain healthy, with many large projects in sectors such as ethylene still on the books or in progress.

ARC circulated an internal survey to our own analysts when we wrote our first Insight on the impact of declining oil prices and we feel the input is still valid for the industry categories represented back then. The benefit of lower fuel prices for the power industry, however, must be balanced with the impact of growth in renewables on the central station power generation market for process automation. Several suppliers have pointed out that the high growth in renewables has not necessarily resulted in high growth for process automation, since most wind farms and solar power generation facilities do not use process automation systems, but typically rely on less sophisticated forms of automation.

Midstream companies still do not appear to be experiencing major negative impact from declining oil prices. The need to transport and/or store oil and gas remains strong and the need to process natural gas and natural gas liquids (NGLs) continues to grow in line with long-term demand forecasts. The solid longer-term forecast for pipeline demand and associated leak detection systems is based on long-term energy consumption and the fact that pipelines offer the most cost-effective transportation option. Midstream terminalling companies are benefitting from the current market contango, with many customers preferring to store liquid petroleum products, rather than selling them at a loss at today’s depressed prices.

Falling oil prices will be a boon for other industries that benefit from reduced energy costs, increased demand for their products, and the general economic stimulus afforded to consumers and businesses alike. The chemical industry is already realizing benefits from falling feedstock and energy costs.

With the significant drop in gasoline prices, the automotive industry has experienced a strong surge in sales of more profitable vehicles such as SUVs, pickup trucks, and other less fuel-efficient vehicles. Some companies are seeing growth rates of 20 percent or more on some models. GM increased its 2015 CapEx budget by 20 percent and will likely be followed by most of the other automotive players as they ramp up to meet consumer demand. By all accounts, most of the automotive suppliers enjoyed a banner year with US auto vehicles sales of 17.5 million in 2015, the most units sold on record.

Trucking companies, package delivery providers such as UPS and FedEx, and airlines are also benefitting from lower oil prices, as fuel is typically the largest expense item on their financial statements. Unfortunately for consumers, not all the benefits of low oil prices will be passed along as many of these companies will use the temporary financial windfall as an opportunity to shore up their balance sheets, pare down debt, and invest in automation and technology that will further enhance their operational efficiencies. Other industries likely to benefit from declining oil prices include electric power generation, aerospace & defense, machinery, and cement & glass.

World Bank analysis indicates that the impact of lower oil prices on world economic growth was slower than originally forecast in 2015. “There are winners and losers in the oil price shift,” according to Jim Yong Kim, president of the World Bank. Kim said that historical estimates suggest that a 30 percent decline in oil prices could help increase the size of the global economy by around 0.5 percent. According to the World Bank forecast, the world economy expanded by 2.6 percent in 2014, while only growing at 2.4 percent in 2015, but is expected to grow at 2.9 percent in 2016, and 3.1 percent in 2017 and 2018. This expansion would be based on low oil prices in conjunction with continued recovery in the US, a gradual improvement in the euro area, and receding domestic headwinds in slower-growing developing countries.

According to ARC analysts (and most economists), the big winners of declining oil prices are the major oil-importing countries of China, India, and Japan, although China has not enjoyed the full benefit due to several factors. Despite the near-term impact on shale and oil sands producers in the US and Canada, ARC expects a net positive impact on the North American economy as the additional energy savings for many companies and increased discretionary incomes for most consumers helps propel domestic economic growth. Many countries in Europe may also realize some economic benefit from lower oil prices, but this could be offset somewhat by the higher taxation levels relative to the US. Countries such as Norway and the UK that have oil and gas operations in the North Sea may also experience fewer benefits due to reduced tax revenues and declining investments in oil and gas.

Not surprisingly, the biggest losers from declining oil prices are the major exporting countries. These include Russia, Iran, and Venezuela, where a large portion of GDP (and many social programs) rely on oil and gas revenues. Venezuela’s decline will also affect countries such as Cuba, Haiti, and Honduras.

ARC Advisory Group believes that the net overall impact of declining oil prices should benefit most global economies through

We are likely to see increased merger and acquisition activity as stronger companies acquire weaker companies to obtain acreage in shale formations or obtain attractive product/technology portfolios to help round out their own solution portfolios. Some noteworthy examples of large multi-billion dollar mergers include Halliburton’s acquisition of Baker Hughes, Shell’s acquisition of BG Group (formerly the exploration arm of British Gas), and Schlumberger’s acquisition of Cameron International Corporation as these companies all look to streamline costs, improve technology portfolios or improve their reserves.

Companies in industries outside of oil & gas that are benefitting from lower oil prices should consider that this is a great time to

Operating companies in the oil & gas sector need to strike an appropriate balance between capital investments in production and technology innovation. Past lessons indicate that it’s often a mistake to curtail targeted investments severely in technological innovation during challenging times, since these investments often help improve competitiveness and financial performance over the long-term.

Based on our deep knowledge of both automation technologies and industry applications and challenges, ARC Advisory Group is well positioned to help owner-operators develop appropriate selection criteria and make informed, fact-based technology selection decisions that will ultimately provide operational, regulatory, and safety benefits, regardless of the current business climate.

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us

Keywords: Oil Prices, Capital Spending, Automation, Oil & Gas, Upstream, Midstream, Downstream, Automotive, Transportation, Refining, ARC Advisory Group.