Last week, ARC attended the North American Foxboro DCS User Group meeting in Massachusetts. This was only the second such meeting since Schneider Electric acquired the Foxboro DCS as part of its acquisition of the former Invensys in 2014. This event was entirely focused on the Foxboro DCS, so if offered ARC a more in-depth look at the changes brought about by the acquisition. I’ll focus on just three of these that seem (to me) most significant.

First is how the product portfolio fit in this acquisition was a very good one. The Foxboro DCS is now a key part of a much more comprehensive Main Automation Contractor (MAC) offering. The addition of Schneider Electric PLCs, drives, and smart electrical equipment really improves Foxboro’s competitive position as a MAC or MEC candidate. This work is ongoing from the DCS and PLC standpoints. I found it entertaining to see elegant legacy installation migration solutions for both the PLCs and the DCS, because while these had been developed independently, it was clear that the thinking in both organizations was very much aligned. Another software acquisition (the former Limewire) has become the “System Auditor” – a decidedly unsexy name, however the product provides analysis and documentation of the as-built DCS configuration. This performs its analytics using the actual files in the installed systems, which is critical for accuracy, given the many ways to tweak various settings in any modern DCS.

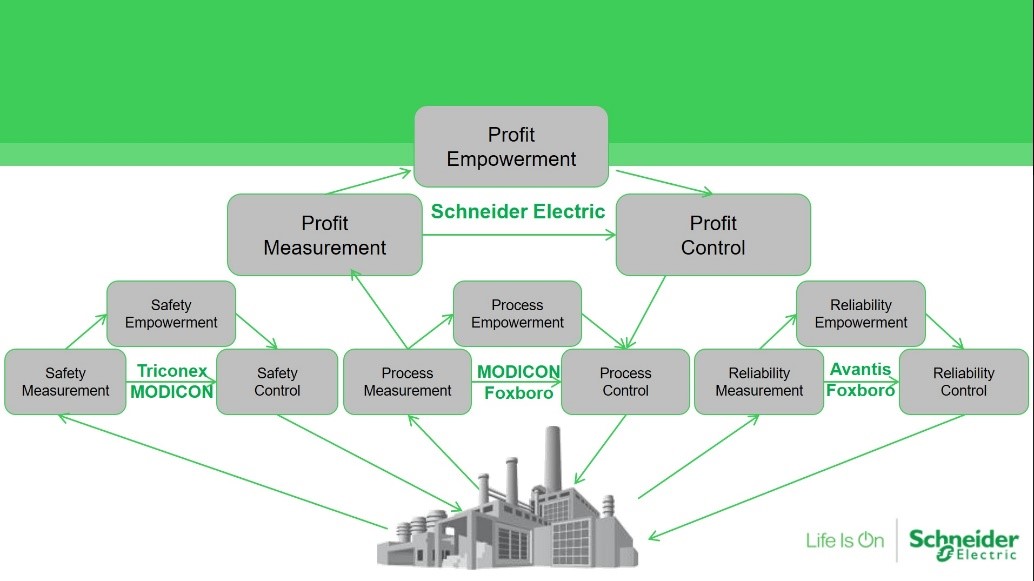

The second change has been the focus on improving customer economic performance. Schneider announced its Profit Advisor at the 2017 ARC Orlando Forum, and economic performance has been a mantra for VP Peter Martin for many years. Profit Advisor is one of a set of business-oriented applications seeking to drive ROI from the DCS products. Others address equipment maintenance, equipment condition, and safety. Delivering superior value through these applications is critical for Schneider Electric, because, quite frankly, many DCSs look very similar these days from a feature and function standpoint.

Third change was Schneider Electric discussing The Open Group’s “Open Process Automation Forum” initiative with its customers. Schneider Electric has been very active in this work, more so than most of its competitors (a couple have declined to participate at all). Schneider Electric’s vision for the DCS future has it splitting into two segments: 1) autonomous cyber-physical systems (CPS) that perform low level automation functions and are as much or more part of the assets they regulate than part of a distinct automation system, and 2) the higher level “money” applications, beginning with APC, online optimization, equipment condition monitoring, EAM, etc. Schneider Electric expects fierce competition for future CPS, and this market will require suppliers to differentiate in ways that are not yet apparent. In the second realm, Schneider feels it can build on its current strategic products and believes it has a significant lead over competitors.

Since the acquisition, in a valuation play, Schneider Electric has tried and failed (twice!) to spin off its software operations, while still holding onto a major stake itself. ARC believes the challenge here is that some software products are so much a part of a bundled offering that they lack well-defined stand-alone valuations. As the industrial IoT emerges and as edge computing technologies more and more resemble the cloud, this issue may recede. But not yet. In general, though, the Foxboro DCS and its community look much healthier and more competitive since they have become part of Schneider Electric.