To be able to provide our Advisory Service clients with holistic coverage of the impacts of the COVID-19 crisis on various markets, ARC Advisory Group has decided to publish our latest Automation Index and Machinery Index as a consolidated Special Report in PowerPoint format. This more concise report focuses on the quantitative rather than qualitative aspects.

Methodology

- We have adopted our CapEx calculations to line up with the machinery and automation indices, but this did not result in significant changes to the overall dynamics.

- For reasons explained in this ARC blogpost, while ARC typically includes seasonally adjusted data in these reports to show business cycles, the impact of the pandemic makes these numbers particularly challenging to interpret. To help overcome this, we have used raw, rather than seasonally adjusted data for our latest Machinery Index.

Automation Markets

Automation Index: Raw vs. Seasonally Adjusted Data

- The direction of the index shows a downward trend for both raw and seasonally adjusted data

- Both indices show almost the same growth rate as in Q1 2020 due to cyclical development not yet impacted severely by changing economics

- However, the downturn is strong enough to point to a downward trend that began several quarters ago

Automation Index: Regional Focus

- In the Americas, the raw data shows negative quarterly YoY development for a long time already. The impacts of trade tensions, oil prices, and challenges in automotive and aerospace & defense are obvious

- In Asia, the cyclical downturns of the electric and semiconductor industry, as well as slowdown in automotive and now corona effects have put a drag on the Automation Index for five consecutive quarters

- Europe has shown stable development as it was not impacted as severely by the trade tensions. Also, the hybrid and process industries stabilized the market when automotive went into trouble last year. In Q1, first signs of a slowdown due to different reasons (including corona), become visible

Automation Index: Guidance

- A number of companies provide guidance of their future expectation in their financial reports

- Software companies still expect a positive outcome for the next quarter due to higher implementation of software-intensive digital solutions

- Hardware-focused automation suppliers that mainly serve the discrete industries expect a very negative second quarter

- Looking at the total financial year, the picture remains similar, with companies that provide hardware solutions expecting a negative result

Machinery Markets

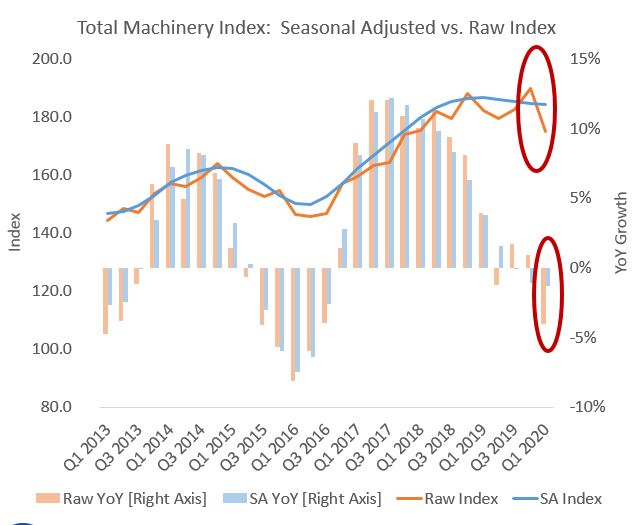

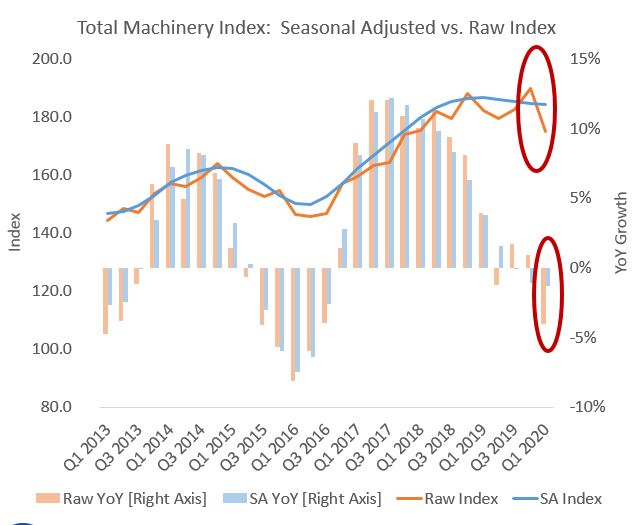

Machinery Index: Preface

- Usually, all our indexes are seasonally adjusted to show the business cycle

- In the current situation, a filter based on past data may not do the structural break justice. Please refer to our blogpost: https://www.linkedin.com/pulse/corona-dip-florian-g%C3%BCldner/

- Seasonal adjusted (SA) data does not show a dip in Q1 202

- Raw data shows a significant dip

- Hence, in this issue of our Machinery Index, all machinery-related data is raw, and thus not consistent with previous issues

Machinery Markets: Overview

- Big drop in machinery markets quarter over quarter in Q1 2020

- Most impacted markets are machine tools and textiles

- Machine tools impacted not only by corona crisis, but also by structural change

- Textile market affected early from lockdowns in China, which hosts a large share of production

Machinery Markets: Corona + Structural Break

- Metalcutting as well as robotics depend strongly on the automotive industry

- Robotics have been booming for several years but are now suffering in automotive – adoption in other industries will continue and may even increase due to higher degrees of automation

- Metalcutting machinery was in a deep structural crisis well before corona as electric cars need less machinery

- Machinery demand in automotive will alter sustainably over the next years

- Metalcutting machinery may not get back to previous levels

Table of Contents

- Automation Index

- Machinery Index

- End User Index

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us