India’s information technology (IT) services industry continues its upward momentum as most of the IT services companies covered in the report exhibited above-average growth. In this report, we analyze the revenues of India’s IT services sector for the second quarter of financial year 2019-2020 and compare these with the same period the previous year.

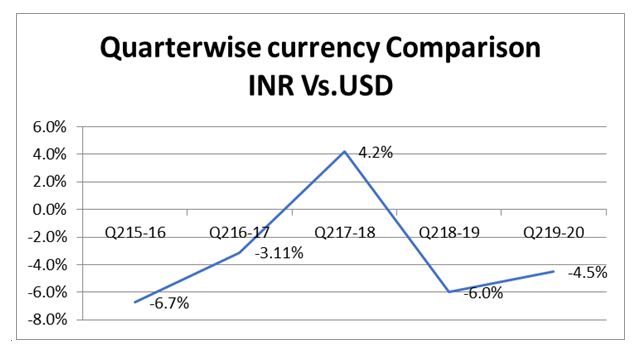

This report discusses the financial results of the top 17 India-based IT companies listed on the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), or both. We believe this Insight provides a representative sample of India’s IT market. The suppliers included in this report recorded combined quarterly revenue of $15.9 billion, representing 7.5 percent year-over-year growth rate. Only three out of the 17 companies reported year-over-year decrease in software or product revenues, while the rest showed growth in Q2. The rupee depreciated by 4.5 percent during the quarter compared with the same period last year.

This ARC Advisory Group report discusses the most recent quarterly r

3i Infotech reported total revenue of $41.7 million for the quarter ending September 30, 2019. This represents a growth of 3.8 percent compared with the same period prior year. Ninety-five percent of 3i Infotech’s revenues came from “IT Solutions” (software products & services, software development, consulting, and IT infrastructure services) and the rest from “Transaction Services” (IT-enabled services).

Cyient reported revenue of $164.2 million for the quarter ending September 30, 2019. The revenues were down by 2.8 percent year over year. Geographically, revenues from the Americas contributed 55.3 percent, EMEA 26.5 percent, while APAC and others contributed 18.2 percent. From the business unit perspective, contributors were: 39.9 percent from aerospace & defense; 11.1 percent from transportation; 12.8 percent from industrial, energy & natural resources; 4.2 percent from semiconductor; 4 percent from medical & healthcare; 18.7 percent from communications; 9.3 percent from portfolio in this quarter. Industry-wise, revenue was 75.1 percent from aerospace and defense, 10.5 percent from energy & utilities, 13.5 percent from medical, 1 percent from communications, 0.2 percent from portfolio and others were down by 0.3 percent. Cyient has added 20 new customers in this quarter. Total employee strength was 14,869 at the end of this quarter.

HCL Technologies achieved total revenue of $2.4 billion for the first quarter, representing an 18.4 percent year-over-year growth rate. Industry application services contributed 71.4 percent, infrastructure services 11.7 percent, and engineering and R&D services 16.9 percent in this quarter. Geographically, 65.8 percent of revenues came from the Americas, 26.8 percent from Europe, and 7.4 percent from the ROW. Vertically, manufacturing contributed 19.8 percent, technology & services contributed 15.4 percent, and financial services 22.4 percent. Life sciences & healthcare contributed 12.9 percent, retail & CPG 10 percent, public services contributed 11 percent, and telecommunications 8.4 percent. The total employee count in HCL was 147,123 in this quarter.

Hexaware Technologies reported a total of $210.5 million revenues, representing 23 percent growth over the same quarter prior year. Geographically, the Americas contributed 75.4 percent; Europe contributed 16.6 percent and APAC contributed 8 percent in this quarter. Vertically, banking and financial services (the largest focus vertical for Hexaware) contributed 38.5 percent; manufacturing & consumer contributed 17.1 percent, healthcare and insurance 19.3 percent; and professional services contributed 14.9 percent; and travel and transportation 10.1 percent. Segment-wise, application development & maintenance (ADM) contributed 41.8 percent to the revenues, enterprise solutions 9.2 percent, digital assurance 15.7 percent, business intelligence & analytics 10.9 percent, business process services (BPS) 8.2 percent, and infrastructure management services (IMS) 14.2 percent. 11 new clients signed in Q3 2019. Hexaware’s employee count including trainees during the quarter stood at 19,062.

