This ARC Insight is taken from an address to the combined Business Security, Information and Communication groups of the International Business Congress (IBC) on April 8, 2016 by ARC Research Director Harry Forbes.

Looking at the future of process automation, ExxonMobil’s recent initiative is noteworthy for several reasons: First because it is being done for ExxonMobil, a leading international oil company with a long reputation for operational excellence. Second, because the products of this program will be technologically quite different from the process automation systems used today. Third, because the organization and the value chain executing this program are also quite different from the way the process automation market works today.

ExxonMobil discussed the objectives of this initiative at the 2016 ARC Industry Forum in Orlando in February, where it generated

During their 2016 ARC Industry Forum presentations, ExxonMobil representatives stated clearly that one objective in making their automation plans public is to promote the development of a business “ecosystem” (a market segment with many companies supplying products and services). This ecosystem eventually would support and enhance the new automation technology that ExxonMobil is adopting. They explicitly said, “We do NOT want to create a system that is only used by ExxonMobil. That would represent a failure of this program.”

Strategies are being developed now with the objective to enable multiple end user and supplier firms to effectively collaborate on the standards and practices that will be required for the ExxonMobil automation development program. These plans should be announced shortly, probably in the second quarter of 2016.

The plants for which these automation systems are being developed are those of the downstream and chemical operations of ExxonMobil. This program is noteworthy for many reasons. In ARC’s assessment, the three most important distinctions are:

ExxonMobil’s downstream and chemical operations represent a very large installed base of plant and automation systems. There are dozens of production sites, hundreds of process unit involved, and literally hundreds and hundreds of large automation systems. And most of these systems are very old, especially certain parts of them. Much of the regulatory automation equipment dates from the early 1980s

This equipment has been carefully maintained for many years, but issues of available parts and also of support for such old technology are becoming more pressing. It was clear that despite the efforts to prolong their life, the use of these systems would have to come to an end in the next 10 years or so and they would require replacement. Internally, ExxonMobil sought a way to realize some incremental business value from replacing these systems. In the company’s evaluation, just replacing these old systems with today’s equivalent systems would not provide this value (apart from longer expected life), and so they looked for a different kind of replacement solution. This requires a little further explanation.

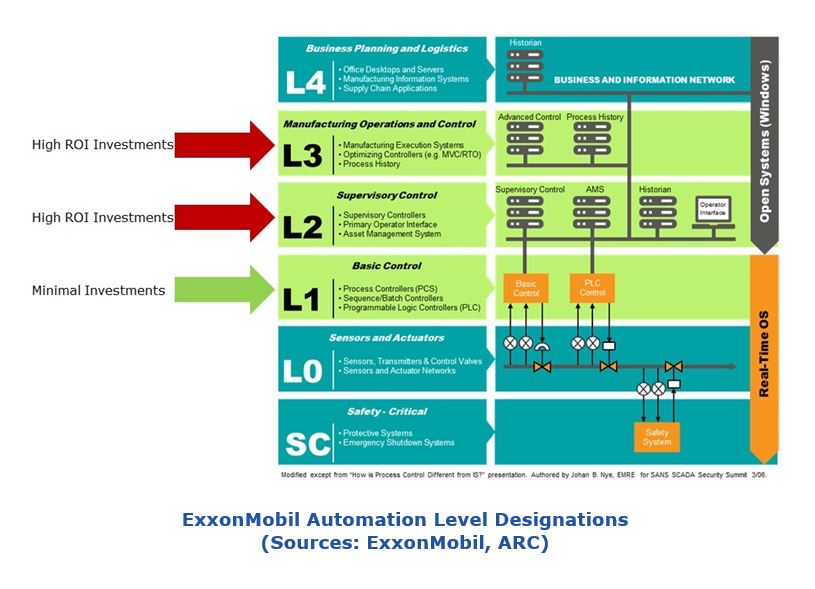

Within ExxonMobil, as with most process manufacturing companies, the automation and production management systems are thought of as hierarchical layers or levels. Each component operates at a specific level. The basic regulatory controls, the base-level automation of the process is designated as “level 1.” These might control a single process temperature, flow, or level. The tasks of higher level functions are things such as providing broader situational awareness and driving the operating point of the overall process to goals that meet business-related objectives. It is at these higher levels that the economic optimization of production operations occurs.

Historically the ExxonMobil automation investment strategy has been to focus its investment in these higher levels, where return on investment was higher. The level 1 equipment is well maintained, but has not received nearly the same level of ongoing investment. It is the level 1 equipment that is now the target of replacement, and there is a great deal of this equipment to replace, as previously stated.

However at the end of its operating life, refreshing or replacing the level 1 equipment (DCS controllers and DCS I/O equipment) is technologically complex and very disruptive to operations. This equipment is closely coupled to both the field and to higher automation levels. Replacement requires system-level projects that cannot easily be subdivided into very small steps. ExxonMobil wanted very much that their new replacement level 1 systems would never again require such a complex and disruptive replacement program. The company wanted new automation that was substantially simpler to refresh. So they began to envision replacing their level 1 equipment with a very different type of system.

