The India pharmaceutical industry has demonstrated remarkable growth via both organic and inorganic routes. The issues encountered at each step have proved to be turning points that have changed the mechanisms and prevalent trends of the sector.

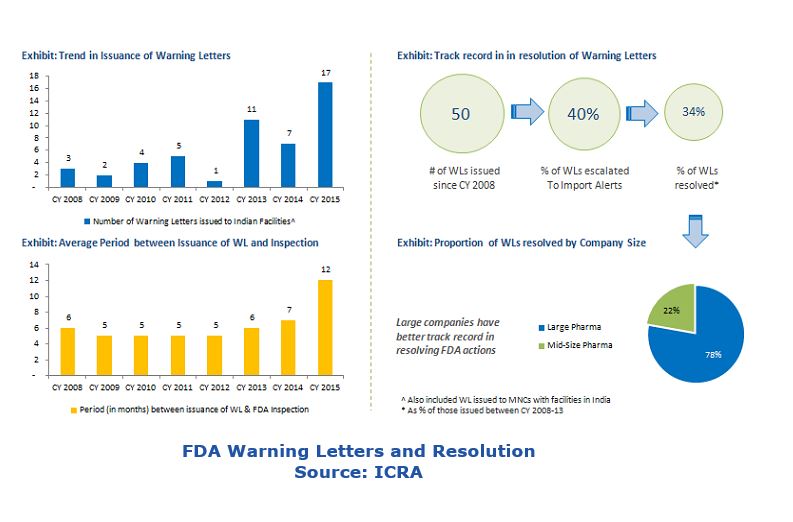

As in most other countries, India’s medical regulatory structure is divided between national and state authorities. The Drug Controller General of India (DCGI) is the national authority responsible for regulating pharmaceuticals. The DCGI registers all imported drugs, new drugs, and biologicals in selected categories and is responsible for approving clinical trials and maintaining quality standards. Recent events indicate that tighter scrutiny by the US FDA (Food and Drug Administration) for drugs shipped to the US is emerging as a key challenge for this sector, one that is causing delays in product approvals and launches. For the short term at least, this is likely to slow growth in India and other countries.

Since India is home to one-fifth of the world’s population, global pharmaceutical companies know that the country’s market is a potential goldmine. Domestic pharmaceutical companies are collaborating and joining hands with global companies to expand their geographic footprint. In a connected world, what impacts one industry or country has global ramifications.

India’s population of over 1.2 billion, characterized by increasing consumer spending, rapid urbanization, and a surge in lifestyle/non-communicable diseases, provides a huge and ready market for the pharmaceutical sector. While economic swings might impact certain industries, when it comes to medicines and healthcare, today’s discerning consumer is far more willing to spend. For the poorer sections of society, the government has introduced schemes giving them access to affordable healthcare.

Additionally, the government has made tax breaks available to the pharmaceutical sector, including a weighted tax deduction of 150 percent for R&D expenditure. The government recently declared that drug manufacturing innovations (indigenous R&D efforts to develop new drugs or improve existing drugs) would be exempt from price regulation for the first five years following approval. The objective is to spur growth in the domestic pharmaceutical market and ensure that pricing regulations do not turn global manufacturers away from India.

After a spate of mergers and acquisitions in 2015, pharmaceutical companies in India are trying to consolidate their positions. However, the combined value of domestic and outbound (i.e., Indian companies investing abroad) M&A deals was $3.7 billion in 2015, as against $5.3 billion in 2014. In 2014, deals were primarily driven by two large domestic mergers (Sun-Ranbaxy and Strides-Shasun); whereas in 2015 outbound deals predominated.

Noteworthy mergers and acquisitions by Indian pharmaceutical companies include:

Although India’s pharmaceutical sector is recognized as a leading producer of generic drugs and has state-of-the-art manufacturing facilities, at the granular level there are apprehensions about patent protection, quality, pricing etc. All these issues come under the magnifying glass of regulatory bodies when international deals are inked.

In the last few years the US FDA has issued a slew of warning letters and import alerts to pharmaceutical companies in India to ensure adherence to cGMP (current good manufacturing practice). Although the extent of deviation from cGMP guidelines varies across companies, some common issues have prompted FDA to take regulatory action:

India’s pharmaceutical sector has to carefully balance multiple issues such as public healthcare and adherence to rigid global regulatory laws while, and at the same time, remaining profitable. Mergers and acquisitions saw an upswing in 2015 and Indian companies have seen progress in terms of R&D capabilities and technical advancements; but these have been negated by regulatory issues, mainly with regard to quality. As we’ll discuss in more detail in a future ARC report, once the compliance issues have been resolved by adopting new technologies and, in some cases, new methods, India’s pharmaceutical sector should grow substantially.

Based on ARC research and analysis, we recommend the following actions for manufacturers, regulatory bodies, and technology suppliers in the pharmaceutical sector (domestic and global):

If you would like to buy this report or obtain information about how to become a client, please Contact Us

Keywords: Pharmaceutical, Mergers & Acquisitions, Government Initiatives, US FDA, R&D, Data Accuracy, Quality, Safety, India, ARC Advisory Group.