Every day, consumers track the journey made by packages ordered through the internet via the suppliers’ websites. Consumers are the final destination for these goods, but most have come a very long way, often from (literally) the other side of the world.

A few years ago, the non-profit Global Canopy published a supply chain hypothesis. It calculated that if you ordered a burger and fries, the ingredients and packaging have gone through around 75 logistical and processing steps before you get to enjoy them. This does not even include all the work and materials that farmers and their suppliers had to go through to produce the raw ingredient.

Consumers are becoming more and more informed. They insist that their goods conform to their needs, preferences, and personal requirements. Governmental and other responsible institutions react by establishing regulations to which every player in the supply chain must adhere.

In the light of the rapid digital transformation of the industrial sector, companies are considering or have started to implement available technologies to create a transparent supply chain. Track & trace solutions can provide insights and control of the entire supply chain process: from the suppliers of raw materials or parts through the in-house process and warehousing up to the end customer.

How does this translate to modern manufacturing and processing? What are the options of track & trace? What are the challenges and opportunities of implementing track & trace into an industrial process? Where does track & trace fit into the increasingly digitalized industrial world?

This report combines previous ARC Advisory Group research and the results of a recent ARC survey. The survey was targeted at all personnel involved with the application, implementation, and/or sales of track & trace products or services.

ARC Advisory Group recently conducted a web survey of almost 50 professionals involved in applying, implementing, and/or selling track & trace products or services. Here are some of our key findings from this research:

While the implementation of track & trace in internal and external logistics is well established, its application across the whole supply chain is still developing in industrial production.

Only 15 percent of the respondents have a supply chain-wide solution in place; another 8 percent are using track & trace for selected applications.

Many respondents do have plans for implementing a track and trace solution. Thirty-eight percent are still investigating, while 8 percent already have concrete plans. Another 8 percent report that their company runs pilot projects or proofs of concept. These numbers suggest growing interest.

We asked the providers to share with us their estimate of how well track & trace solutions have been adopted in the different world regions. We used a weighted ranking to make the answers comparable. According to their estimates, North America leads the list with an adoption rate of 39 percent, followed by Western Europe with 37 percent and developed Asia with 33 percent. Not surprising, the remaining regions show lower adoption rates: Eastern Europe, Middle East, and Emerging Asia show averages of around 25 percent.

While the implementation of track & trace in internal and external logistics is well established, the application across the whole supply chain is still developing in industrial production.

Track & trace solutions are moving from pure logistics applications into the industrial manufacturing and processing world. Industrial production holds a much wider set of requirements and challenges for these solutions.

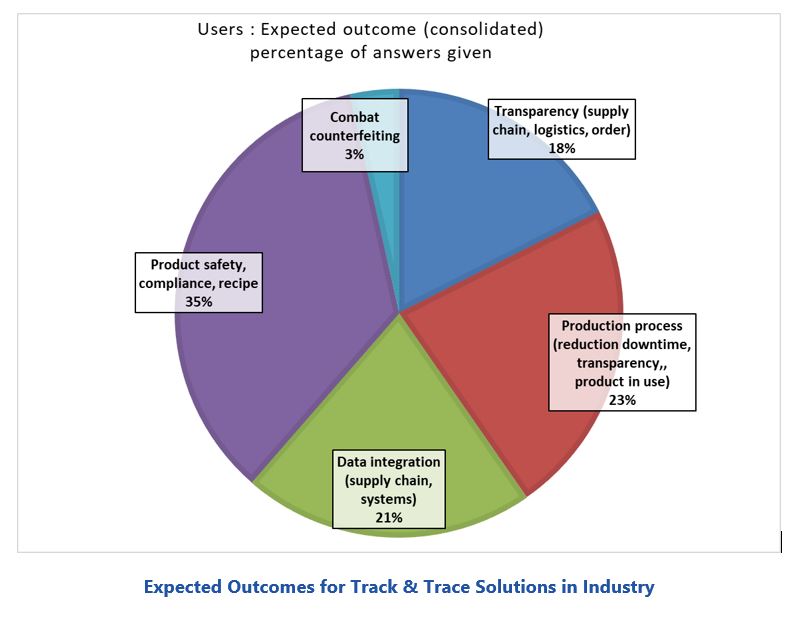

Industrial users have a long list of demands and expectations concerning track & trace solutions. Important concerns are the product safety and quality (25 percent), regulatory compliance (31 percent), and the conformance of recipes and specifications (38 percent). This also includes the transparency of ingredients or composition towards the consumer (31 percent).

