Las Vegas was packed December 2-6 due to the influx of more than 65,000 attendees for

CEO Andy Jassy spent about 2 ½ hours in his Tuesday keynote, with some periodic support from others of course, highlighting a litany of releases that included new AWS industrial software services. Some announcements were new while others highlighted capabilities previewed at Hannover Messe in December 2018 and just made available. The deluge of announcements (go to the bottom of the page) was a testament to the theme of demonstrating depth and breadth of capabilities. For AWS industrial software markets, the event was a pointed example of the resource commitment AWS and other hyperscalers Microsoft Azure and Google are putting into modernizing industry via data. These modern capabilities are at the heart of industrial transformation, which leverages software to support new and more agile business processes, services, and models that companies will use to reinvent how they operate and serve customers.

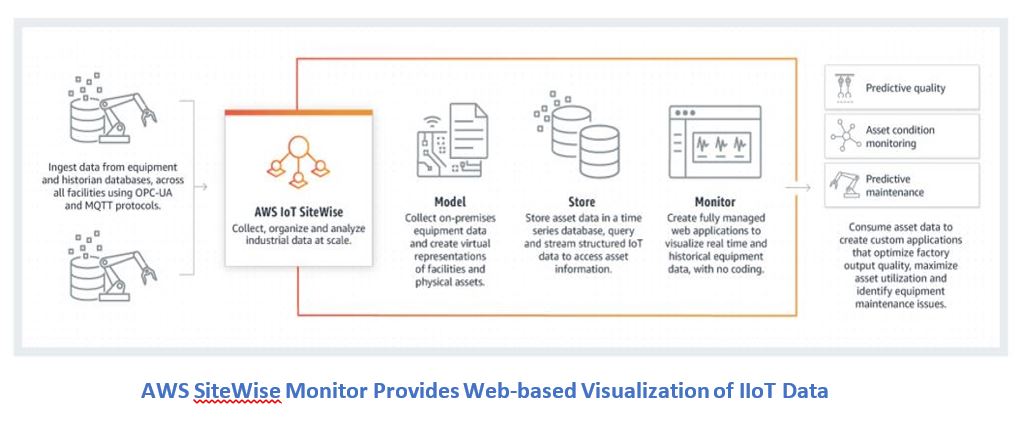

The company launched AWS IoT SiteWise in 2018 as a managed service to collect, store, organize, and monitor data from industrial equipment. As my colleague Chantal Polsonetti noted back in March, hyperscalers are intent on competing at the edge, and AWS continues to release new capabilities with that in mind. This intent to compete was clearly communicated during Thursday’s keynote by Werner Vogels, CTO of Amazon, who noted that manufacturing still has a ways to go to truly transform.

ReInvent, AWS announced SiteWise Monitor. This new software services enables SiteWise users to visualize equipment data and monitor and interact with it. As the visual below suggests, it extends SiteWise’s IIoT capability beyond modeling and storage into fully-managed web application visualization and near real-time and historical data interaction.

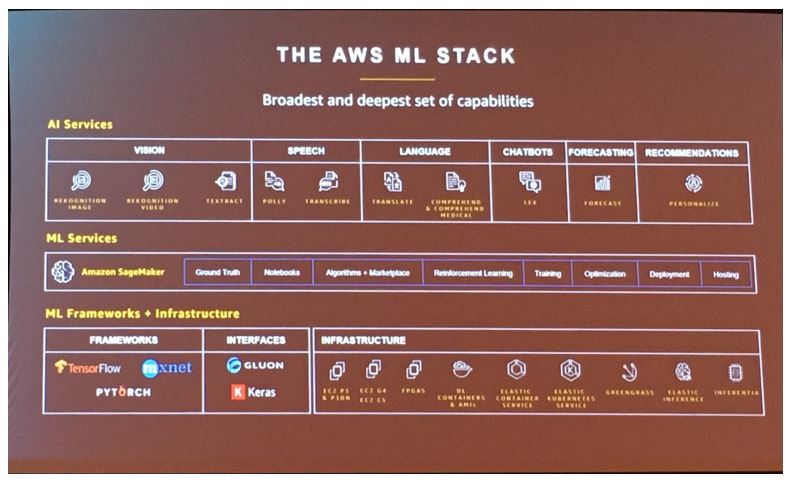

One of the things I’ve always appreciated is how AWS presents its approach to machine learning, which was front-and-center at ReInvent. As demonstrated in the image, it separates machine learning into three tiers, based on user type. Beginning from the bottom-up, their solutions support deep expertise and then enable more democratized use as you move up the stack.

