Overview

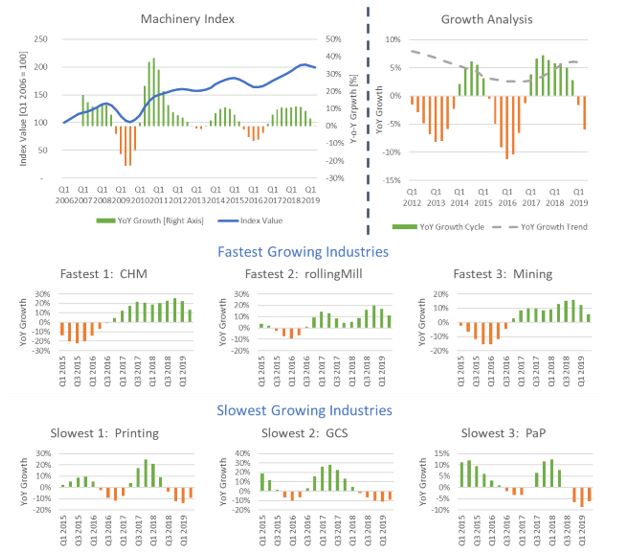

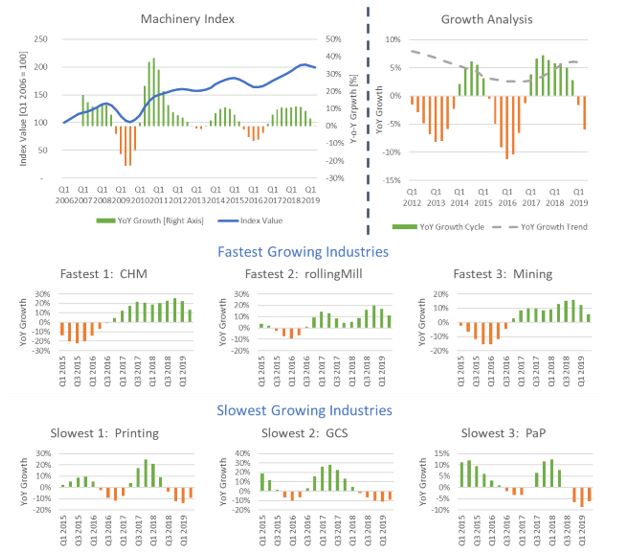

- Our Index is contracting for the first time since Q4 2016 on a Y-o-Y basis

- Machinery markets are at a turning point in business cycle

- Fast-moving markets have already turned negative in Q4 2018 on a Y-o-Y basis, many followed on Q1 2019

- Heavy machinery markets started to show negative

Y-o-Y growth in Q2 2019

- Electronics and semiconductors in particular are currently slowing down the market

- Machine tools follow and the downward trend will accelerate over the next quarters

- Downturn also strongly affecting other industries that have been struggling in recent years (pulp & paper, printing, textiles)

- Quarter-over-quarter market development is more dynamic, with shorter cycles

- The downturn began to accelerate as early as Q4 2018

- These charts add the index levels to the overall picture

- Electronics and semiconductor machinery peaked in 2018 at 3 or 4 times 2006 levels

- Oil & gas and plastics and rubber experienced a strong boom, but also crashed and have not yet returned to a healthy growth path

- Printing and metal forming have been moving sideward for quite some time

- Some markets have experienced nearly constant growth since 2010 (compressors, packaging, HVAC, elevators, material handling, lumber & woodworking)

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us