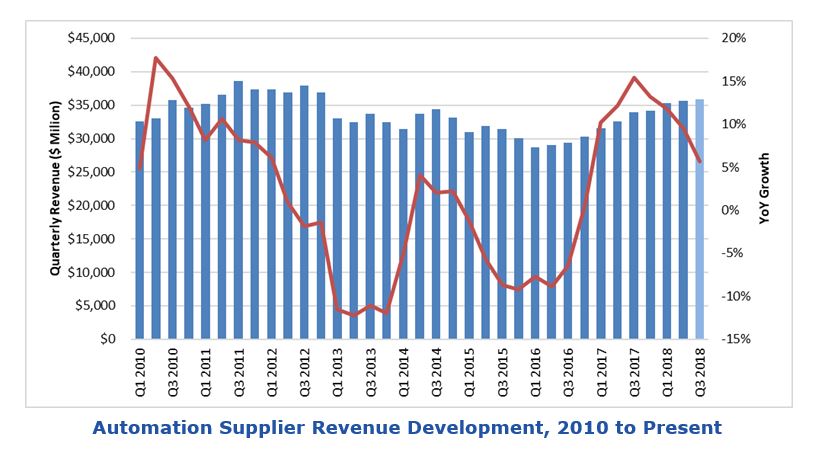

Automation suppliers saw revenue intake slow during the first half of 2019, posting a drop of slightly under half a percent overall; Q2 revenues slipped by more than 1 percent. Stronger order activity earlier in the year also cooled to low single-digit levels. Process-centric suppliers saw about 4 percent growth during the first half of the year, while discrete supplier revenues dropped by nearly 5 percent. The trade war between the US and China loomed large, cooling the investment climate for automation projects in many discrete industries in Asia.

Compared to the second quarter of 2018, the total combined revenues of automation suppliers to both the process and discrete manufacturing industries slipped by 1.3 percent (see Figure 3). Process industry suppliers saw their combined revenues grow by about 3 percent; while suppliers to the discrete industries saw a 6.6 percent drop in combined revenues. Note that due to its large size but relatively small automation component, GE Power has an outsized effect on the overall market (revenues fell by 25 percent), so we have removed it from the overall analysis, though we will continue to cover that organization in the writeup that follows.

Among suppliers that report order intake, most saw declines in activity. Orders fell by 2 percent during the quarter (Figure 4). As with revenues, we have excluded GE Power (which saw a 22 percent drop in orders) from our analysis.

In this Insight, ARC Advisory Group includes the most recent quarterly results for major automation suppliers that publicly report their results. To convert the revenues of non-US suppliers to US dollars, we average exchange rates for foreign currencies used for the entire second quarter of 2019. The euro dropped by nearly 9 percent relative to the dollar from Q2 2018, while the yen slipped by 1.5 percent over the same period.

ABB recently made changes to its reporting structure, splitting its automation revenues across three business units. ABB Robotics & Discrete reported a 9 percent drop in both revenues and orders during the quarter; weak activity was most pronounced in the automotive, 3C (computer, communications, consumer electronics) and machine builder markets. ABB Motion saw flat order activity and an uptick of 1 percent in revenues; in euros order activity rose by about 4 percent, driven by orders for drives, services, and traction equipment. ABB Industrial Automation saw orders fall by 8 percent, while revenues slipped by 2 percent. Order activity was impacted by lower larger orders in Europe and the Middle East, which saw outsized activity in the prior year. Currency translation reduced ABB’s revenues and orders in dollar terms by a further few percentage points during the quarter.

Aspen’s revenues increased by about 23 percent during the quarter, largely due to the company’s adoption of accounting standard (ASC Topic 606), which impacts the timing and method of revenue recognition for term license contracts. License revenues, which increased by about 33 percent from the prior period, were affected most by the new practice. Maintenance revenue was essentially flat, while revenue from other services slipped by about 6 percent. Aspen also attributed strong revenue growth to good performance in its engineering and APM business segments. Annual spend, the company’s measure of the annualized value of all term license and maintenance contracts, which it believes to be a more accurate measurement of its business performance, reached $541 million during the quarter, an increase of nearly 11 percent.

