In January, we analysts began our quarterly ritual of updating forecasts for our annual Automation Index report. While some industries like automotive were down, electronics and semiconductors were expected to bounce back in 2020 and the process industries were still healthy and just a bit flatter than last years. And then came the coronavirus.

For two months, the coronavirus has been tightening its choke hold on the world, spreading fear even faster than the COVID-19 respiratory illness that it causes. Starting in China, the world’s manufacturing hub, authorities there quickly closed factories, limited travel, and quarantined millions of people with brutal but effective measures that would be unthinkable in other countries. These efforts may well have prevented a more severe outbreak, but the virus still has managed to spread to nearly 100 countries, resulting in almost 100,000 infections and over 3,000 deaths.

In the industrial world, companies have restricted business travel, canceled major events, and required some employees to work from home. While some production in China is resuming and most factories in the west are still in operation, the coronavirus has impacted supply chains, the lifelines of factories, to various degrees. In a world of global supply chains, the effects of disruptions can propagate far, and the lack of even a single part can bring production to a screeching halt.

We don’t know how far the virus will spread, nor how long it will plague us, nor when we will manage to contain it. Back in the forecasting department, making projections becomes a challenge, so instead, analysts reach for their scenario methodology.

ARC has developed and refined a tool for generating scenarios that can help shed light on markets in which development is uncertain. Rather than providing a single curve that represents how we think markets will develop, scenarios provide 3 to 5 possible paths forward, framed by best and worst case curves.

The baseline scenario is the curve that represents the most likely way forward. In the case of the coronavirus, the baseline scenario is actually the best case, while additional scenarios look at the impact of different parameters.

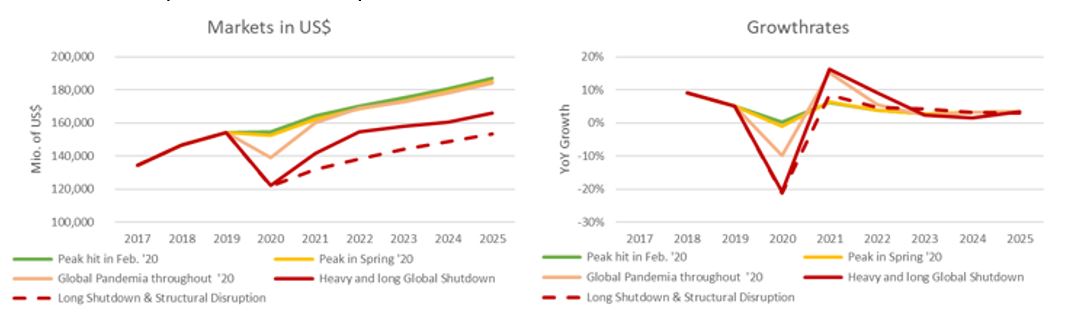

The two charts show us the baseline and four possible scenarios for the impact of the coronavirus on the development of ARC’s Automation Index. The chart on the right plots the expected growth rates on the Y-axis and the time horizon on the x-axis. The two best cases scenarios are that the virus has already peaked or will peak in the next few months. Growth would be dragged down to around 0%, but the market structure would remain intact. In the middle scenario, the virus plagues the world as a global pandemic throughout 2020, resulting in a contraction of -10%.

The two red lines represent worst case scenarios from a severe spreading of the virus that result in a -20% market contraction. Such severe conditions can destroy market structure and infrastructure. For example, key component suppliers could go out of business, or a shipping company might declare bankruptcy. The dotted red line assumes that some structural disruption occurs, so that markets need more time to recover or restructure themselves.

The x-axis expresses the time that each scenario needs to return to more or less normal conditions. In all cases, we don’t expect a long-term effect on automation markets. Most would likely bounce back after a year on the strong assumption that the virus is contained, and a vaccine is developed and distributed.