Infosys reported $3,210 million revenues for the quarter ended September 30, 2019. This represents 9.9 percent growth over the same period the prior year. Infosys and its subsidiaries added 96 customers during the period. Vertically, 31.9 percent of revenues came from insurance banking and financial services; 10.1 percent from manufacturing and 7.6 percent from hi-tech; 15.2 percent from retail and 6.4 percent from life sciences; and 13.1 percent from energy, utilities, and 13.1 percent from communication and services, and 2.6 percent from others. Geographically, 61.4 percent of revenues came from North America, 24.1 percent from Europe, 2.7 percent from India, and 11.8 percent from ROW. Infosys and its subsidiaries had a total headcount of 223,486 employees at the end of this quarter.

KPIT-Birlasoft reported revenue of $109.9 million for the quarter ended September 30, 2019. This represents a growth of 7.4 percent year over year. Geographically, the Americas contributed 78.4 percent, Europe 11 percent, and ROW 10.5 percent. Vertically, manufacturing 19.8 percent, energy and utilities 17.8 percent, BFSI 19.9 percent, retail 11.6 percent, Lifesciences 16.9 percent, and automotive 14.1 percent contributed to the revenue in this quarter. Segment-wise, integrated enterprise solutions represented 32.5 percent of revenues, SAP practice 16.8 percent, and digital transformation (DT) 28.4 percent, custom application development 13 percent and other horizontal contributed 9.3 percent. The company added 17 new customers during the quarter, with total headcount of 9,994 employees at the end of September 30, 2019.

Mindtree reported revenue of $271 million for the quarter. This represents 10 percent year-over-year growth in revenue. Geographically, 73.7 percent revenues came from the Americas, 17.6 percent from Europe, 4.2 percent from India, and 4.5 percent from ROW. Vertically, 39.8 percent of revenues came from technology, media and services; 21.6 percent from BFSI; 21.7 percent from retail, CPG, and manufacturing; and 16.9 percent from travel & hospitality. The company’s employee strength was 21,267 at the end of September 30, 2019.

NIIT Technologies reported revenue of $145 million for the quarter ended September 30, 2019. This represents a growth of 9.3 percent from the prior year. Geographically, revenues from the Americas contributed 49 percent, EMEA contributed 37 percent, and ROW contributed 14 percent. Vertically, banking, insurance and financial services and insurance contributed the major revenue with 48 percent; travel & transportation 28 percent; and other 24 percent. Segment split is as follows – application development and management contributed 74 percent, business process outsourcing 3 percent, management services 17 percent, system integration and package implementation 1 percent, and IP assets 5 percent. In Q2, the company added 10 new customers to its client list. The headcount was 10,800 at the end of this quarter.

Persistent Systems reported revenue of $125.5 million for the quarter ended September 30, 2019. This represented 6.2 percent growth compared with the previous year. Services contributed 77.5 percent while the IP-led business contributed to 22.5 percent of Persistent’s business. Segment-wise, technology services contributed 45.2 percent to the total revenues, digital 22.4 percent, alliance 28.1 percent, and accelerate 4.3 percent. Geography-wise, North America contributed 81.4 percent, Europe 9.9 percent, India 6.7 percent, and ROW 2 percent. The headcount was 10,543 in this quarter.

Ramco reported revenue of $21.8 million with a growth of 11.8 percent in this quarter. Majority of Ramco’s revenue came from markets outside India. The company recorded an upward growth in this quarter.

Sasken reported revenue of $17.5 million for the quarter ended September 30, 2019. This represents a growth of 6.2 percent compared to last quarter. Geographically, 40 percent revenues came from North America, 22 percent from EMEA, 22 percent from India, and 16 percent from APAC. Services generated 66 percent of Sasken’s revenues with the rest coming from products. Sasken group had a total headcount of 1,734 in this quarter.

Sonata reported total revenue of $98.2 million for the quarter ended September 30, 2019. This represents a growth of 13.2 percent year over year. Geography-wise, 53 percent of revenues came from North America; 30 percent from Europe, including UK; and 17 percent from ROW. Vertically, 28 percent of revenues came from outsourced product development (OPD); 27 percent from travel transportation and logistics (TTL); 26 percent from retail & CPG; and 19 percent from others. Sonata added 7 new customers in this quarter. The employee count stood at 3,901 in this quarter.

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us

Keywords: IT (Information Technology), IT Services, Quarterly Supplier Revenues, Software Development, Business Process Outsourcing (BPO), ARC Advisory Group.