Especially in the consumer-driven industries like food & beverage, pharmaceuticals and CPG, these points are crucial as mistakes not only lead to loss of resources or monetary loss due to recalls but can also lead to severe repercussions if their production process is considered non-compliant with regulations. Furthermore, the loss of consumer confidence can have long-term consequences.

Another major expectation is the transparent monitoring of the production process, be it the transparency of the process (28 percent) or the traceability of the product in use (44 percent).

Furthermore, end users expect the data integration of their whole supply chain (38 percent), integration of existing systems and infrastructure (25 percent), and the integration of data concerning direct suppliers and customers (13 percent).

From a consumer point of view, we can assume that transparency of the supply chain is probably the first benefit that comes to mind. However, for industrial end users, this appears to be a less prominent benefit. Just 15 percent of industrial end users surveyed expect transparency of the inbound and outbound supply chain, while 25 percent are interested in traditional “track your order” capabilities. The industrial manufacturers seem to see transparency as a given and are more concerned with the specific requirements of their processes.

Combating counterfeiting is often mentioned as one of the important features of track & trace solutions. Our survey shows that 30 percent of the responding industrial companies see this as a major expected out-come.

Industrial manufacturers face a variety of challenges and inhibitors when implementing or planning to implement a track & trace solution.

As expected, the main internal challenges are the costs of the solution/implementation. Forty-one percent of users cite operations costs as the main challenge and another 32 percent mention infrastructure costs. It’s not surprising to see costs as the main internal inhibitor. More interesting, is the high percentage of respondents that mention that they are hindered by unclear business models and uncertainties concerning the return on investment.

In response to the same question, 23 percent of suppliers surveyed mentioned that the customers don’t believe in the success of track & trace. A possible conclusion is that providing customers with comprehensive and relevant information could have a positive impact on the implementation of track & trace solutions. This could be achieved through industry-specific business models and case studies.

Technology is another big challenge; 23 percent of end users mentioned concerns about availability of suitable technology, integration into the existing IT infrastructure, and about possible cybersecurity implications. The fact that the suppliers are less concerned about the technology, suggests that these problems might be less severe than perceived by the users.

We also asked the respondents about the external inhibitors, either experienced or perceived. These factors may hinder or even prevent the implementation of track & trace solutions. The purpose of this question was to identify those inhibiting factors perceived by suppliers and users that are beyond their control.

The main external inhibitor mentioned is the lack of cooperation across the supply chain and challenges when sharing data. This was identified by the end users (36 percent) as well as the suppliers (32 percent).

Another major concern for suppliers (23 percent) and users (27 percent) alike is the lack of industry standards and norms. Missing or incomplete standards for products, industries, processes, or markets in the affected industries will delay or avoid implementation of a system that influences their complete supply chain. The diversity of national/international standards adds to this issue: 27 percent of users point out lack of appropriate standards and norms as an external inhibitor.

Another aspect is the way end users are implementing their track & trace solutions. Respondents were allowed multiple answers. Fifty-nine percent of users across industries favor an ERP solution, either integrated or as a module. Fifty percent of users prefer it to be part of the control layer or as an Industrial IoT cloud solution. Another common solution is the use of track & trace in combination with MES or using external providers (both 23 percent). Fewer users choose standalone solutions.

These results point to the users’ preference of integrating track & trace solution into existing systems and explains why data integration is one of the major concerns.

The answers given by users from the food & beverage and CPG industries (both major user industries for track & trace solutions) indicate an even stronger trend in this direction. More than half of these respondents prefer to integrate their track & trace solution with ERP or use a module for ERP. Forty-two percent use it integrated or as a module of their control layer. Over one-third use Industrial IoT cloud solutions and 18 percent prefer the integration with MES.

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us