Azbil saw revenues increase by about 1 percent, while order activity increased by 1.5 percent during the quarter. The company’s Building Automation business grew by about 3 percent, while orders grew by about 6 percent. The Advanced Automation business saw sales fall by 2 percent; orders fell by over 9 percent during the period. Azbil’s Life Automation business fell by over 5 percent, but order activity increased by about 9 percent versus the same period in 2018.

Emerson Automation Solutions reported sales growth of over 5 percent during the quarter. Underlying sales increased by 3 percent, with unfavorable currency exchange rates sapping 3 percent and acquisitions adding 5 percent. Emerson attributed growth to increased MRO activity and an increase in projects to expand and optimize its customers’ existing production facilities. Sales in the Americas grew by 1 percent as upstream oil and gas activity softened and discrete end markets slowed down. In Asia, the Middle East, and Africa, sales increased by 7 percent, driven by infrastructure investment in Asia; the Middle East posted more modest 1 percent growth. Europe posted 1 percent growth on steady demand in the chemical, life sciences, and oil & gas sectors.

FANUC saw revenues fall by over 24 percent during the quarter; order activity dropped off by more than 25 percent. FANUC’s Factory Automation Division revenue fell by 29 percent, while the Robot Division saw sales slip by nearly 20 percent during the quarter. The FA division was impacted by the trade war between the US and China and saw a slowdown in the machine industry in China, Taiwan, and South Korea; demand in Japan also weakened. The robotic business saw a slowdown in investment in the Americas and weakening sales in China, partially offset by good performance in Europe and the domestic Japanese market.

Flowserve reported a 2 percent increase in revenue; orders increased by nearly 7 percent during the quarter. The company’s Pump Division saw revenues grow by nearly 1 percent, while orders grew by almost 6 percent. Flowserve’s Flow Control Division saw revenues increase by over 3 percent; bookings grew by about 9 percent.

Fortive saw revenues grow by more than 16 percent during the quarter. The company’s Professional Instrumentation business sales increased by 27 percent (0.1 percent organic growth, boosted significantly by acquisitions, with currency translation sapping 1.9 percent), while the Industrial Technologies division saw revenues grow by about 3 percent (4.4 percent organic growth, with 0.5 percent from acquisitions and minus 2.3 percent from unfavorable currency exchange).

GE Power saw revenues fall by 25 percent during the quarter; order activity dropped by 22 percent. Segment profit dropped by 71 percent versus 2018 to $117 million. Order activity was a mixed bag as Gas Power orders increased by 27 percent with sales of 16 heavy-duty gas turbines and four aeroderivative units, while Power Portfolio orders fell by 62 percent due to the timing of several large steam system orders.

Honeywell’s Performance Materials and Technologies (PMT) group saw revenues increase by 1.4 percent versus Q2 of 2018. Within PMT, Honeywell Process Solutions sales remained essentially flat at $1.3 billion during the quarter. The company reported strong short-cycle demand in Process Solutions, along with robust licensing, engineering, and catalyst sales with the UOP business.

Metso’s Flow Control division saw revenues rise by nearly 13 percent during the quarter; order activity increased by 9 percent. Revenues grew on timely backlog execution and strong activity in the equipment and services businesses, particularly in support of Asia’s oil & gas sector.

Mitsubishi Electric’s Industrial Automation group reported an 8 percent drop in sales during the quarter. The company’s factory automation business declined due to a slowdown in capital expenditures in the semiconductor, machinery, display, and smartphone sectors. Mitsubishi’s automotive equipment business saw reduced demand in Japan and other parts of Asia despite increased activity in sales of electric-vehicle related equipment in other parts of the world.

Moog’s industrial sales fell by nearly 5 percent during the quarter. Automation revenues were flat versus 2018. Simulation and test revenues were also flat, while energy product sales dropped by nearly 30 percent as a result of Moog’s exiting the wind pitch control business.

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us

Keywords: Automation Suppliers, Quarterly Results, Asia-Pacific, Europe, Middle East & Africa (EMEA), Latin America, North America, ARC Advisory Group.