Beginning with their frameworks and infrastructure, AWS supports what could be considered “deep” expertise for machine learning, and there aren’t a lot of these folks floating around. This bottom layer provides tools for those practitioners who want to experiment with algorithms and other building blocks for developing machine learning.

The next layer consists of machine learning services, which are designed for machine learning developers, and tilt toward various types of API shortcuts for building, training, and deploying machine learning. Finally, the top layer is designed for the least technical users, providing a platform for employing machine learning as artificial intelligence, such as vision, speech, language, etc.

While many points can be made about the stack, it’s well thought out and provides an easy way to step into how an industrial company might consume machine learning. What it highlights is the need for those serious about AI to consider how they will align resources to use machine learning—in an industrial setting, those with the competitively differentiating knowledge and skills likely float more toward the top of the machine learning stack.

Self-service tools for operations personnel will never be the sole means for competitive excellence. If you consider the AI services available to them at that top layer—vision, chatbots, forecasting and the like—more will be necessary to deliver new means of competitive differentiation, the real goal of digital transformation, from the unique skills and knowledge inherent in these individuals. Tools and skill-sets from further down the stack will be required to put that differentiating intellectual property and skills into action. That’s not a knock on AWS by any stretch—it’s just that their stack points out that hybrid skills and multi-disciplinary work groups will be required to harness digital transformation as a competitive weapon.

Another takeaway from AWS’ presentation of machine learning at ReInvent further cements the next wave of the evolution: Expect machine learning to be embedded wherever it can be done. This trend leverages machine learning not as just an outcome-based tool but also as a means of supporting efficiency and accuracy of work. An example is Amazon SageMaker CodeGuru, which uses machine learning to automate the review, correction, and improvement of code. Already, business process system providers are integrating machine learning into supply chain, resource planning, work management, and a host of other areas. Expect a lot more of this ubiquitous view of how machine learning can be used.

Jassy also announced the availability of Outposts, Local Zones, and Wavelength. Outposts are racks of servers that provide hybrid-cloud managed services (e.g. AWS does the maintenance) at virtually any physical location, allowing customers to run local workloads and use AWS tools outside of designated cloud regions and on premises. Local Zones are regional extensions of AWS capabilities using locally deployed infrastructure in specific geographies to support ultra-low latency use cases. Los Angeles was announced as the first one. Wavelength embeds AWS compute and storage at the telecom edge (e.g. mobile devices) of 5G networks. Multiple partners were cited, with Verizon being highlighted.

Discussion of Local Zones didn’t hint at any industrial angle. While the exact use wasn’t detailed, customers of Outposts included a few industrial companies, a few of which were mentioned at the analyst summit and some were publicly highlighted, such as Vitesco Technologies, a business area of Continental AG.

Collectively, these solutions (and others) demonstrate that the descent of the hyperscalers to the edge and IIoT is inevitable. For operational users of these types of tools, it also highlights how IT and OT currently have different definitions of the edge. IT’s perspective is typically defined as it relates to data centers. OT considers the edge to extend from control systems to the devices and equipment that generate data feeding those systems. Those two views will need to continue to be harmonized for IT and OT to effectively converge.

My most prominent takeaway was reinforcement of an observation I made in my recently published Industrial Analytics Market Research Study. As hyperscalers, like AWS, continue to put their considerable resources to developing software, hardware, and ecosystems, it’s putting immense pressure on established industrial solution providers. Due to the sheer scale at which a company like AWS can support many of the core components of digital transformation, such as analytics and IIoT, many of these capabilities will effectively become commoditized. This will present a choice for users: do I use a capability from a hyperscaler (that is probably the company’s platform of record) or do I purchase the same service from my established industrial provider? With this competitive reality in mind, it is crucial that established industrial providers identify and position their value in distinct and unique ways.