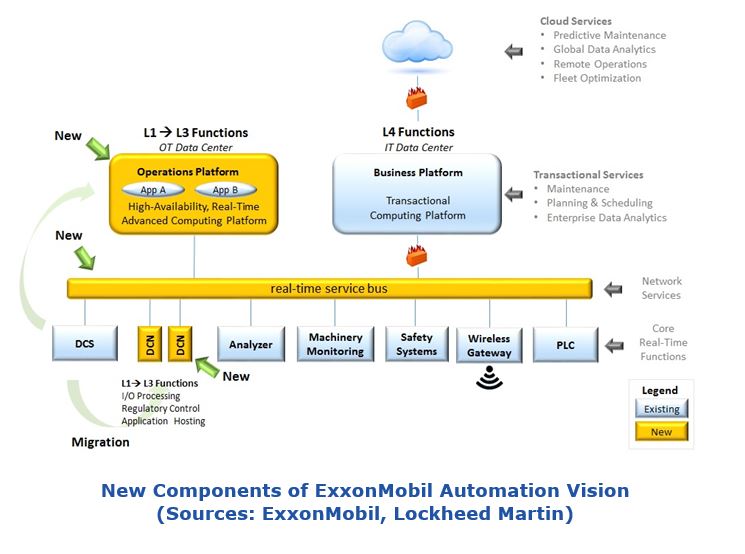

This was all done through purely internal work, but in February 2015 ExxonMobil discussed this vison publicly (though in general terms) at that year’s ARC Industry Forum in Orlando. Following that event, the company continued to discuss the vision privately and in more detail with a number of automation and system suppliers and potential suppliers. In late 2015, ExxonMobil announced a contract with Lockheed Martin. This contract calls for the development of a new set of process automation products.

The chart below shows the envisioned architecture. The new components are colored yellow, while the existing systems are light blue. The new capabilities are broken into three major areas:

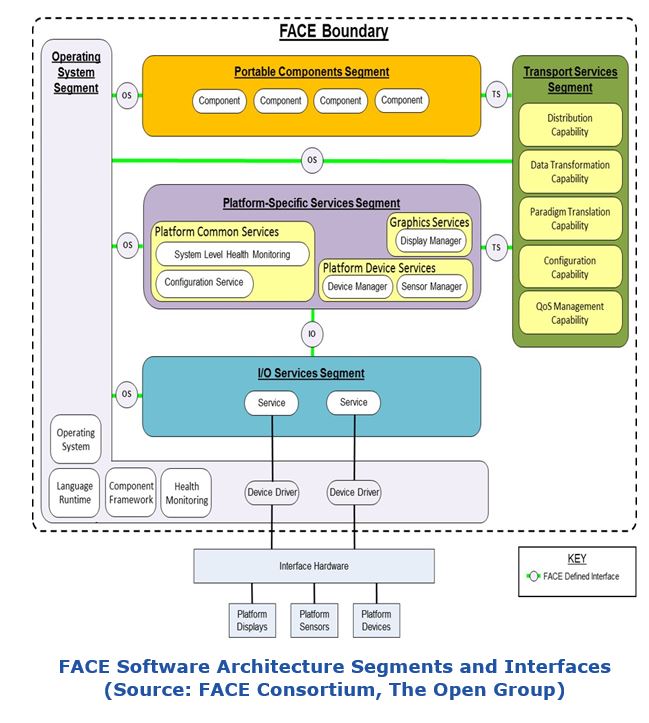

Besides the system architecture, software is an absolutely critical component of the program deliverables; truly the most important part. Therefore, the program will adopt a rigorous software design framework. This framework serves to isolate platform dependencies and require that software components use only fully specified interfaces for their interoperation.

What is notable about this framework (named the Future Airborne Capability Environment, or FACE) is that it has been developed over the past several years by firms serving the U S Department of Defense. The framework is now used to develop and procure many avionics systems for US military aircraft, including unmanned aircraft, and its use within the Department of Defense may expand further in the future. The overall reasons for using FACE in defense projects is to speed up system delivery through re-use of validated software components and to enable rapid and simpler incremental improvements to avionics systems installed in fleets of aircraft.

Please note that these objectives of FACE in military avionics programs (rapid development and incremental expansion/improvement) align very well with the objectives that ExxonMobil articulated for the replacement of its level 1 or regulatory automation systems.

While it’s not possible to make any definitive conclusions at this early stage, ARC’s preliminary assessment of this program covers the risks, ecosystem, schedule, and potential benefits.

The greatest risks from the perspective of end users is the need to integrate a number of software capabilities for configuration, operation, monitoring, and management of such an automation system. Some key features of DCS software have historically been difficult to implement. Examples are online control parameter and configuration changes, alarm management, system-wide I/O and data use analysis, and online device and system software backup and upgrade. This type of software needs to be rock-solid through years of continuous operation, since it fundamentally manages the process operations. Any new technology program cannot compromise the operational integrity of the plants.

Second, it will be necessary for the program to cultivate a support ecosystem of businesses. While ExxonMobil envisions that in this new architecture many routine maintenance tasks should become much simpler, the lifetime of process automation systems is measured in decades, making it critical to have ongoing support channels through the system life cycle.

Finally, the schedule for this program is very ambitious, with the first actual installations now scheduled for 2019.

The potential benefits are those envisioned by ExxonMobil; a simplified automation system architecture, ease in updating or extending the system and thus smaller and more incremental system upgrades and extensions. Another benefit may be greatly reduced dependence on any single automation supplier going forward, albeit that the overall system and its architecture will inevitably require life-long support.

While this program carries considerable risk, ExxonMobil’s evaluation is that now is an appropriate time, technologically, for the process automation industry to move in an important way toward a new architecture featuring much higher levels of system interoperability and much smaller modularity than is common in DCS products today.

ExxonMobil may well be correct in that evaluation.

If you would like to buy this report or obtain information about how to become a client, please Contact Us

Keywords: Cloud Computing, DCN, DCS, DDS, ExxonMobil, FACE, Future Airborne Capability Environment, Open Source, Process Automation, ARC Advisory.