The rapid growth of e-commerce and its impact on fulfillment operations affects not only retailers, but also wholesalers, manufacturers, and logistics service providers. These effects are pervasive and occur more rapidly than many logistics executives previously anticipated. ARC Advisory Group’s recent survey-based research captures the profile of today’s fulfillment environment and provides insights into the pressures on, and priorities of, practitioners and how they are adjusting processes and investing in technology to align their operations with changing requirements.

Fulfillment accuracy remains the most important capability or performance attribute in warehouse operations. However, fulfillment responsiveness is the capability most expected to increase in importance over the next five years. This is likely a result of heightened customer expectations for expedited fulfillment of online orders. These expectations have been driven largely by services such as Amazon Prime. In addition, warehouses that use system-directed waveless fulfillment consider it to be an effective way to support responsive operations while obtaining high labor utilization.

Traditional store replenishment and distribution center (DC) replenishment remain the most prevalent fulfillment channels. However, direct-to-consumer (e-commerce) and drop ship operations are expected to increase extensively over the next three years. Logically enough, piece picking is expected to increase more than case or pallet units. These expectations suggest that the current transformation in fulfillment activities, largely driven by e-commerce, will continue.

System-directed wave release (order batching) remains in high use and respondents expect this to increase. However, use of put-walls to support methods, such as zone picking, appears to be limited and selective. In contrast to waving, system-directed waveless (dynamic) fulfillment is in limited use but appears to be growing quickly due to its alignment with the demands placed on operations. Finally, the technology investment priorities of warehouse executives show that tried and true technologies such as warehouse management systems (WMS) and conveyor/sortation systems remain top priorities, while other supporting technologies, such as labor management systems, voice recognition, automated guided vehicles (AGVs), and palletizing, are also given wide-spread consideration.

Overall, our results suggest that warehouse operations are in the midst of a rapid and fundamental change, but not likely as rapid and wide-spread as some headlines would suggest. In fact, our results indicate that warehouses remain pragmatic in their approach toward change.

To obtain a broad-based understanding of the fulfillment environment, ARC Advisory Group, in partnership with DC Velocity magazine, conducted a survey of retailers, wholesalers, manufacturers, and third-party logistics service providers (3PLs). We captured the profile of today’s fulfillment environment and obtained insights into the changing demands placed on fulfillment operations, the pain points and priorities of practitioners, and how stakeholders are responding by adjusting processes, investing in technology, and reconfiguring warehouse operations.

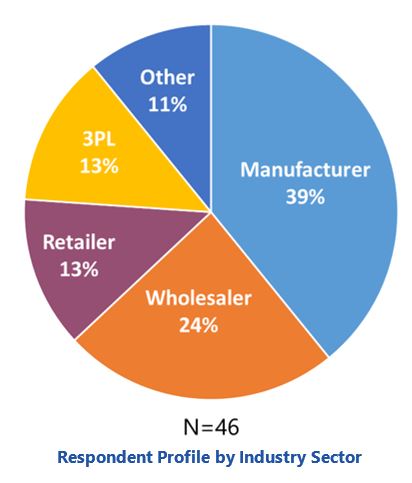

ARC Advisory Group created a web-based survey and distributed it to ARC Advisory Group and DC Velocity contact lists. We removed unverifiable and unqualified responses, and conducted our analysis based on a sample of 46 qualified responses (see respondent profile by industry sector). The survey was structured around:

We included a time-phased element (past, present, and anticipated future) to provide context to changes in progress.

This survey-based research is a sequel to a project ARC conducted with DC Velocity in 2016. Much of the structure remains the same and there-fore provides a historical frame of reference for this survey’s results.

We broke fulfillment performance into four high-level operational capabilities to determine their relative importance to practitioners:

More than half of our survey respondents indicated that fulfillment accuracy is most important, followed by fulfillment responsiveness. As the primary role of fulfillment operations and critical to customer satisfaction, accuracy is clearly paramount. However, warehouses generally adjust operations to improve other performance measures while “maintaining order accuracy.”

When we asked respondents how they anticipate the relative importance of these considerations to change over the next five years, we obtained a different picture (see Exhibit 1). Going forward, most practitioners (77 percent) clearly expect fulfillment responsiveness to increase in importance. This is likely due to customer expectations of expedited delivery, driven by the recent acceleration in next-day and same-day delivery of e-commerce orders by Amazon and others. This study shows additional support for a widespread increase in the importance of responsiveness, especially with respect to motives for using waveless fulfillment processes, which will be discussed in the operational profiles section.

It’s likely that expectations for throughput to increase in importance is driven by the ongoing trends of volume increases and cost pressures.

Respondents provided qualitative feedback about the major factors affecting their warehouse operations. They noted the change in order profiles, with a trend toward a greater number of smaller orders. However, labor-related issues, such as availability and the cost of labor, were most frequently mentioned. The other important factors noted, in decreasing order of importance, were competitive pressures and the increase in direct to consumer/e-commerce fulfillment.

We asked respondents about the degree to which their order fulfillment constitutes certain fulfillment paths. The paths include traditional store replenishment (to retail locations), DC replenishment (to downstream or partner DCs), direct fulfillment of retail partner’s customers’ orders (drop ship), and direct-to-consumer (e-commerce or other). Over the next three years, most respondents anticipate that direct-to-consumer and drop ship are the two order fulfillment types most likely to increase extensively (see Exhibit 2). It’s widely known that e-commerce is a rapidly expanding retail fulfillment channel. However, our drop ship statistics show the degree to which e-commerce is affecting manufacturers and other upstream partners, as retailers increasingly expect their suppliers to take on a greater role in order fulfillment. These responses are similar to those we received in our 2016 survey, indicating that the current trends show no signs of abating.

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us