I probably don’t really have to remind most readers of this blog about this, but it appears that the global oil & gas supply chain is becoming even more dynamic than in the past, if that’s possible…

For example, not too long ago, ARC wrote several reports discussing the dramatic reversal in the global supply chain for LNG. Initially, North America’s apparently insatiable appetite for imported liquified natural gas had spurred the relatively rapid licensing, construction, and commissioning of quite a few LNG receiving/regasification terminals (providing new business opportunities for suppliers of OT and IT alike). Then, as new hydraulic fracturing and vertical drilling techniques made it possible for energy companies to start tapping into the vast quantities of both oil and natural gas trapped within the continent’s shale formations, the owners of those relatively new LNG receiving terminals started making the huge capital investments required to add LNG liquefaction trains and exporting facilities to those terminals (including additional investments in OT and IT). The Sabine Pass facility in Louisiana became the first operating LNG export facility in the Lower 48 states in 2016. By 2021, four LNG export facilities currently under construction are expected to be completed. According to the US EIA, combined, these five plants are expected to have an operational export capacity of 9.2 billion cubic feet per day.

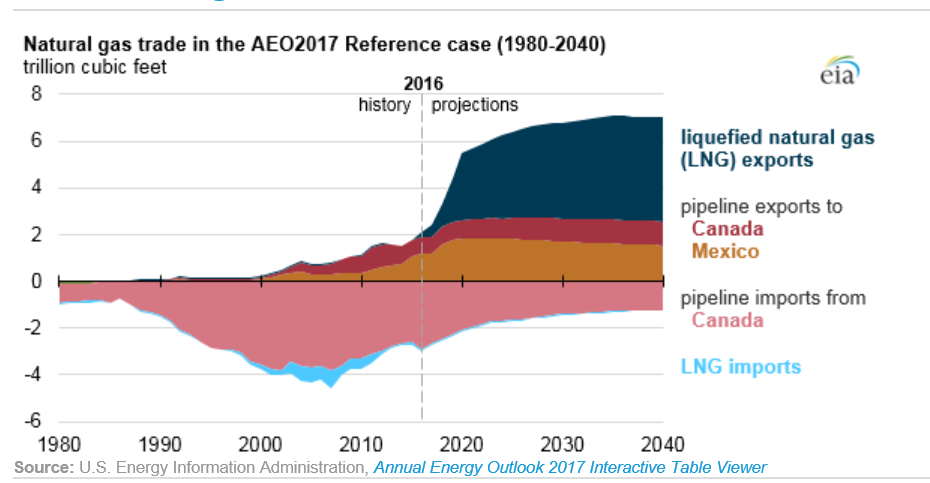

Here are some further insights from the US EIA’s Annual Energy Outlook 2017 (AEO2017) Reference case report, issued in February:

“The United States is expected to become a net exporter of natural gas on an average annual basis by 2018…driven by declining pipeline imports, growing pipeline exports, and increasing exports of liquefied natural gas (LNG). In most AEO2017 cases, the United States is also projected to become a net exporter of total energy in the 2020s in large part because of increasing natural gas exports.

In 2016, the United States was a net importer of natural gas, with net imports of 0.9 trillion cubic feet (Tcf), or 2.6 billion cubic feet per day (Bcf/d). As several LNG export projects currently under construction are completed, LNG exports are expected to make up a growing share of natural gas exports and to surpass pipeline exports of natural gas by 2020.”

Now, just last week, I saw a news item indicating that India’s Reliance Industries made its first purchase of US crude oil. This exported crude (made possible, of course, by the lifting of government regulations barring same), will be shipped to that privately held company’s mega-size, state-of-the art, integrated refinery and petrochemical complex in India. This follows similar purchases made by several of India’s state-owned oil companies.

As a Baby Boomer who got his driver’s license in the late 1960s and began commuting to work in the mid-1970s, this is all really difficult to get my mind around. I still have vivid memories (kind of surreal right now…) of waiting in long lines at gas stations for hours on end waiting to fill up my car’s tank so I could at least get back and forth to work. More recently, Baby Boomers, Gen Xers, and Millennials alike can certainly relate to the dramatic fluctuations in gasoline prices we’ve seen at the gas pumps in recent years.

So, what does this increasingly dynamic environment mean for owner-operators trying to rationalize and justify new investments in operational and information technologies and solutions, particularly technologies and solutions enabled by OT/IT convergence and the emerging IIoT? ARC analysts will continue to explore this in future reports and blogposts.